Whales, individuals or entities that hold a significant amount of digital currencies, play an instrumental role in shaping market trends. Recently, some intriguing transactions were noticed involving Maker (MKR) and Ethereum (ETH), two leading cryptocurrencies, prompting discussions and speculation within the crypto community. The on-chain data was shared by on-chain analysts Lookonchain.

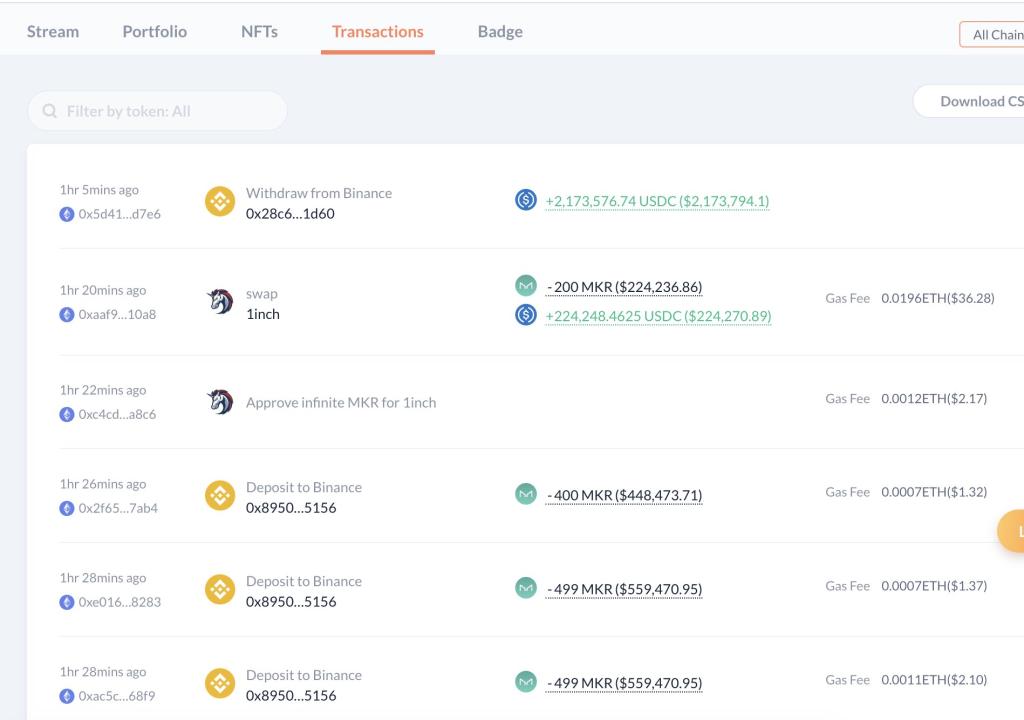

An unidentified whale, known for their market-moving actions, has been heavily involved in the MKR market over the past few weeks. This savvy player offloaded approximately 1,598 MKR tokens, equivalent to nearly $1.8M, causing the token’s price to drop by an estimated 2%. Interestingly, the sale was followed by a withdrawal of 2,760 MKR tokens ($2.5M) from the prominent digital asset platform, Binance, between early to mid-July. The average withdrawal price during this period was approximately $918.

Based on the current market prices, the estimated profit made from these transactions reaches an impressive $560K. It seems that strategic trading moves of such influential figures can significantly sway the market dynamics and impact the perceived value of specific cryptocurrencies.

However, the story does not end there. Along with the aforementioned MKR movements, the whale also engaged in extensive Ethereum (ETH) trading. A staggering sum of 1,998 ETH tokens ($3.76M) and 141.7 MKR tokens ($130K) were bought from Binance, utilizing a total of 4M USDC, a stablecoin pegged to the US dollar.

Since late June, there has been a substantial uptick in this whale’s Ethereum accumulation activities. The individual or entity purchased an impressive total of 11K $ETH tokens ($20.7M) and an additional 1,435 $MKR tokens ($1.32M) from Binance, further amplifying their influence on these two significant digital assets.

The recent MKR dump by a whale, resulting in a 2% price drop, has certainly caused a stir in the crypto community. However, it’s important to remember that the cryptocurrency market is inherently volatile and influenced by a variety of factors, including the actions of large-scale investors, or ‘whales’. While the whale’s recent sale of approximately 1,598 MKR tokens did cause a temporary dip in the token’s price, it’s crucial to note that such market movements are not uncommon in the crypto space.

Therefore, while investors should always stay informed and monitor market trends closely, this particular event does not necessarily signal a long-term concern for MKR investors. As always, individuals should consider their own risk tolerance and investment goals when making decisions.