There was some bullish price action in early October when Bitcoin briefly popped above $28,000 for the first time in 6 weeks (following mid-August market crash).

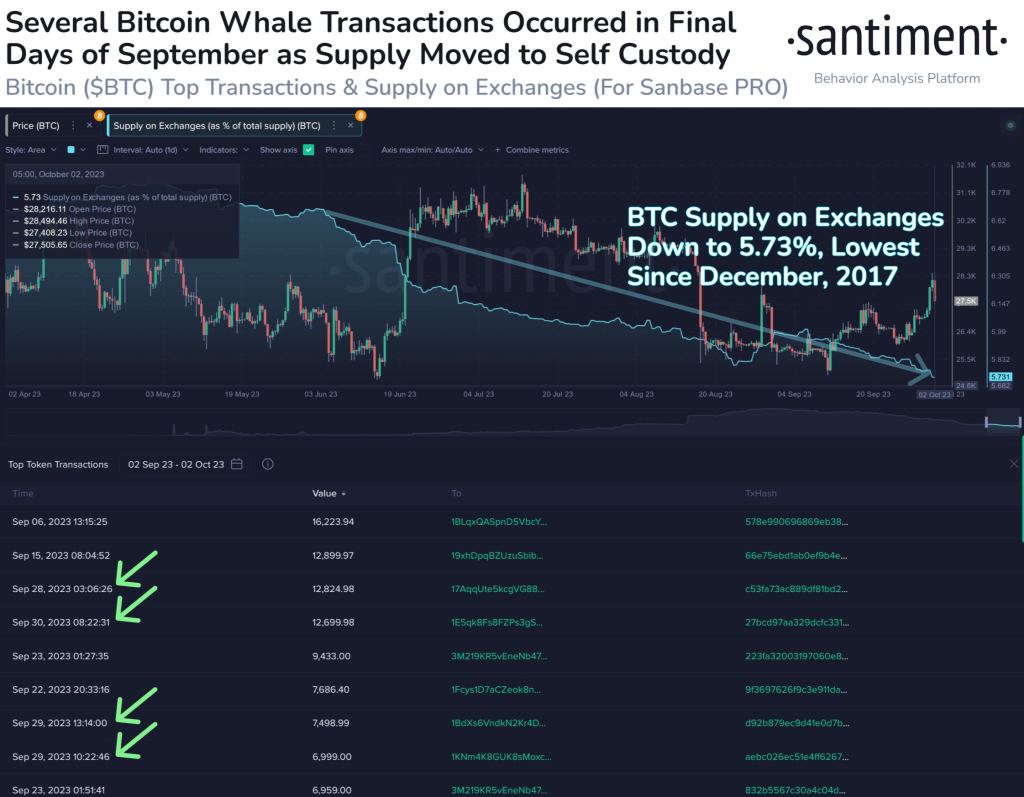

Just prior to that move, there were 4 large transactions ranging between $187 million and $346 million in value. This suggests that some major players were accumulating Bitcoin ahead of the price pop.

In addition, the supply of Bitcoin on exchanges has continued to decline, dropping from 5.99% on September 1st to 5.73% currently (lowest level since 2017). This reduction in available supply is viewed as a positive sign for Bitcoin’s price, according to Santiment.

Source: Santiment – Start using it today

However, at the time of this writing, Bitcoin is trading below $28,000 again, at around $27,500. So the bulls were not able to sustain the push above $28k.

According to prominent crypto analyst Altcoin Sherpa, the late August wick above $28k tagged previous resistance and likely marked a short-term price bottom. The 4-hour moving averages still look bullish, so he believes this recent price action looks okay overall.

Altcoin Sherpa expects Bitcoin to continue chopping and retesting the $28k level again. If the bulls can flip that previous resistance into support, it would strengthen the case for a sustained move higher.

So in summary, while Bitcoin remains rangebound for now, some analysts see the recent bullish developments as setting the stage for an eventual breakout. But more upside confirmation is likely needed before declaring a new bull market. Traders should watch the $28k level as a key price hurdle.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.