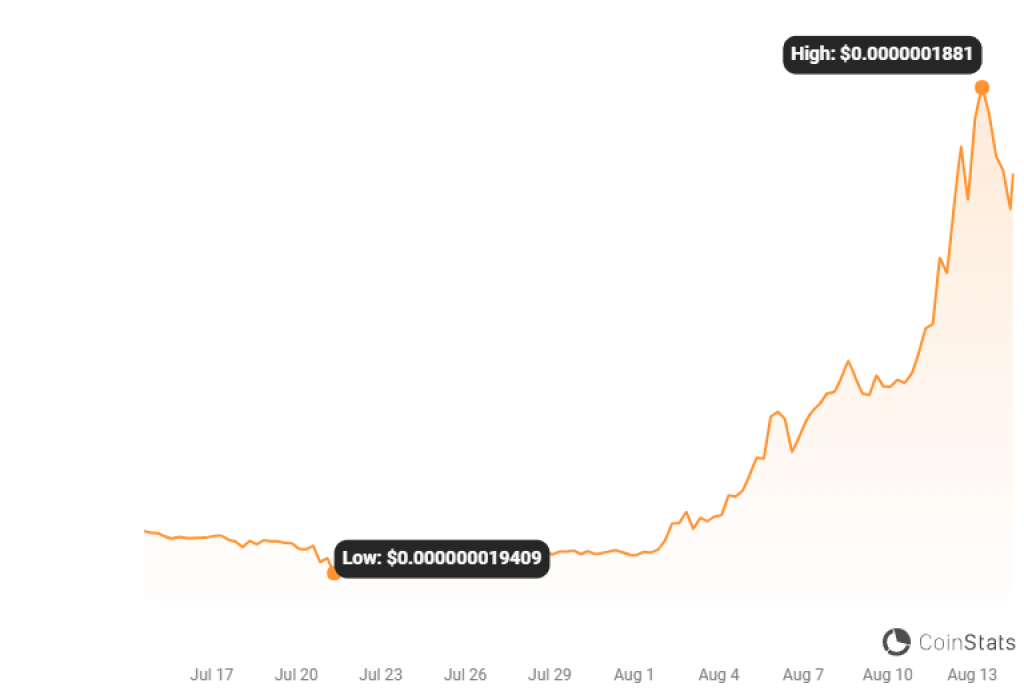

The cryptocurrency Bad Idea AI, known by its ticker $BAD, witnessed a ~500% surge in its price during the month of August. This rapid ascent has caught the attention of many in the crypto community, leading to increased scrutiny of its top holders.

For those closely monitoring $BAD, one top holder, in particular, stands out. This entity, identified by the wallet address “0x6745”, holds a whopping 120.3T $BAD, which equates to 14.5% of the coin’s total supply, reports LookOnChain, one of the top on-chain analysts in the world of crypto.

A deep dive into the transaction history of this wallet reveals some intriguing details:

- In the initial moments after $BAD was launched, Wallet “0x6745” swiftly acquired 139.5T $BAD, representing 16.8% of the total supply. This massive purchase was executed via three distinct addresses and cost the holder 7.4 $ETH, approximately $14K.

- Not long after, the same entity offloaded 19.2T $BAD, raking in a substantial 225 $ETH, which translates to around $414K.

As of now, BAD’s top holder retains 120.3T $BAD across seven different wallets. With the current value of $BAD, this holding is estimated to be worth a staggering $19M.

Source: CoinStats

Speculation and Implications

The concentration of a substantial portion of $BAD’s total supply in the hands of a single holder, spread across seven wallets, is indeed a cause for discussion. In the unpredictable realm of cryptocurrencies, such a distribution pattern is akin to walking on a tightrope.

On the brighter side, this could be interpreted as a show of immense confidence in the coin’s prospects. This particular “whale” might possess privileged insights or a particularly optimistic perspective on $BAD’s trajectory, prompting them to amass and retain such a significant amount.

However, there’s a shadow to this silver lining. This level of concentration introduces the peril of potential market manipulation. With such a hefty stake, this holder wields considerable power over the coin’s valuation, with the capability to sway prices dramatically through sizeable transactions. Actions of this magnitude can introduce wild price swings, which might adversely affect retail investors.

To sum it up, the impressive ascent of $BAD is undeniably noteworthy. However, prospective investors should approach with prudence and undertake comprehensive due diligence. The dominance of a single whale in the $BAD waters is a reality that warrants careful consideration.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.