Not much has changed with the market in the last 24 hours. Bitcoin closed above $7000, looking to confirm the break out it recently made. The general consensus is that we are either looking at a breakout above towards $7400 or a retracement towards the current support of $6850. The second scenario seems more likely as indicators show the bull move has been slightly exhausted. We looked at what several traders thought about the current market situation:

Bitcoin (BTC)

Turningmecard provided an insight into Bitcoin, and suggested that a breakout could be expected on the 31st:

“I analyzed the daily chart, which is pretty bullish at the moment. NOW is a perfect chance to break upwards, actually! Guys, for the last 6 month, we had this thick red cloud above us, which is bearish. But now, we have a green cloud, which, if we penetrate through we can have good support. It is now good chance to break through 74/75 level, which is the descending triangle top, and challenge 7900 daily 200ma, which, most of the times rejected BTC . If above that, i believe 10k will happen.”

He suggests this position could also lead to a re-test of $6980/$7020, try $7170 from there and fall to $6800 or lower afterwards. Check out his complete analysis here to see what his actual trade plans for this level are.

Trader jollyjoker747 expands on the bearish sentiment:

“Bitcoin is currently moving inside a rising wedge pattern. RSI/Stoch overbought. “CMF” showing no real buying power. Many traders expect 7500 this week, but I see this as highly unlikely. Watch out for a break out of the wedge. If we break upward, my first target would be the 7500-7600 range. Breaking downward would drop us to the accumulation area around 6500, or even lower, to the support zone 5800-6000.”

AndyMillaa observed the Heikin Ashi candles, RSI, Bollinger Bands and a couple more indicators and confirmed the short/long targets of $6850/$7400 we mentioned at the beginning.

Ethereum (ETH)

Trader easyMarkets was his usual concise self with his analysis of ETH:

“ETHUSD is approaching our first resistance at 305 (horizontal overlap resistance, 76.4% Fibonacci retracement, 61.8% Fibonacci extension) where a strong drop might occur below this level pushing price down to our major support at 283 (horizontal pullback support, 61.8% Fibonacci extension, 50% Fibonacci retracement).

Stochastic (89,5,3) is approaching resistance where we might see a corresponding drop in price should it react off this level.”

Ripple (XRP)

Exsilium thinks there could be a slight bull trap scenario developing with XRP:

“There have been a number of formations broken to the upside over the last 24 hours, including bearish formations such as the Ascending Triangle. There is a confluence of resistance here at 0.354 with the descending trend-line from 6/3 which has been touched 4 times since then making it a pretty strong resistance trend-line. There is also the horizontal resistance area at 0.354 from 8/19 which was again tested on 8/21 which preceded a drop within 24 hours to below 0.31.”

He also looks at 1H RSI/1H Fischer and 4H RSI/4H Fischer and feels that most of these indicators are oversold and signal a sell-off. Check out the complete analysis here to see his current plans for future bullish/bearish scenarios.

@JoshMcGruff from Twitter had a more bullish overview of the currency:

$XRP breaking out of its 1HR cloud. Looking for it's time in the sun. pic.twitter.com/JrgR3JuARd

— Josh McGruff (@JoshMcGruff) August 28, 2018

Other thoughts

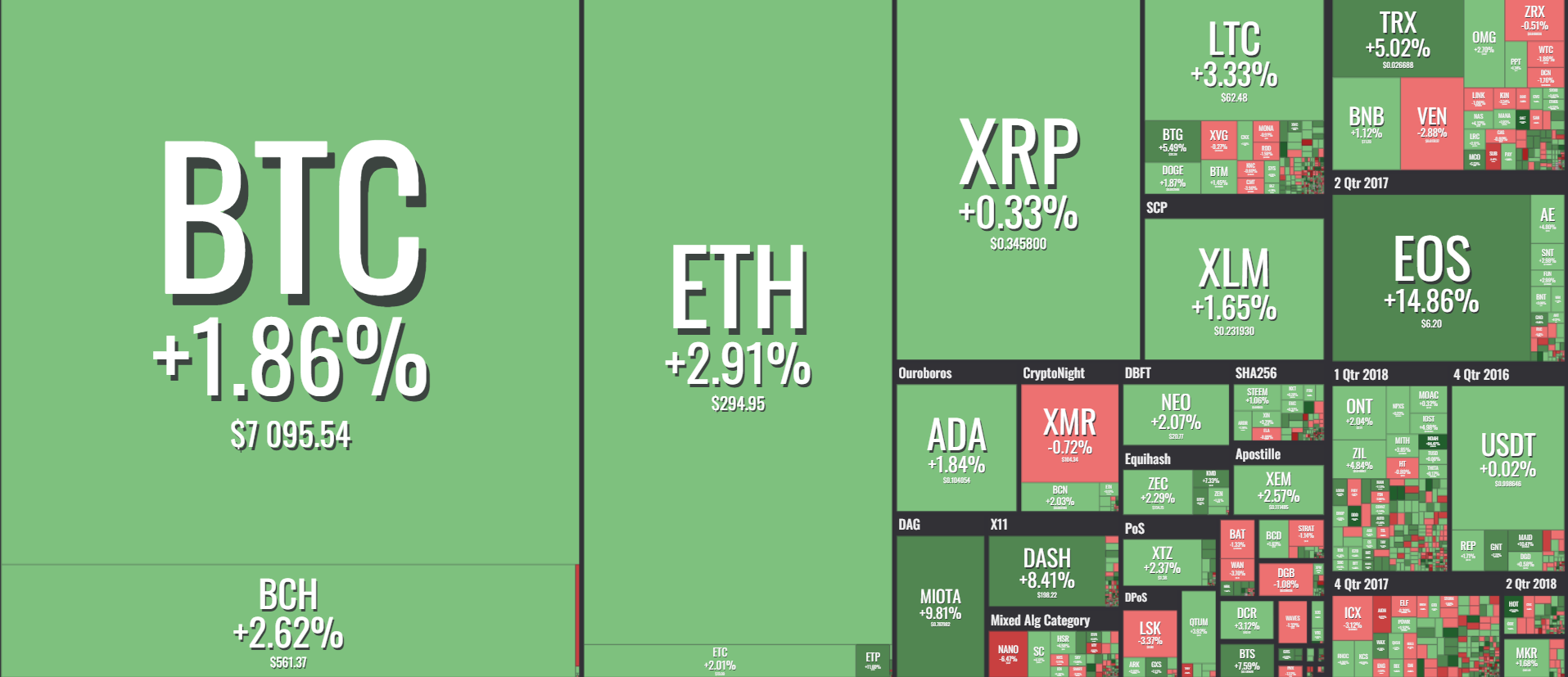

Naturally as the bull move is being exhausted we are starting to see a bit more red on the market. Various currencies that performed well during the last couple of days are now seeing some slight retracement, with Substratum (8%), Nano (8%), Aion (5%) and Bytecoin (4%) leading the drop-off. These coins going down has cleared the stage for others to have their own positive runs, and cryptocurrencies like Noah Coin (103%), Holo (21%), EOS (17%) Metaverse (10%) and Golem (10%) took advantage of that. Bitcoin remains in consolidation but we likely won’t have to wait too long to see where it’s headed to next.