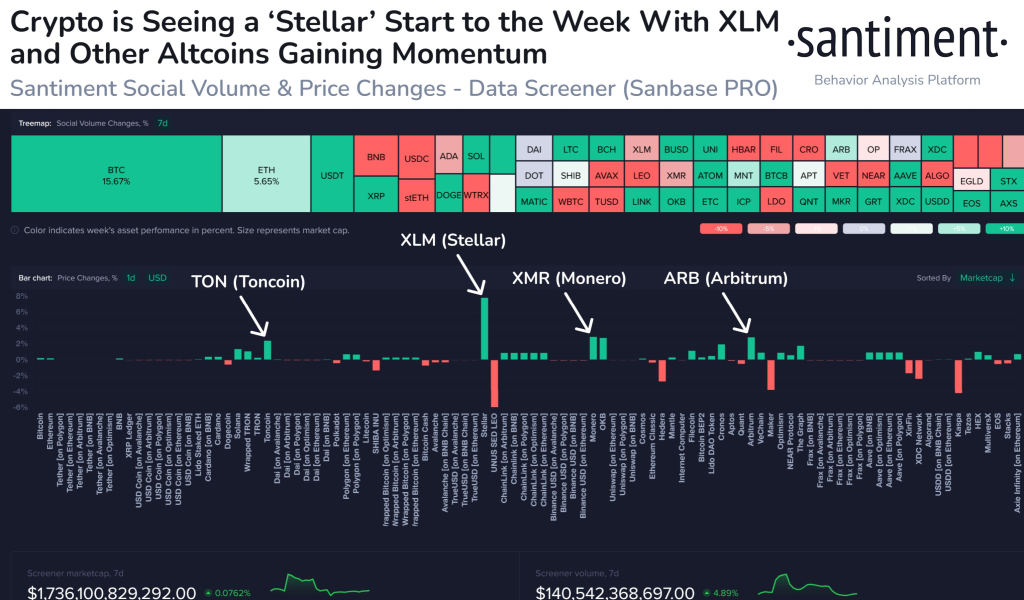

Santiment, a prominent analytics platform, recently spotlighted Stellar (XLM) as a cryptocurrency showing “mini breakout” potential. The asset has seen an 8% rise, and Santiment notes that it has been “consistently shorted by the crowd.” This suggests that liquidations could further pump up the price.

Additionally, Santiment advises keeping an eye on other cryptocurrencies like $TON, $XMR, and $ARB.

Source: Santiment – Start using it today

What you'll learn 👉

What Does It Mean When a Coin is Consistently Shorted?

When a cryptocurrency like Stellar (XLM) is consistently shorted, it implies that traders are betting on the asset’s price to decline. They borrow the asset to sell it, planning to buy it back at a lower price. If the price unexpectedly rises, these short positions may get liquidated, creating a buying frenzy that can significantly boost the asset’s price, a phenomenon known as a “short squeeze.”

Coinpedia-Market-Insight’s Analysis:

Coinpedia-Market-Insight offers a comprehensive technical outlook on Stellar (XLM). The asset has shown a double-bottom pattern, a bullish indicator, as it bounced back from its 200-day Exponential Moving Average (EMA). This recovery rally has broken past the resistance trendline, potentially averting what is known as a “death cross,” another bullish sign.

At the time of the analysis, XLM was trading at $0.12269, a 37% discount from its 2023 high of $0.1959. This bullish double-bottom reversal suggests a potential surge in Stellar Lumens’ market value. The rally is also positively influencing the trajectory of the 50-day EMA. With a 7.67% increase in the last 48 hours, XLM has surpassed the 50% Fibonacci level, indicating strength in the asset’s price.

The asset is aiming for the $0.1425 mark, challenging what is known as the supply belt. This supply belt aligns with the 23.60% Fibonacci level. If the bullish momentum continues, XLM could break this supply belt and aim for the $0.20 mark. However, there is a downside risk: if a downtrend occurs that breaks the 200-day EMA, XLM could drop to as low as $0.094.

Summary:

Both Santiment and Coinpedia-Market-Insight suggest that Stellar (XLM) is currently in a bullish phase with potential for further upside. However, it’s important to note that the asset has been consistently shorted, which could lead to volatile price movements. As always, exercise caution and conduct your own research before making any investment decisions.

You can review our XLM price prediction here.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.