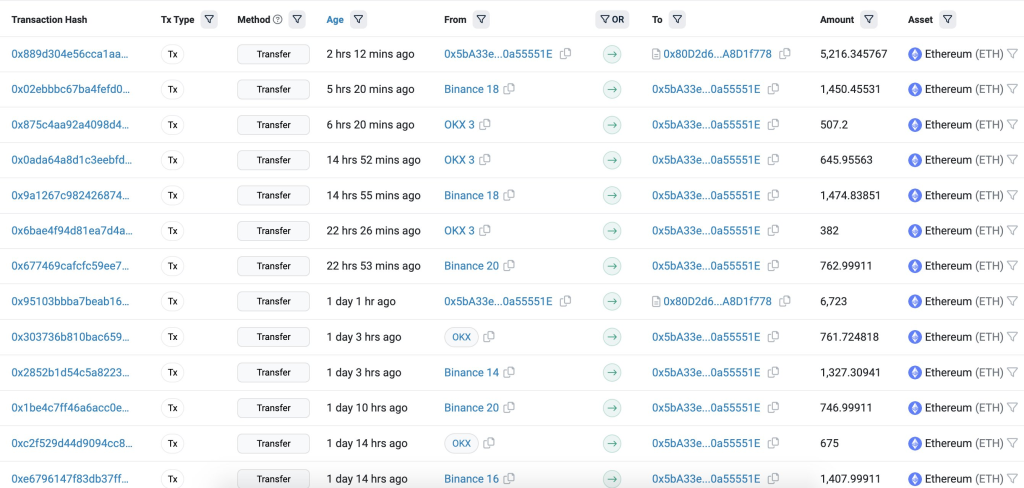

According to on-chain data, after a recent market crash, a whale deposited massive amounts of stablecoins, totaling 10 million USDC and 57 million USDT, to leading exchanges Binance and OKX.

Following these deposits, the same whale has withdrawn a total of 17,901 ETH (Ethereum), equivalent to $30 million, from these platforms. The Ethereum address associated with these transactions is 0x5ba33e59528404daca7319ca186b0e000a55551e.

What you'll learn 👉

What Does the $30M ETH Withdrawal Mean?

The withdrawal of $30 million worth of ETH is a significant move that warrants attention. There are several interpretations of what this could mean:

Hedging Against Volatility

The whale may be hedging against further market volatility by moving a large amount of Ethereum out of exchanges. By doing so, they could be looking to either hold the asset in a private wallet or use it for other investment opportunities.

Diversification

The whale could be diversifying their investment portfolio. After depositing large sums of stablecoins, the withdrawal of $30 million in ETH might indicate a strategy to balance their holdings between stable assets and more volatile ones like Ethereum.

Market Influence

Whales often have the power to influence market trends. The withdrawal could be a strategic move to create a sense of scarcity of Ethereum on exchanges, potentially driving up its price.

Regulatory Precautions

With increasing scrutiny from regulatory bodies on cryptocurrency transactions, the whale might be taking precautions by moving assets to private wallets, away from centralized exchanges that are subject to regulation.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.