A tweet by Rekt Capital has sparked discussions about Bitcoin’s four-year cycle resistance, its historical technical feats, and its potential trajectory as we approach another halving event in 2024.

What you'll learn 👉

Bitcoin’s Four-Year Cycle Resistance

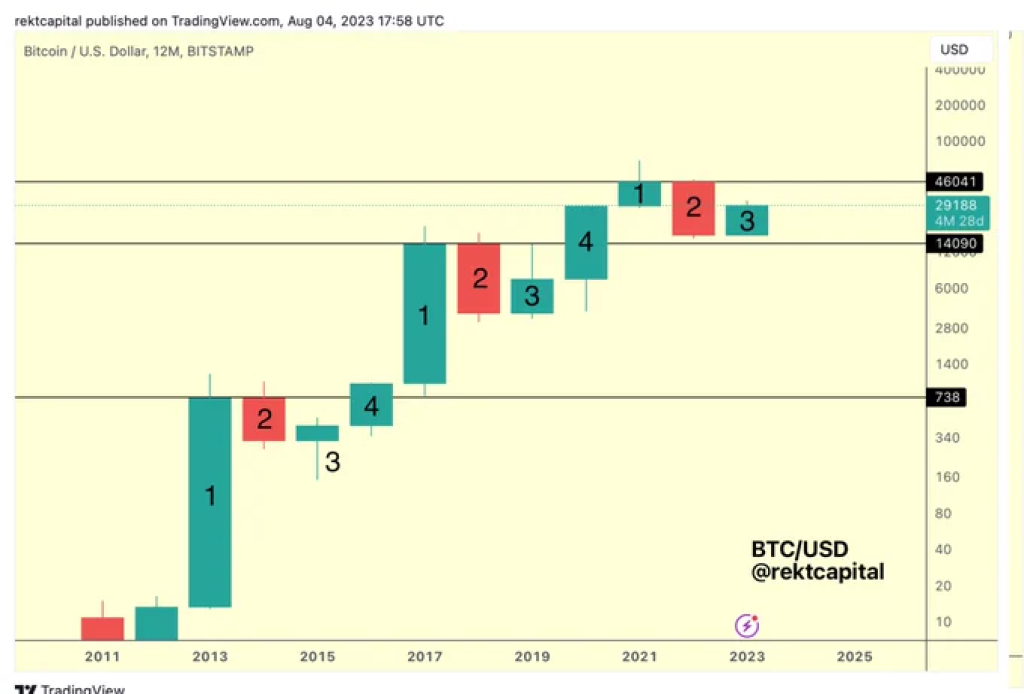

Bitcoin has consistently shattered its four-year cycle resistance, marked by significant candles every four years. In 2016, Bitcoin (#BTC) surpassed the $738 mark, and in 2020, it broke beyond $14,090. Predictions are rife that in 2024, Bitcoin will convincingly breach the $46,000 resistance, marking another milestone in its journey.

Monthly Timeframe Analysis

September has raised questions about the transformation of old monthly support into new monthly resistance. Bitcoin seems to have confirmed the ~$27,150 level as new resistance, a historic technical feat as this level has acted as resistance for the first time ever. Previously, prices soared through this level, but now Bitcoin is experiencing rejection from this level, raising uncertainties about the strength of this resistance.

Macro Perspective: A New Uptrend

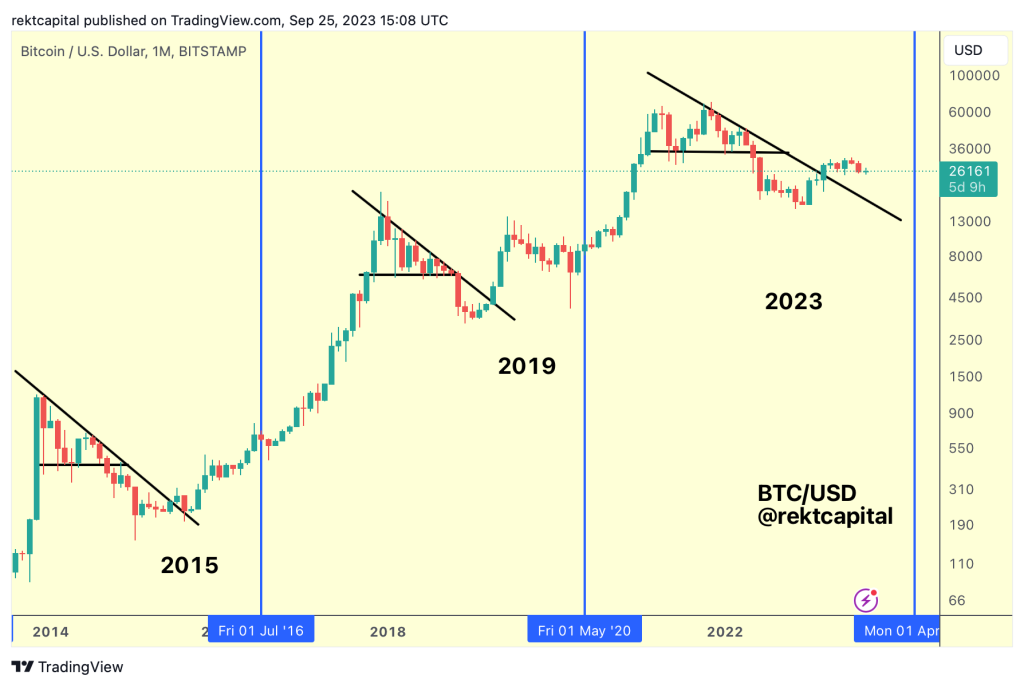

Despite the current predicaments, Bitcoin remains in a new macro uptrend, having broken its macro downtrend several months ago. The upside post-breakout may not have been exhilarating, but historical patterns suggest that significant upside is typically observed close to and after the halving events.

In 2015 and 2019, Bitcoin experienced initial push-ups before consolidating for months going into the halving. The real momentum was witnessed close to and after the halving events. The current scenario in 2023 resembles 2019 in several aspects, hinting at a potential downside in Bitcoin’s price. However, the cycle in 2023 could borrow elements from both 2015 and 2019, creating its unique trajectory.

Pre-Halving and Post-Halving Scenarios

The pre-halving period is crucial for preparing for post-halving price appreciation. Any downside experienced in the pre-halving period needs to be leveraged effectively to maximize gains in the post-halving phase.

The upcoming months leading to the April 2024 halving could be uneventful, with Bitcoin possibly consolidating at these highs or experiencing a period of downside, only to resolve closer to or around the halving event.

Bitcoin’s journey is marked by its consistent breaking of four-year cycle resistance and its unique cycles borrowing elements from previous ones. The analysis of monthly timeframes and macro perspectives reveals potential downsides, but history has shown that real momentum is gained post-halving. As we approach the 2024 halving, the crypto community remains watchful, leveraging the insights from experts like Rekt Capital to navigate the uncertainties and possibilities that lie ahead in Bitcoin’s path.

Bitquant, another prominent entity in the crypto analysis realm, has also weighed in on Bitcoin’s future, offering a contrasting perspective to prevailing speculations. According to Bitquant, Bitcoin is poised to not only reach but surpass its previous all-time high before the upcoming halving. Contrary to some predictions, Bitquant asserts that Bitcoin will not top before the halving and will not reach $160K due to the substantial magnitude of every pullback.

Instead, it is anticipated to peak after the halving in 2024, with a target price hovering around a staggering $250K. This bold prediction underscores the high expectations and the volatile, unpredictable nature inherent in the crypto markets, adding another layer of intrigue to the ongoing discussions about Bitcoin’s trajectory.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.