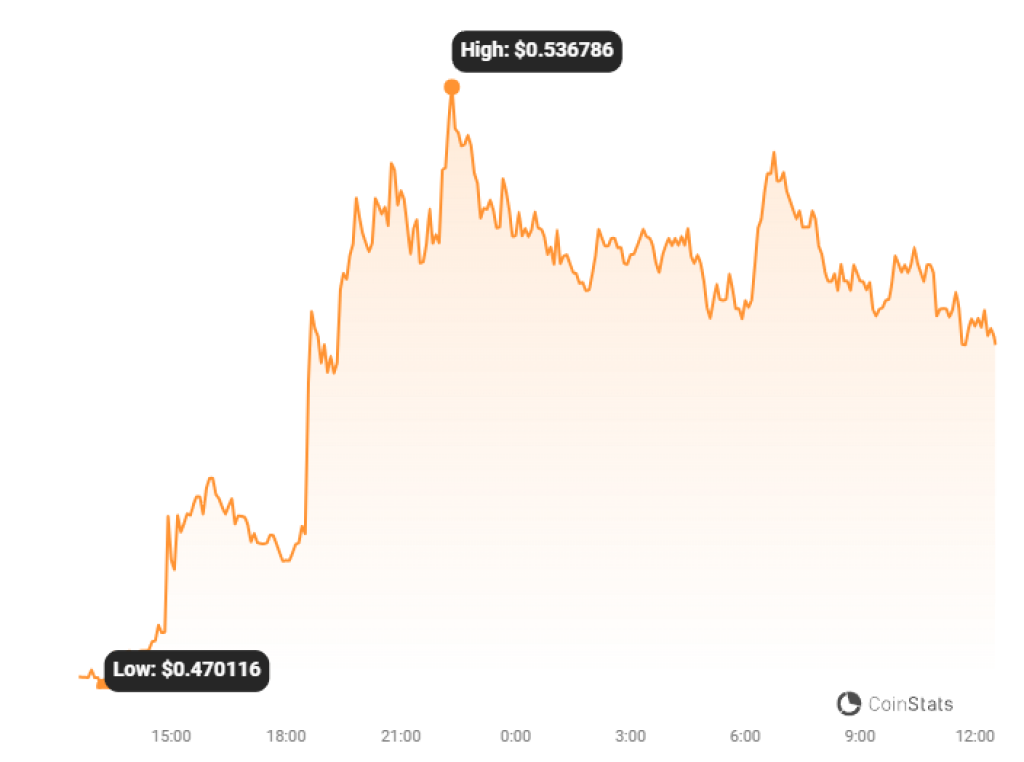

Curve DAO (CRV) saw an approximate 12% surge in its price, a move that is ostensibly linked to significant accumulation by whale investors. The dynamics of the market were notably influenced by substantial withdrawals and strategic financial maneuvers by these whales according to the data by Lookonchain.

