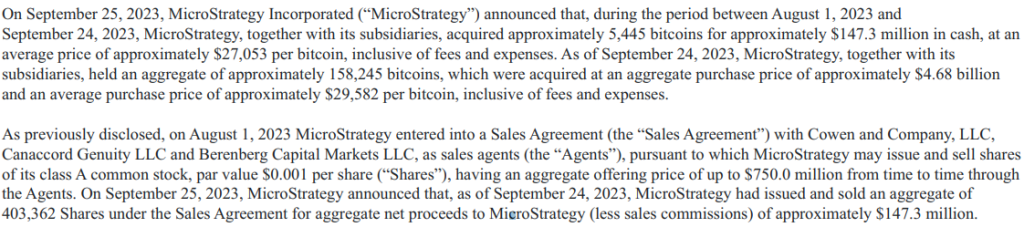

In one of its latest moves, MicroStrategy has expanded its Bitcoin holdings. The leading business analytics firm has acquired an additional 5,445 BTC, investing approximately $147.3 million. This acquisition was executed at an average price of $27,053 per Bitcoin, showcasing the company’s commitment to bolstering its cryptocurrency portfolio.

As of September 24, 2023, MicroStrategy’s cumulative Bitcoin holdings stood at 158,245 BTC, representing a substantial investment of approximately $4.68 billion. The average price at which the Bitcoins were acquired is $29,582, indicating a strategic and calculated approach to the company’s cryptocurrency investments.

A Strategic Investment Approach

MicroStrategy’s continuous and significant investment in Bitcoin underscores its belief in the cryptocurrency’s value and potential. The company’s acquisition strategy is marked by meticulous planning and execution, aimed at maximizing returns and mitigating risks associated with the volatile cryptocurrency market.

MicroStrategy’s consistent investment in Bitcoin has been a focal point in the cryptocurrency market, influencing market dynamics and investor sentiment. The firm’s unwavering confidence in Bitcoin’s value proposition has bolstered the cryptocurrency’s standing in the financial ecosystem, prompting discussions about its role and relevance in contemporary finance.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.