Ethereum (ETH) and Solana (SOL) have been at the forefront of investor interest in the world of crypto. Their recent price movements and future predictions offer intriguing insights into potential market trends. Here’s an in-depth look at the current price dynamics of both Ethereum and Solana and what they might indicate about their future.

What you'll learn 👉

Ethereum’s Price Dynamics

Ethereum’s price has been undergoing a correction phase, with a WXY structure observed in its wave count. This structure suggests another low could be on the horizon. However, there is also a possibility that the low has already been reached, but this can only be confirmed with a strong impulse to the upside and a three-wave pullback.

The key support level for Ethereum is currently around $1,710. However, if this level doesn’t hold, the next bullish support level is around $1,658. It’s important to note that the move down currently appears to be corrective rather than impulsive, which could suggest a potential reversal in the near future.

Source: TradingView

Ethereum’s price has been oscillating within a trend reversal area and has yet to break out. A sustained break above $1,755 could indicate a trend reversal. On the daily chart, Ethereum was oversold and has since recovered quite a bit, moving up around 5.5% to 6%. This is not enough to confirm a trend reversal, but it does indicate that the correction phase could be nearing its end.

Looking at the bigger picture, if Ethereum completes a three-wave move with a WXY structure, we could expect a deeper correction. However, if this is followed by a five-wave move up, it could indicate the start of a new bullish trend. This scenario is still unclear and will require further confirmation.

In the event of a break below the $1,710 level, Ethereum could potentially reach a new low of around $1,627. If this level doesn’t hold, Ethereum could head towards the $1,530 to $1,540 range. However, if Ethereum manages to hold the $1,658 level, it could signal the start of a third wave up, giving more confidence that Ethereum has reached its bottom.

Solana (SOL) Price Analysis: Bullish and Bearsih Scenario

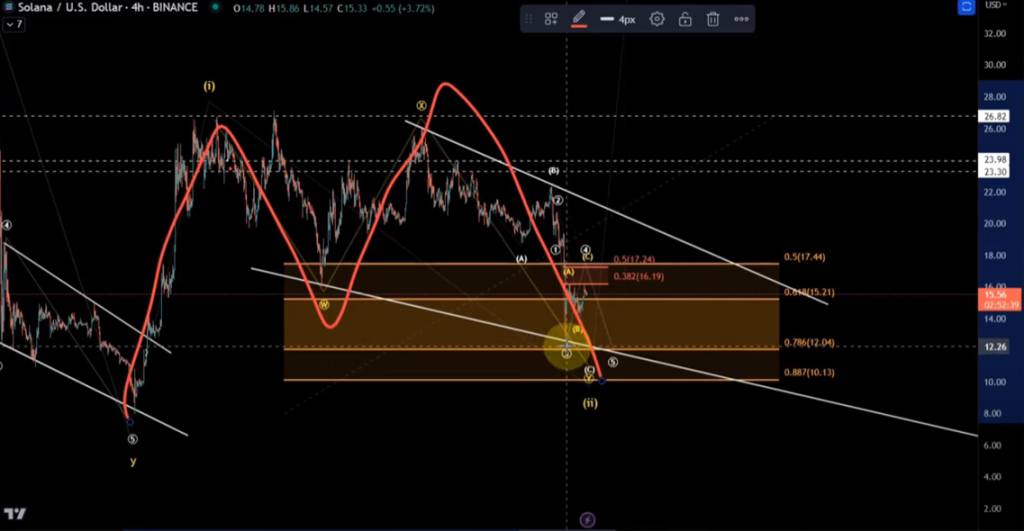

Solana’s price has been consolidating over the recent period, moving sideways with no significant changes in its wave count. The current wave count suggests that Solana is in a correction phase, with a potential for one more low unless there’s an impulse above $17.90.

The bullish scenario for Solana suggests that the first wave was followed by a WXY correction, with the possibility of another low. However, this low would ideally not sustain below the $12 level. If it does, there’s an increased risk of Solana developing an ending diagonal, which is a bearish wave count. This would likely lead to a break below the $8 mark.

Source: TradingView

On the other hand, the bearish scenario suggests that Solana is in an ending diagonal with waves one, two, three, four, and five. If Solana’s price sustains below the 78.6% retracement level, it indicates a failure to create an impulse, suggesting that it was just a correction and is now coming down in an ending diagonal to finish off the overall bear market.

In the short term, Solana could potentially form a one-two setup, with the first wave possibly being a diagonal. However, without a break above resistance and without having five waves of the next larger degree followed by a subsequent three-wave pullback, it’s difficult to confirm that a low has been made.

If Solana manages to break above the $17.90 resistance, it would increase the likelihood of the bullish count. However, until there’s evidence of a trend reversal, the focus remains on the downside. A break above $17.90 would make the bullish count more plausible, highlighting the potential for a trend reversal.

Conclusion

Both Ethereum and Solana are at pivotal points in their price trajectories. Ethereum’s price movements suggest a potential reversal in the near future, with key support levels providing crucial indicators. On the other hand, Solana’s price dynamics indicate a correction phase, with a potential for another low unless there’s a significant upward impulse.

The question of whether Solana can keep up with Ethereum is contingent on several factors. Solana’s ability to break above its resistance and show evidence of a trend reversal will be key in determining its future trajectory. Similarly, Ethereum’s ability to hold its support levels and show a strong impulse to the upside will be crucial in confirming its trend.