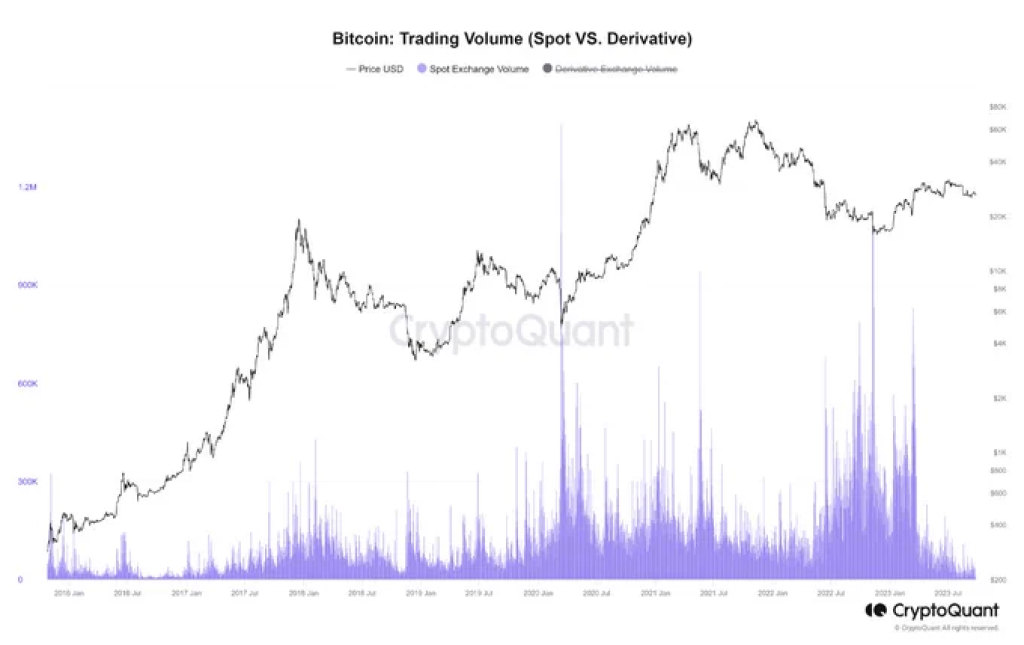

In a recent revelation, the spot trading volume of Bitcoin has plummeted to a level unseen in six years, highlighting a significant shift in investor behavior. The prevailing sentiment seems to be one of steadfast belief in Bitcoin’s future value, with holders appearing more inclined to retain their coins rather than capitulating to the allure of immediate profits.

This week, the transaction volume has experienced notable fluctuations, oscillating between 8,000 and 15,000 daily transactions. This data, provided by CryptoQuant, starkly contrasts the over 600,000 transactions executed in March of this year, illustrating the abrupt and substantial drop in trading activity.

One of the predominant factors attributed to this decline is the escalating apprehension regarding the macroeconomic landscape. The uncertainty and instability in the broader economic environment seem to be fostering a more cautious approach among Bitcoin traders and investors.

Moreover, the quantity of Bitcoin that is either being HODLed or deemed lost has reached a staggering 5-year zenith of 7,891,382.976 BTC according to Glassnode data. This indicates a growing conviction among the Bitcoin community in the enduring value and potential of the cryptocurrency, reinforcing the trend of holding over trading.

“People are demonstrating a heightened interest in maintaining possession of their coins, showcasing a robust belief in their prospective value, rather than liquidating their holdings at the initial glimpse of profit,” states an observer of the crypto market dynamics.

The prevailing holding sentiment and the reduction in spot trading volume underscore a pivotal moment in the cryptocurrency domain. It reflects a maturing market where participants are increasingly viewing Bitcoin as a long-term investment rather than a speculative asset for short-term gains.

This development could potentially herald a phase of consolidation and stabilization in the Bitcoin market, with long-term holders playing a crucial role in shaping the future trajectory of this pioneering cryptocurrency.

In conclusion, the current trends in Bitcoin trading and holding patterns are indicative of a more discerning and strategic approach by the market participants. The evolving dynamics suggest a deepening faith in Bitcoin’s inherent value and a growing commitment to its long-term potential, amidst the uncertainties of the macroeconomic scenario.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.