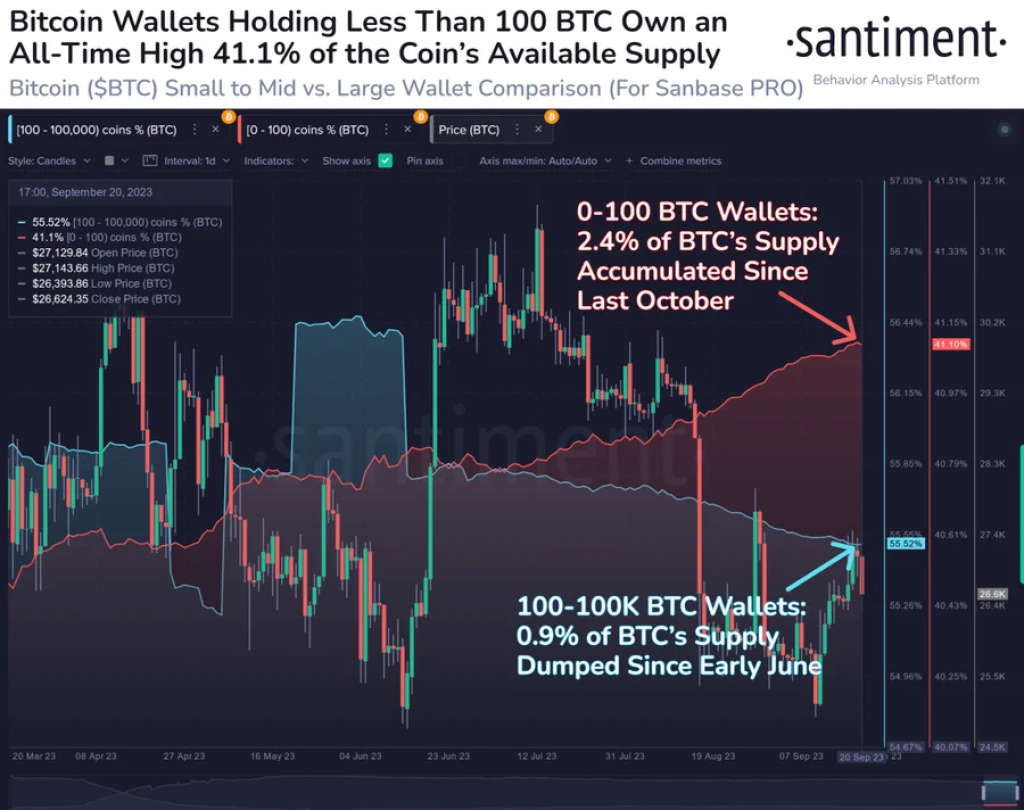

Santiment’s data reveals a major shift in Bitcoin’s ownership structure – non-whale wallets have hit record highs in their holdings, while the supply controlled by whales has declined concurrently.

Source: Santiment – Start using it today

Non-Whale Wallets Ascend: Santiment defines non-whale wallets as those holding fewer than 100 BTC. According to their latest data, these wallets have ascended to new all-time high levels, now possessing 41.1% of the available Bitcoin supply. This surge underscores a broadening distribution of Bitcoin, potentially signaling increased adoption and dispersion of the asset among retail investors.

Whale Wallets Recede: Conversely, whale wallets, categorized as those holding between 100 to 100,000 BTC, have experienced a decline in their holdings. They currently own 55.5% of the Bitcoin supply, marking their lowest possession since May. This decline in whale wallet holdings could be indicative of a diversification strategy or a redistribution of assets, reflecting a changing landscape in Bitcoin ownership dynamics.

Implications and Insights: The shift in Bitcoin ownership patterns is pivotal. It may be reflective of a more decentralized and equitable distribution of Bitcoin, a core principle of the cryptocurrency ethos. The rise in non-whale wallets suggests a growing confidence among smaller investors, possibly driven by increased awareness and understanding of the cryptocurrency market.

Moreover, the decrease in whale wallet holdings could be interpreted as a strategic move by large-scale investors to mitigate risks or to diversify their portfolios amidst the evolving market conditions. It’s crucial to consider the potential impact of this shift on market dynamics, liquidity, and price volatility, as the interplay between whale and non-whale actors continues to shape the cryptocurrency ecosystem.

Market Reactions and Future Outlook: The cryptocurrency market is inherently responsive to shifts in supply and demand dynamics. The observed alteration in ownership structures can have multifaceted implications on market behavior, price movements, and investor sentiment. A more dispersed ownership could lead to a more stable and resilient market, reducing the susceptibility to sharp price movements due to large-scale transactions by whale entities.

However, the future trajectory of Bitcoin and the broader cryptocurrency market remains subject to a myriad of factors including regulatory developments, technological advancements, and macroeconomic conditions. The ongoing evolution in ownership distribution will be a key aspect to monitor, as it will undoubtedly play a pivotal role in shaping the future landscape of the cryptocurrency market.

In conclusion, Santiment’s revelation about the changing tides in Bitcoin ownership—highlighting the ascent of non-whale wallets and the concurrent receding of whale wallets—offers a nuanced perspective on the evolving cryptocurrency ecosystem. It underscores the necessity for continual analysis and understanding of market structures and participant behaviors to navigate the intricate and dynamic world of cryptocurrencies.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.