The popularity of digital currency has paved many individuals to create virtual currency or cryptocurrency accounts. Many prefer this option as it’s believed to be a quick way to transact money. Apart from this, digital currency allows peer-to-peer transactions with minimal fees because they don’t need third parties, such as credit institutions or banks.

Suppose you’re planning to start stashing your cash in a digital currency wallet. In that case, you may need to know some tips and tricks to keep your money safe on this platform. This will help you ensure that your account is free from hacking attacks and similar issues. For that purpose, here are some ways to help you:

What you'll learn 👉

1. Secure Your Password

According to swtftx.com, hackers have sophisticated tools that could crack weal passwords. Because of this, you need to use ultra-strong passwords. The stronger your password is, the more secure it is against unauthorized access. You may need to use at least eight characters, lowercase and uppercase letters, and alphanumeric and special keys. You may also refrain from using your names and any word associated with you, such as your birth month and address.

For a safer password, you may consider using multi-factor authentication, so you’ll receive a notification whenever someone tries to access your wallet. Apart from this, you may consider applying biometrics. Also, it’s best to keep your password to yourself and avoid saving it on your device. You may also need to change your password from time to time to keep your account protected.

2. Avoid Using Public Wi-Fi

While public Wi-Fi makes internet access better, it exposes your computer and devices to security risks. Hackers can access your personal information, login credentials, and financial information if a Wi-Fi connection is compromised.

Other public Wi-Fi users can intercept your data if you connect to an unencrypted website. To avoid these issues, you may need to access private Wi-Fi points. You may also consider using mobile data connections.

3. Delete Suspicious Emails And Messages

If you receive suspicious messages on social media platforms and email, you must immediately remove them. To determine if a message is linked to phishing and other ethical issues, you may need to check out the following:

- Asking for personal information, including currency account details

- Sense of urgency

- Suspicious and inconsistent links

- Unrealistic threats

4. Get Updated With Recent Data Breaches

Since hackers always find new ways to access anyone’s accounts, you should keep a wary eye on recent data breaches. You may join online communities that share information regarding scams, phishing, and similar activities you may need to know. This way, you could anticipate the possible attacks your account may receive.

5. Keep Your Devices Clean

Invest in the latest anti-virus programs to protect your device against hacking attacks and personal information theft. You may use a solid firewall to improve your device’s security further. In addition, you may need to clean up or delete the dormant apps in your webs, especially the ones you downloaded from non-secure sites.

6. Use Cold Storage

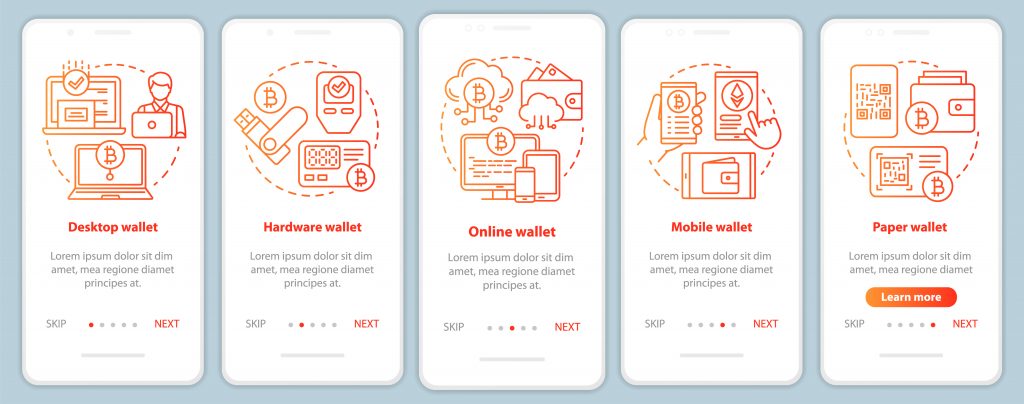

Cold wallets are physical devices you may use to store your digital currency keys and encryption and are accessible offline. Because of this, they’re free from cyberattacks. In addition, cold wallets make your assets unaffected by third-party liabilities.

7. Keep Multiple Wallets

As a digital currency investor, you must refrain from keeping all your assets in a single account, so they won’t all be at risk should your private key be stolen. Furthermore, it makes your accounts more private. When creating multiple wallets, remember to use different passwords and login details, having the same defeats as various accounts.

8. Know The People To Contact If Issues Happen

Keeping a list of people and numbers in your contacts is necessary. Informing them may be the best thing to do if your data or account gets hacked. This way, you may request your funds to be frozen. This mandatory reporting to your digital currency is vital if an issue such as hacking occurs, so you’ll receive further instructions on what to do.

Wrapping Up

Having a digital currency wallet is an excellent decision if you plan to have quick, cashless, peer-to-peer transactions. However, to always keep your crypto assets safe, you may need to know how to maximize your account’s safety while using the wallet that suits you.

Applying the tips and tricks you’ve gained from this article helps make the most of your virtual currency experience. You’ll spend and transact without worrying about the risks lurking behind your cryptocurrency use.