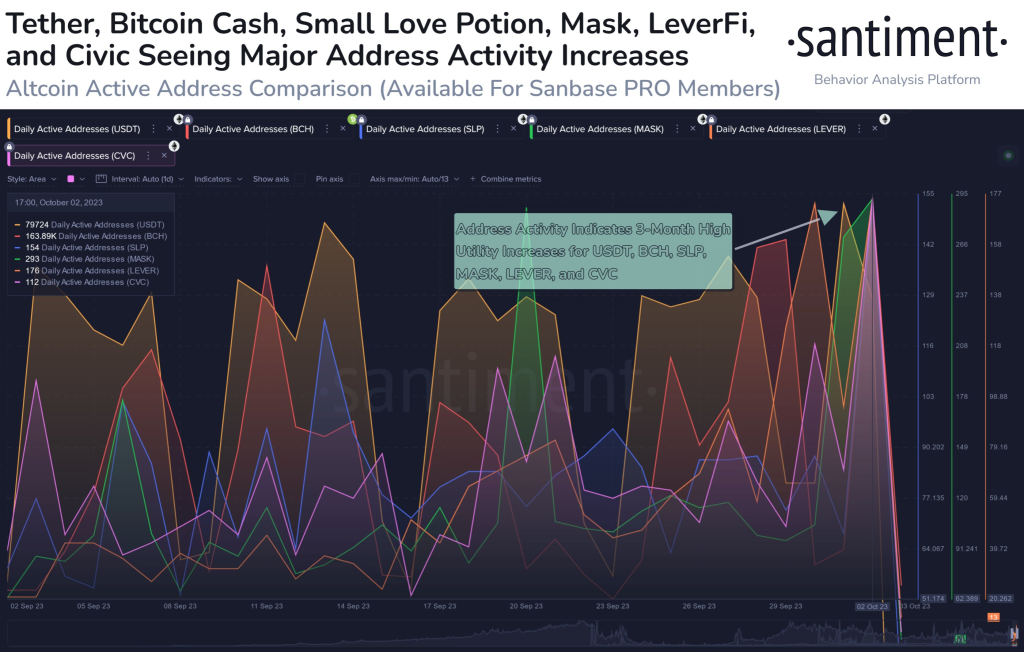

Despite broader crypto markets declining for two straight days, blockchain analytics firm Santiment has identified pockets of resilience among select altcoins witnessing expanded network usage. According to Santiment, several cryptocurrencies are seeing noteworthy increases in active unique addresses, suggesting strengthening utility and engagement.

Source: Santiment – Start using it today

In a recent thread, Santiment highlighted Bitcoin Cash (BCH), Smooth Love Potion (SLP), Mask Network (MASK), Lever Finance (LEVER), and Civic (CVC) as assets exhibiting usage growth amid choppy trading conditions. The firm pointed to rising address counts as a positive indicator that these altcoins could weather short-term market weakness.

Notably, Santiment also flagged stablecoin Tether (USDT) experiencing an uptick in unique interactions. The world’s largest stablecoin by market cap continues to gain adoption for crypto trading and transactions despite its high-profile struggles.

The on-chain activity spikes spotlight assets decoupling from broader sentiment and capitalizing on recent development milestones. While speculative trading wanes, platforms demonstrating real-world utility can sustain user demand even when prices languish.

Santiment considers diverging address usage a healthy sign as crypto emerges from its bear market slump. Usage and engagement metrics often signal which networks maintain grassroots support amid volatile swings.

Of course, depressed token values present buying opportunities that partially explain more accounts transacting. But platforms lacking fundamental utility rarely see sustainable growth stemming from bargain hunting.

By distinguishing altcoins crossing usage inflection points, traders can identify resilient technologies backed by maturing utility. These hidden pockets of strength tend to outlast downturns and generate renewed hype once recovery resumes.

Rather than tracking short-term price oscillations, usage analytics capture foundational shifts around adoption and maturation. For discerning traders, on-chain clues offer invaluable conviction during times of uncertainty.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.