Bitcoin has undergone several boom-and-bust cycles since its inception in 2009, with prolonged bear markets typically followed by explosive bull runs. According to veteran crypto trader Stockmoney Lizards, Bitcoin is poised for another major bull cycle by late 2024. Here are 10 reasons why:

What you'll learn 👉

1. Diminishing Supply from Long-Term Holders

The total Bitcoin supply held by long-term investors recently hit an all-time high of nearly 15 million BTC. As more investors embrace a buy-and-hold strategy, less Bitcoin is available on exchanges for active trading. This scarcity fuels further price increases.

2. Upcoming Bitcoin Halving in April 2024

The highly anticipated halving event, which occurs every 4 years, will reduce the block reward from 6.25 BTC to 3.125 BTC in 2024. With miners receiving fewer new bitcoins, the rate of supply expansion is cut in half – exerting upward pressure on prices.

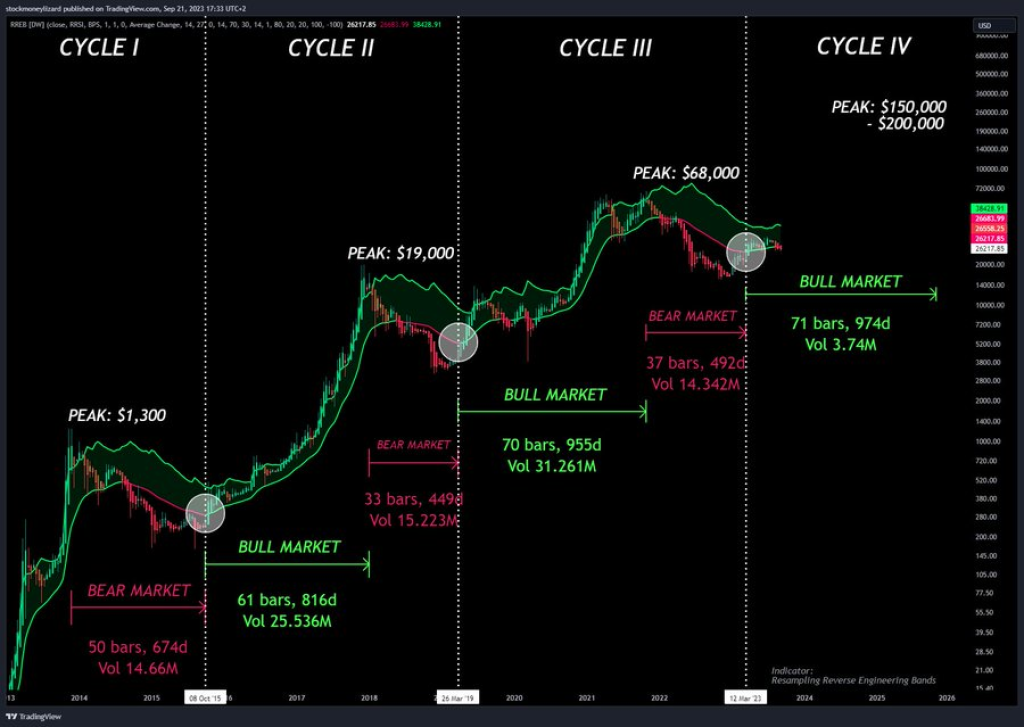

3. Predictable Bitcoin Market Cycles

The halving gives rise to distinct Bitcoin market cycles. After an all-time high, a bear market ensues. Then we see pre-halving price action, followed by a prolonged bull run starting approximately 1 year after the halving. Right on schedule.

4. Differentiation from Struggling Altcoins

While the SEC pursues legal action against certain altcoin exchanges, Bitcoin remains insulated from these securities-related concerns. This differentiation strengthens Bitcoin’s value proposition as a censorship-resistant asset.

5. Expanding Crypto Adoption

Growing crypto adoption by major financial institutions and payment platforms like Mastercard, PayPal, and Visa underscore Bitcoin’s expanding utility and integration into the mainstream financial system.

6. Scalability Developments

The Bitcoin network has already processed over 110 trillion transactions. Continued scaling solutions like the Lightning Network prepare Bitcoin for an influx of new users.

7. Hedge Against Inflation

With inflation surging globally, investors may increasingly turn to provably scarce Bitcoin as an inflation hedge – similar to gold’s historical role.

8. Safe Haven Asset During Geopolitical Crises

Bitcoin has emerged as a global safe haven asset, as evidenced during the pandemic, Lebanon’s banking crisis, and Russia’s invasion of Ukraine. Geopolitical unrest often elevates Bitcoin’s appeal.

9. Self-Fulfilling Prophecy

If Bitcoin price begins showing signs of a new parabolic advance, this can attract significant speculative interest and momentum traders – creating a self-fulfilling prophecy.

10. Technical Analysis

Veteran traders are closely watching key levels, momentum oscillators, and moving averages. These technical indicators suggest Bitcoin is still early in the accumulation phase preceding the next bull market. Patience remains key.

In summary, perennial bull Stockmoney Lizards makes a compelling case for why Bitcoin is on track for another epic bull run over the next 12-18 months. Between fixed supply emission, mainstream adoption, world events, and market psychology – the stage is set for Bitcoin to continue its meteoric rise.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.