Chainlink (LINK) appears to be showing signs of a potential bullish trend reversal based on recent price action and on-chain data.

After bouncing off long-term support around $6, LINK broke back above its 200-day moving average at approximately $6.70. This move could signal the start of an uptrend, with upside potential toward the next resistance zone around $8.50.

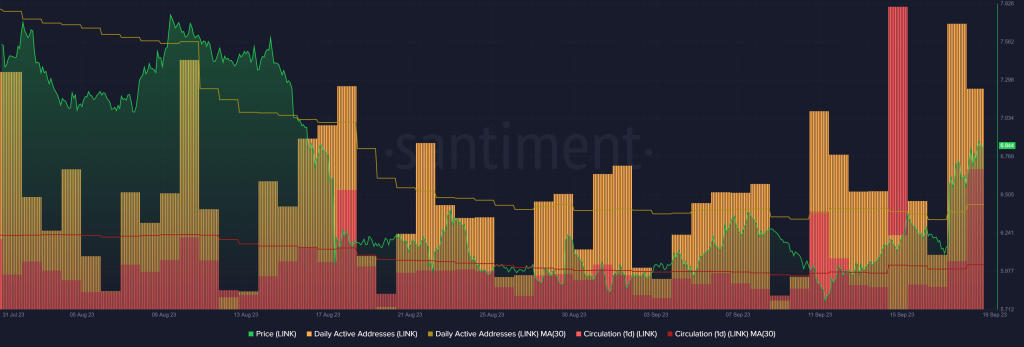

On-chain data also supports the case for a bullish reversal. On September 19th, Chainlink saw its highest number of daily active addresses in 2 months, with over 3,000 active addresses on the network. On September 20th, active addresses remain elevated with nearly 3,000 active addresses again. High network usage indicates growing interest and engagement with Chainlink’s decentralized oracle network.

Source: Santiment – Start using it today

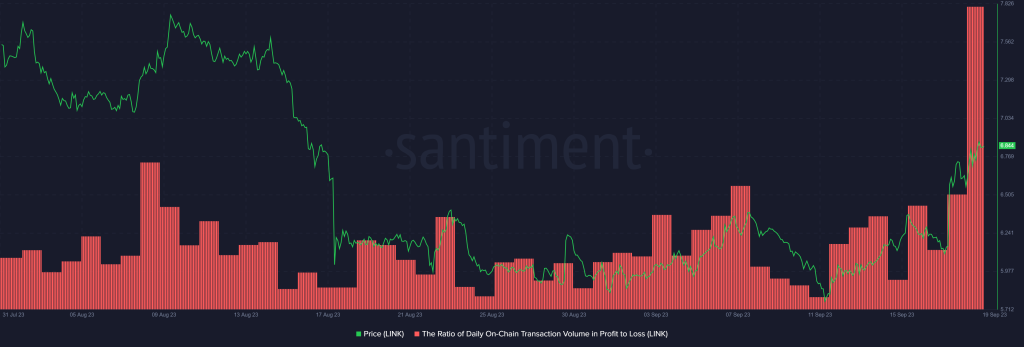

In addition, Chainlink’s ratio of daily on-chain transaction volume hit a 2-month high on September 19th at 4.78. This ratio compares the on-chain transaction volume to the network’s market capitalization and can indicate investor confidence when it reaches higher levels. Essentially, a higher ratio signals that investors are transacting more relative to the network’s market valuation, underscoring strong utility and adoption.

Source: Santiment – Start using it today

Analyzing the trend using technical indicators also paints a bullish picture for LINK in the short-term, despite remaining in a downtrend on the medium- and long-term timeframes. The MACD line is above the MACD signal line, showing bullish momentum. The RSI has bounced from oversold levels below 30 up to above 55, demonstrating accelerating upside momentum.

With the price breaking key resistance levels, on-chain activity spiking, and technicals pointing to bullish momentum, the path of least resistance for LINK appears to be higher in the near-term. The first level of resistance is the psychological $8.50 zone, with stronger resistance around $9.50 where the 50-day moving average currently resides. On the downside, initial support exists around the broken resistance level of $6.00, followed by stronger support around $5.00.

In conclusion, Chainlink’s on-chain and price activity indicate a short-term trend reversal is underway. While the medium- and long-term outlook remains bearish, the cryptocurrency looks poised to push higher toward $8.50 resistance as long as short-term momentum remains intact. Traders and investors will be closely watching to see if this bullish momentum can be sustained.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.