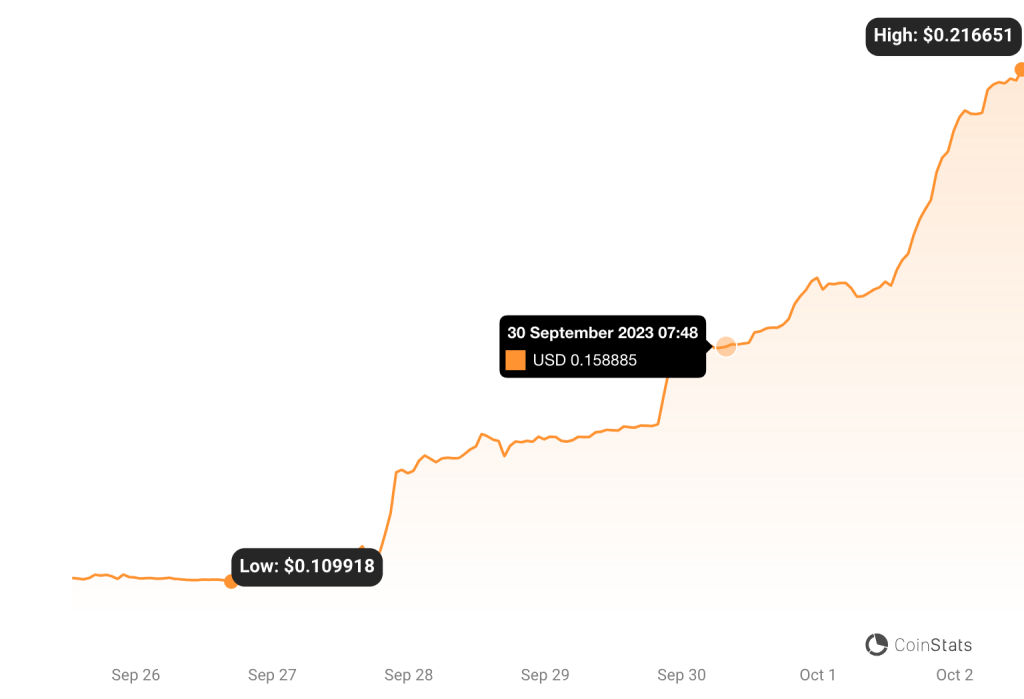

The decentralized finance (DeFi) token Canto (CANTO) has seen its price surge over 25% in the last 24 hours to currently trade around $0.22. This rally comes as the market reassesses Canto’s potential as an overlooked opportunity in the red-hot DeFi space.

Canto operates in the emerging realm of tokenized treasuries, also known as real-world assets (RWA). The protocol allows users to mint stablecoins backed by short-term US treasuries. This model is similar to MakerDAO, which has seen tremendous growth by collateralizing loans with crypto assets.

Source: CoinStats – Start using it today

With macro conditions signaling higher rates for longer, protocols collateralized by US debt stand to benefit. MakerDAO has capitalized on this trend, seeing its MKR token surge in value. As a smaller tokenized treasury play, Canto could follow a similar trajectory if adoption accelerates.

Some speculate Canto is undervalued compared to MakerDAO given its lower market cap and circulating supply. The recent migration to a Layer 2 Polygon blockchain has also sparked optimism regarding scalability and lower gas fees.

Sentiment is mixed on Canto’s potential. Supporters see it as a way to gain exposure to tokenized treasuries at a discount compared to MakerDAO. Critics argue the lower liquidity and community engagement make it more speculative.

The narrative around “DeFi blue chips” has driven speculation, with investors pivoting to established protocols like MakerDAO. This demand could spill over to smaller counterparts like Canto if the sector continues gaining steam. Canto’s upside will ultimately depend on execution and real-world adoption. But its profile as an overlooked tokenized treasury play gives it an intriguing risk-reward profile worth monitoring in the weeks ahead.