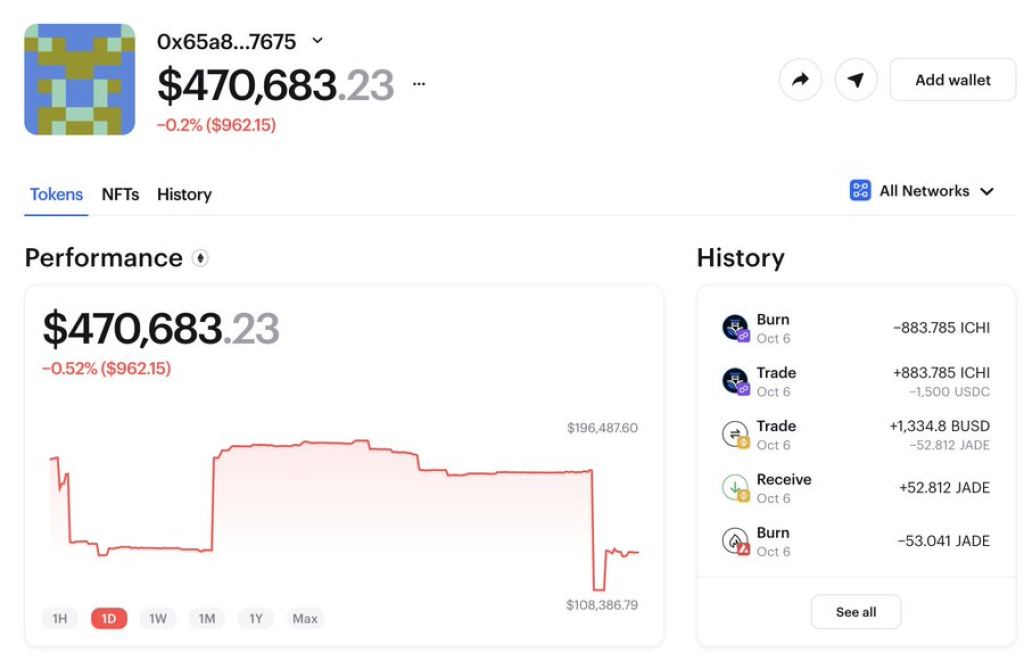

According to on-chain analytics platform Lookonchain, there are arbitrage bots conducting daily trades across Ethereum and Binance Smart Chain (BSC) earning up to $12,000 per day in risk-free profits.

What you'll learn 👉

Trading Strategy Allows Risk-Free Profits

The trading strategy involves monitoring token prices across the two chains to spot sudden price divergences. When a token drops sharply in price on one chain but not the other, the bot quickly buys on the chain with the lower price. It then transfers or “bridges” the tokens to the other chain to sell at the higher price for instant profit.

Real Examples Show Lucrative Opportunities

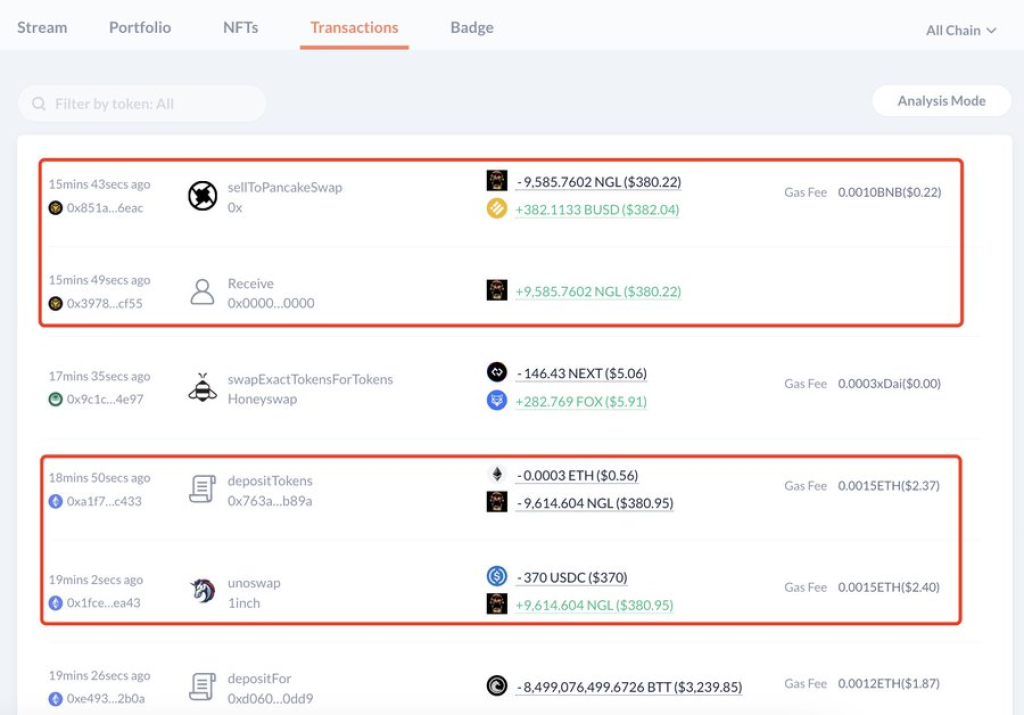

Lookonchain shared actual examples of profitable trades these bots have executed:

- One bot spent 370 USDC to buy NGL on Ethereum when its price briefly plunged. It quickly bridged the tokens to BSC and sold them for 382 DAI, earning ~$7 profit after gas fees.

- Another trade involved buying 2000 BUSD worth of DCK on BSC and bridging to Ethereum to sell for 1998.88 USDT, resulting in a ~$21 loss after fees.

Bots Conduct Frequent Trades for Up to $12K Daily Profits

Analyzing the on-chain data shows these two bots conduct 5-10 arbitrage trades per hour. This results in estimated hourly profits between $50 to $500, and total daily earnings of $1,200 to $12,000. The more price volatility and divergences, the more profit opportunities.

Automated Trading Necessary to Capitalize on Fleeting Opportunities

Performing these trades manually would be nearly impossible. To successfully capitalize on short-lived price divergences across chains requires advanced bots programmed to monitor markets 24/7 and execute trades within seconds.

While not risk-free due to gas fees and technical risks, on-chain arbitrage remains a relatively safe strategy exploited by sophisticated traders. The profits serve as a rebate to traders for providing liquidity and keeping prices aligned across fragmented DeFi ecosystems.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.