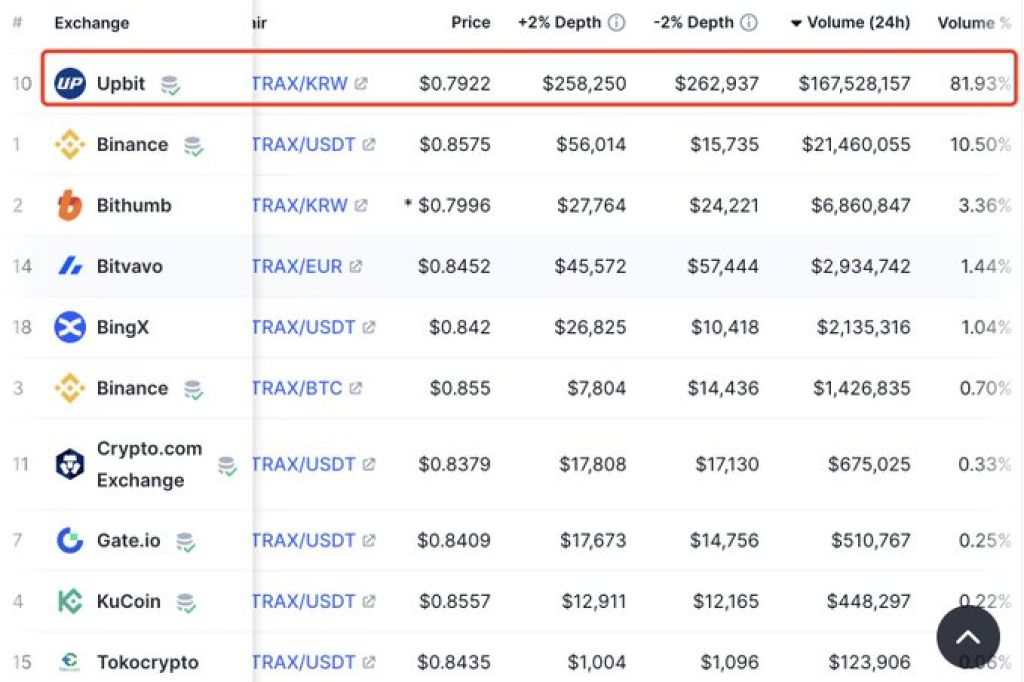

STRAX’s cryptocurrency value surged by over 85% in just one day, with most trades happening on the Upbit exchange. This leap positions it as one of the leading gainers among the top 200 coins. Data analysis from Lookonchain offers insights into the catalysts behind this significant rise.

What you'll learn 👉

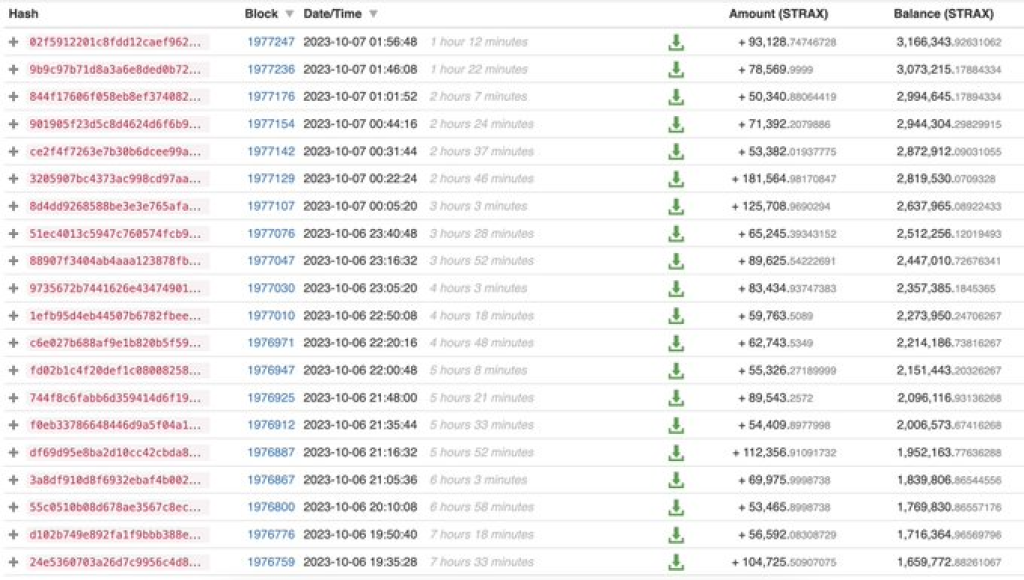

Aggressive Accumulation

Specifically, one wallet address accumulated a massive 1.8 million STRAX tokens over a 12 hour period leading up to the surge, worth approximately $1.52 million. This represents 1.2% of the total STRAX supply in circulation.

This wallet seems to have made a strategic bet that STRAX was undervalued relative to its fundamentals. By aggressively acquiring tokens before the wider market caught on, they were able to ride the wave of a massive breakout.

The concentration of trading volume on Upbit exchange suggests that strong demand from Korean traders may have helped fuel the parabolic rise once the accumulation wallet’s activity was discovered.

Cashing Out Substantial Profits

Whether motivated by insider information or a conviction call, this trader’s huge STRAX buy order paid off spectacularly as prices went vertical. Their early positioning allowed them to cash out substantial profits.

For traders looking to replicate such profits, on-chain analysis provides invaluable clues to identify potential opportunities. But research and risk management remains critical when pursuing such concentrated strategies.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.