The cryptocurrency landscape is defined by constant change – new innovations, technological advancements, and evolving miner strategies and market forces. In navigating this complex and shifting terrain, insights from respected industry analysts and experts are critical for making sense of key developments and informing strategic decisions. This article explores the latest happenings and contrasting trends surrounding Kaspa. By examining the perspectives of leading voices, we gain crucial perspective on Kaspa’s progress and the divergent dynamics at play as the project charts its course forward.

Drawing on the insights from CryptoGrodd.ada, a crypto analyst, and Jim, S𐤊i ₿um, a technical analysis expert, we explore Kaspa’s upcoming developments, miner psychology, and the implications of the recent shifts in hashrate and earnings on the project’s future outlook.

What you'll learn 👉

Revolutionary Advancements

CryptoGrodd.ada (@groddofcrypto), has shared some exciting updates about Kaspa’s future. He revealed that the project is set to launch Testnet 11 for 10 bps in the next two weeks, and the Mainnet beta is expected to be rolled out by the end of October or early November.

Mem Pool Upgrade

In addition to these developments, Kaspa is also concentrating on a mem pool upgrade, which is currently undergoing extensive internal testing. CryptoGrodd.ada highlighted the potential transformative journey that Kaspa is embarking on, hinting at the promising future of $KAS.

Miner Psychology and Strategy

Hashrate and Earnings Dynamics

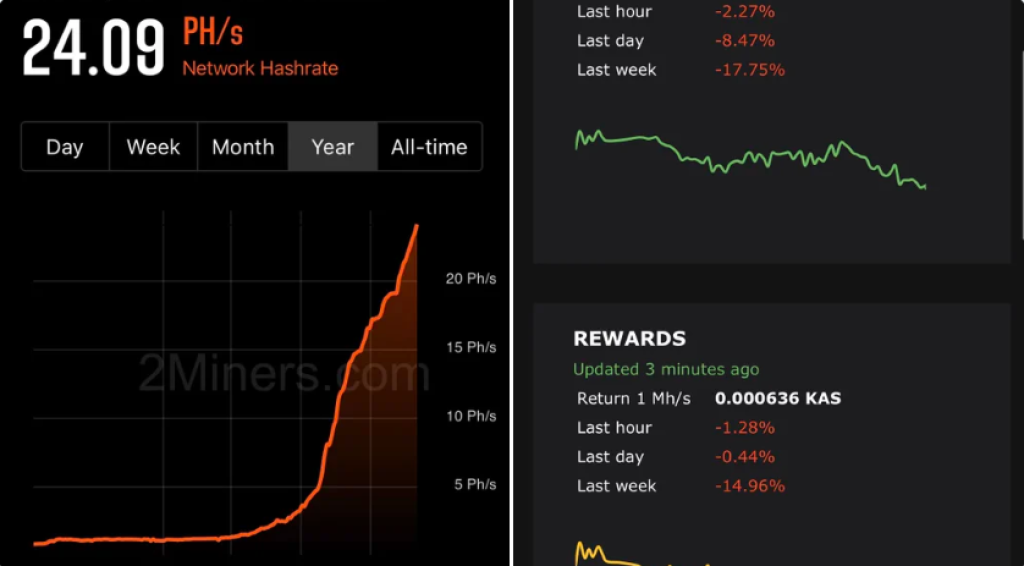

Jim, S𐤊i ₿um (@Cryptographur), also brought to light the new all-time high hashrate of $KAS, which reached 25 PH yesterday. However, he also pointed out a significant decline in block rewards and earnings over the last seven days.

Impact on Miners

This contrast raises important questions about the impact of these developments on miner psychology and strategy. It prompts discussions about how the contrasting dynamics in hashrate and earnings might impact the decisions of miners in the short and long term.

Possible Reasons Behind the Divergence

Increased Competition and Adjustment in Block Rewards

The divergence between climbing hashrate and falling rewards can be attributed to increased competition within the network and possible adjustments in block rewards. More miners are competing to validate transactions, leading to more distributed rewards and potentially decreased rewards for individual miners. Additionally, if Kaspa has undergone adjustments in block rewards, this could explain the falling rewards despite the climbing hashrate.

Market Dynamics and External Pressures

The value of rewards is also influenced by the market value of the cryptocurrency and external market pressures such as regulatory developments and shifts in investor sentiment. If the market value of KAS is experiencing a decline or if there is increased selling pressure, the rewards, even if consistent in terms of KAS, would be worth less, leading to falling rewards in real value terms.

Mining Difficulty and Operational Costs

A climbing hashrate can lead to increased mining difficulty, meaning that miners need to expend more computational power to earn rewards. If the increase in difficulty outpaces the increase in hashrate, it could lead to reduced rewards for miners. Additionally, the increased operational costs due to the climbing hashrate, such as higher energy consumption, can also impact the net rewards earned by miners.

Conclusion: Implications and Future Outlook

The diverging trends of climbing hashrate and falling rewards in Kaspa underscore the complexities inherent in the crypto landscape. The insights from experts like CryptoGrodd.ada and Jim, S𐤊i ₿um are crucial in unraveling these complexities, guiding stakeholders in navigating the intricate dynamics and making informed strategic decisions. The ongoing developments in Kaspa necessitate a keen eye and nuanced understanding to discern the potential implications and opportunities that lie ahead in this evolving market scenario.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.