Crypto influencer Crypto Rover believes Bitcoin is gearing up for a major price movement in the next 5-10 weeks. He sees potential for Bitcoin to fall to $12,000 or surge to $63,000.

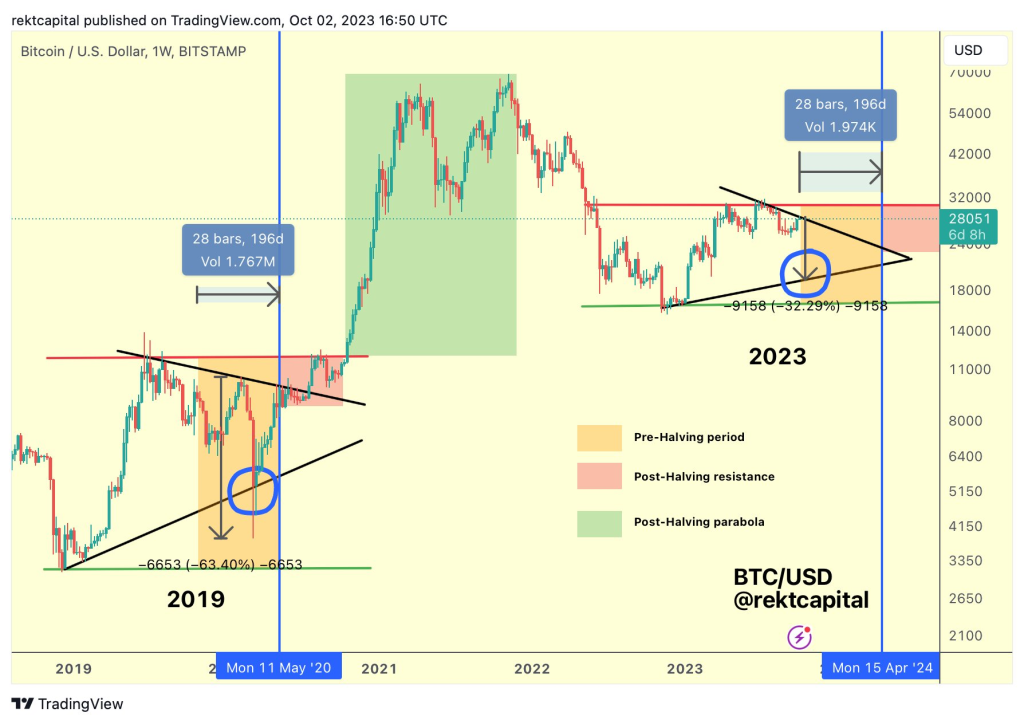

This view mostly saligns with Rekt Capital’s analysis that the next 140 days leading up to Bitcoin’s halving in April 2024 may present the last opportunity to buy Bitcoin below $20,000.

Bitcoin saw its largest volume spike on Monday, October 2nd, just hours after surpassing $28.4K for the first time since mid-August.

The next BIG #Bitcoin move is happening in the coming 5-10 weeks.

— Crypto Rover (@rovercrc) October 4, 2023

Bearish Target: $12,000

Bullish Target: $63,000 pic.twitter.com/TbDa5ZFdC2

Currently trading around $27,645, Bitcoin recently bounced off its lower high resistance level per Rekt Capital’s chart. History suggests Bitcoin could see a 30-60% retracement after rejecting from a lower high. However, the potential retracement depth decreases over time as the macro higher low support level rises ahead of the halving.

In the 2019 cycle, Bitcoin fell 63% after rejecting from its lower high. For this cycle, Rekt Capital estimates only a 19-31% retracement is needed to revisit the higher low support around $20,000 depending on when the pullback occurs. The closer to the halving, the higher Bitcoin’s support level becomes.

Rekt Capital’s 2023 cycle analyses:

When examining Bitcoin’s current 2023 cycle, time becomes a crucial factor in projecting potential price levels. As we move closer to the 2024 halving event, three key levels are affected:

a) Bitcoin’s macro lower high resistance level will likely increase over time as bulls regain control. A lower high rejection today would be at a lower price point than one in early 2024.

b) Bitcoin’s macro higher low support level is likely to rise as we near the halving. The higher low provides a price floor for corrections. This support level will ascend through early 2024.

c) The total retracement depth from the lower high is dependent on time. If a lower high rejection happens near the halving, the retracement magnitude could be much smaller vs. one earlier in 2023.

In summary, technical and cycle analysis indicates Bitcoin could see volatility back toward $20,000 over the next few months before starting its next parabolic rally after the halving in April 2024. But unpredictability is inherent in crypto.

As Crypto Rover notes, Bitcoin could also surge toward $63,000 or even fall toward $12,000 in the coming weeks based on market sentiment. Either way, the next major Bitcoin price movement appears imminent.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.