Chainlink ($LINK) has recently witnessed significant activity, with a notable number of new wallets emerging and substantial amounts of $LINK being withdrawn from Binance according to Lookonchain. This activity has sparked speculation and discussions among crypto enthusiasts and experts, pondering whether this could be indicative of whales accumulating $LINK.

What you'll learn 👉

Fresh Wallets and Withdrawals

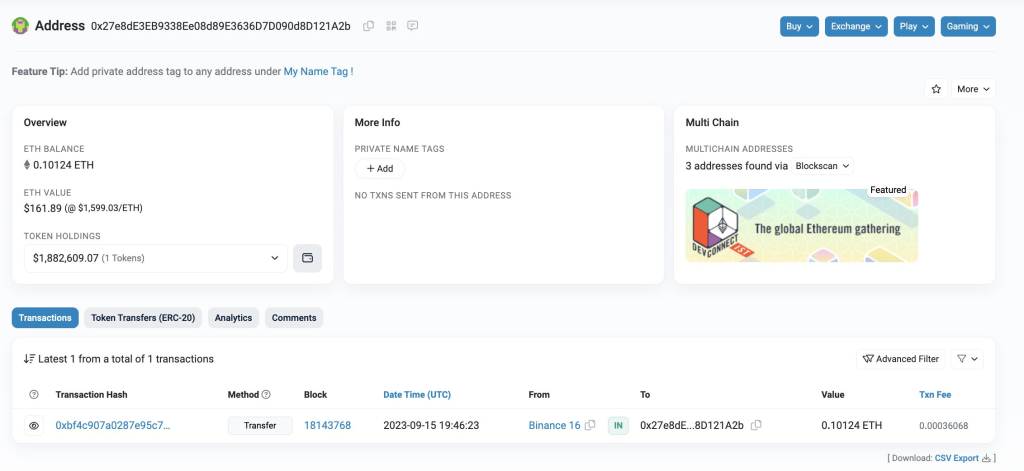

On September 15, a total of 81 new wallets were created, and by September 18, these wallets commenced the withdrawal of $LINK from Binance. To date, these wallets have collectively withdrawn approximately 4.7 million $LINK, equivalent to $31.58 million.

In a similar vein, Lookonchain observed that around 35 new wallets, also created on September 15, initiated $LINK withdrawals from Binance on September 19. These wallets have so far withdrawn a total of 755,687 $LINK, amounting to roughly $5.08 million.

Speculations of Whale Accumulation

The sudden influx of fresh wallets and the substantial withdrawals have led to speculations and inquiries within the crypto community. The question on many minds is: Are there whales accumulating $LINK? The term “whales” refers to individuals or entities that hold large amounts of a cryptocurrency, and their movements and activities are closely monitored as they have the potential to influence market trends and prices.

Chainlink’s Multisig Controversy

Adding to the intrigue, Chainlink has recently been the subject of controversy due to a change in its multisig wallet requirements. The company has downplayed a recent adjustment in the number of signers required on its multisig wallet, a move that has received backlash on social media platforms, including X (formerly known as Twitter).

Crypto researcher Chris Blec was among several users who criticized Chainlink for discreetly reducing the number of signatures required on its multi-signature wallet from 4-of-9 to 4-of-8. This 4-of-8 multisig requirement is a security measure that mandates four out of eight signatures to authorize a transaction. Critics argue that such a change, especially done quietly, can have implications on the security and integrity of the wallet, potentially making it more susceptible to unauthorized access and fraudulent activities.

The convergence of heightened wallet activity and the multisig controversy has placed Chainlink under the crypto community’s microscope. The substantial withdrawals and the creation of new wallets have fueled discussions and speculations about possible whale accumulations and their potential impact on $LINK’s market dynamics.

Meanwhile, the adjustments in multisig wallet requirements and the ensuing backlash underscore the importance of transparency and security in the rapidly evolving crypto landscape. The developments within Chainlink serve as a reminder of the multifaceted and dynamic nature of the cryptocurrency ecosystem, where market movements and organizational decisions are intertwined and closely watched by stakeholders.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.