Bitcoin Halving in April 2024 ticks away, the crypto community finds itself in a unique position. The landscape today is starkly different from the one that existed during the last Halving. The key difference lies not in technical analysis or price charts, but in something far more fundamental: the Bitcoin supply.

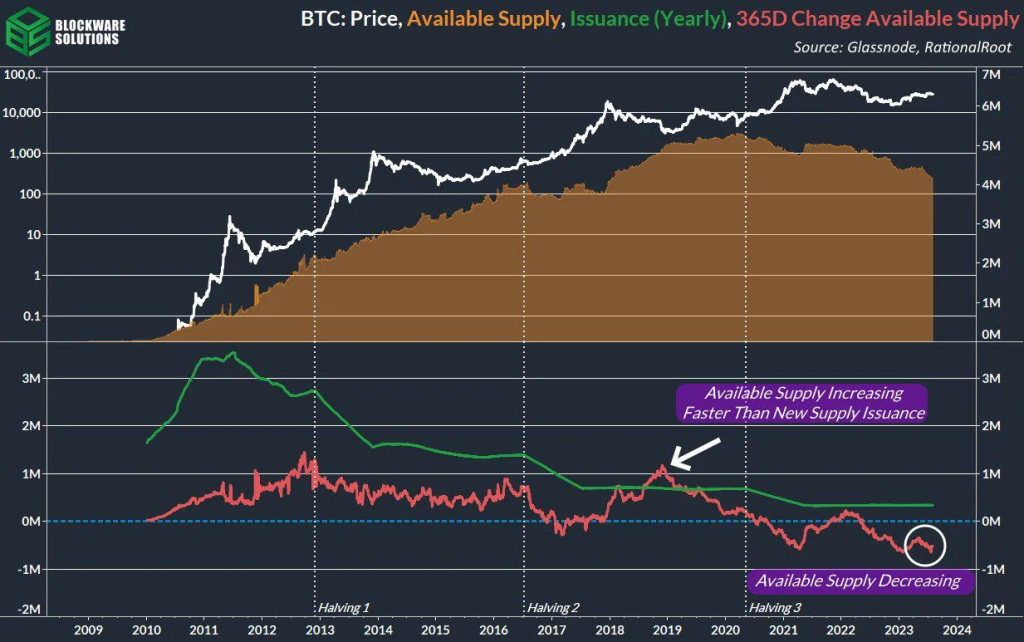

Each Bitcoin Halving event is designed to slow the growth of the Bitcoin supply, thereby increasing its scarcity. This reduction in inflation, coupled with a steadily rising demand, naturally exerts upward pressure on the price.

However, it’s not the total Bitcoin supply that’s of interest here, but a specific segment: the Bitcoin supply available for trade. While all Bitcoin is fundamentally the same, it’s worth noting that up to 70% of the total supply is currently held by long-term holders. Moreover, 50% of the total supply is in the hands of the most dedicated long-term holders, those who have not sold for over two years.

When you factor in the Bitcoin supply that was lost forever in the early days of crypto, the amount left over for exchanges to offer to new entrants is significantly reduced.

Comparing the 2020 and 2024 Halvings

The 2020 Halving saw the Bitcoin supply available for trade reach new all-time highs. In contrast, as we approach the 2024 Halving, we’re witnessing multi-year lows in the available supply according to the post by Reddit user partymsl. From a supply perspective, the 2024 Halving will be a completely different beast compared to its 2020 counterpart.

So, what happens when there’s barely any supply left to trade, but demand continues to rise due to a bull run? The answer is simple: the price adjusts upwards until demand and supply reach equilibrium. Given the current supply dynamics, the next bull market could prove to be a fascinating period in the evolution of Bitcoin.

Over various timeframes, Bitcoin’s price performance has demonstrated both growth and decline. In the last 24 hours, the price of Bitcoin (BTC) has seen a slight increase of 0.35%, bringing it to $29,214.10 with a 24-hour trading volume of $12,513,156,884.50. However, over the past week, the cryptocurrency has experienced a slight dip, with a -0.12% price decline.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +This trend continues when we look at the past month, with Bitcoin’s price decreasing by -5.2%. Despite these short-term fluctuations, Bitcoin’s annual performance tells a different story. Over the past year, Bitcoin’s price has increased by 26.3%. However, it’s worth noting that the current price is still -57.72% lower than its all-time high of $69,044.77, which was recorded on Nov 10, 2021.

In conclusion, the scarcity of Bitcoin is not just a concept, but a tangible reality. As we approach the 2024 Halving, the dwindling supply of Bitcoin available for trade could set the stage for unprecedented price movements. The countdown is indeed on, and the crypto world watches with bated breath.