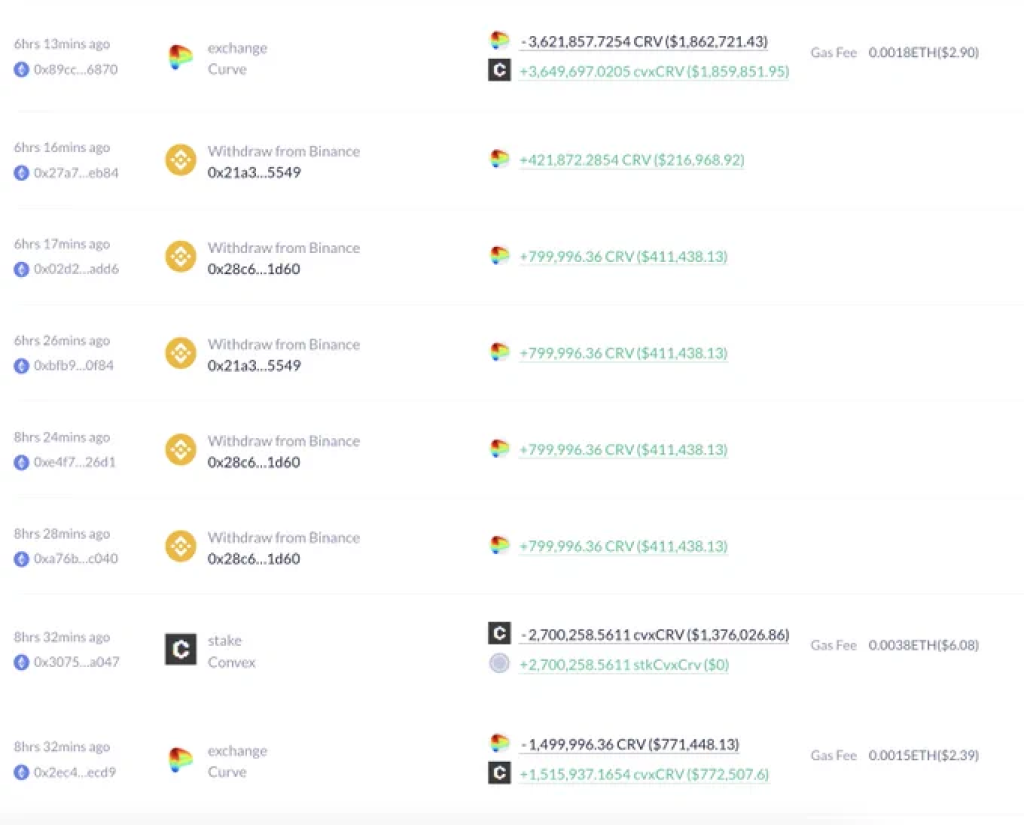

The whale identified as 0xDf14 has been particularly active, withdrawing a substantial 5.17 million $CRV, equivalent to $2.7 million, from Binance in a span of just 20 minutes. This is part of a larger series of withdrawals by the same entity, totaling 14.44 million $CRV or $7.55 million.

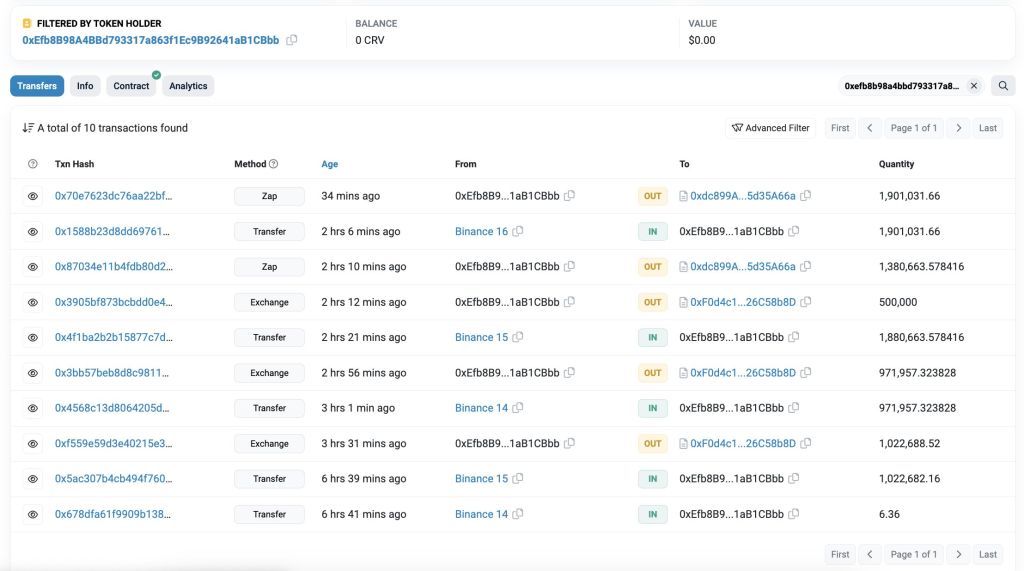

In a parallel move, another whale, 0xEfb8, withdrew 5.78 million $CRV, amounting to $3.02 million, from Binance within the last 7 hours.

The activity of 0xDf14 didn’t stop there. An additional withdrawal of 5.12 million $CRV, equivalent to $2.7 million, was made from Binance approximately 6 hours ago. Cumulatively, this whale has withdrawn a staggering 19.56 million $CRV, translating to $10.33 million, from #Binance in the past three days.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Intriguingly, all the $CRV accumulated by this whale has been staked on Convex, highlighting a strategic move to possibly earn yield on their holdings.

Following the uptick in the price of $CRV, Michael Egorov, presumably reacting to market dynamics, deposited a total of 23.26 million $CRV ($12.3 million) into Silo. Subsequently, he borrowed 3.75 million $crvUSD within the past hour.

In a final strategic play, Egorov exchanged the borrowed 3.75 million $crvUSD for $USDT and promptly repaid the debt on Aave.

Source: CoinStats – Start using it today

This series of calculated moves and substantial withdrawals by whale investors underscore the dynamic and strategic nature of cryptocurrency markets. The significant accumulation of $CRV by whales and the subsequent price surge highlight the impact of large-scale movements on market trends and prices.

It remains to be seen how these developments will shape the future trajectory of $CRV and whether other market participants will follow suit in leveraging strategic financial maneuvers in the evolving cryptocurrency landscape.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.