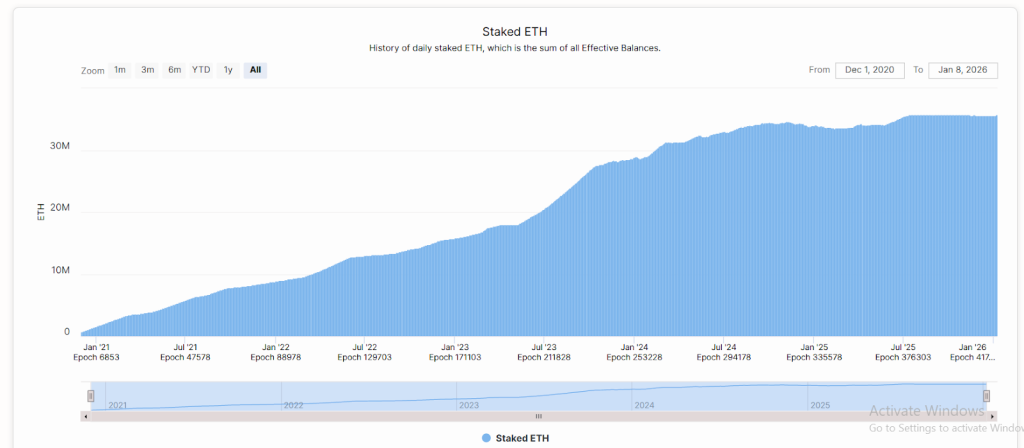

Ethereum staking queue hit a 2-year record high in September 2025, with over 860,000 ETH, worth around $3.7 billion, waiting to be staked. This highlights a growing trend: in volatile markets, real yield is becoming the go-to way to earn passive income.

Real yield turns idle crypto into active earners. High APYs are attractive, but not all yields are sustainable. Many projects promise big numbers without backing them with real liquidity or secure tokenomics, putting investors at risk.

In this category, Digitap ($TAP) stands out as the best new ICO crypto to watch. Its structured tokenomics offer up to 124% APY, paired with a low entry price of $0.0427 per $TAP. With a live app, real utility, and a growing user base, Digitap delivers a rare combination of high yield, tangible adoption, and long-term potential in one early-stage crypto.

Let’s explore some of the top-performing altcoins currently offering competitive APYs for investors seeking passive income and their respective yield mechanics.

What you'll learn 👉

1. Digitap’s 124% APY: The Lead Staking Yield Mechanism in 2026

Digitap is built around a revenue-backed, non-inflationary staking model that rewards users without diluting long-term holder value. Unlike many DeFi projects that rely on continuous token emissions, Digitap distributes staking rewards from a fixed, pre-allocated pool, ensuring no new tokens flood the market.

During its presale stages, Digitap offers up to 124% APR for early adopters, transitioning to up to 100% APR after launch. This structure is supported by strict supply discipline and on-chain safeguards that protect token scarcity, making the yield sustainable over time.

Beyond staking, Digitap uses a 50% buy-back mechanism, where half of all protocol revenue is used to purchase $TAP from the market. These tokens are then redistributed to stakers and liquidity providers, creating a continuous demand loop that ties rewards directly to platform adoption and transaction activity.

2. Ethereum (ETH): Low-Risk Low-Return DeFi Staking

Ethereum offers one of the safest ways to earn passively through its proof-of-stake system. Holders who lock their tokens in the network earn rewards ranging from 3% to 5% APY. However, solo staking requires a minimum of 32 ETH to run a validator node.

Investors with less than 32 ETH can use third-party liquid staking platforms like Coinbase and Lido. These platforms let users stake ETH without running a validator. The rewards are smaller than newer altcoins but backed by Ethereum’s robust infrastructure.

Compared to high-yield altcoins offering up to 124% APY, Ethereum’s returns are modest at best. However, it remains a stable, low-risk option for long-term passive income in the DeFi ecosystem.

Staked ETH 2020-2026 Source: beaconcha.in

3. Starknet (STRK): Layer 2 Yield Opportunities

Starknet, a layer 2 blockchain built on Ethereum, offers faster transactions while retaining Ethereum’s security. With STRK, users can earn between 8.9% and 21% APY by participating in network activities such as governance and protocol incentive programs. Active participants can earn higher rewards.

Unlike ETH, STRK rewards are less predictable. Returns fluctuate based on network adoption, activity, and liquidity. Compared to newer high-yield tokens, it is relatively modest but can be higher risk, higher reward.

While Ethereum offers stable but lower yields, STRK gives investors a chance to capture aggressive returns in the growing Layer 2 ecosystem. It’s a solid option for those willing to take a bit more risk for better upside.

4. Celestia (TIA): Modular Blockchain Meets Staking Rewards

Celestia is a modular blockchain that separates consensus from data availability. This design allows developers to build scalable blockchains on its network.

Participants who secure the network and participate in governance can earn 5.5%-22% APY through staking and network activity. Active participants have more potential to earn higher rewards.

TIA’s staking yields are tied to network adoption and usage. Rewards fluctuate based on demand for data availability from rollups and application-specific chains. Passive holders usually earn closer to the base rate, while active contributors can maximize returns.

5. Jupiter (JUP): 20% APY Staking on Solana

Jupiter is one of the leading decentralized exchanges in the Solana ecosystem. Its dominance in the ecosystem gives the JUP token real utility, which is tied directly to its trading volume, liquidity depth, and regular on-chain activities.

Active holders can earn rewards through staking, governance participation, and protocol incentive programs. Users who engage more in governance or liquidity-related activities tend to earn higher returns.

However, JUP’s yields are closely tied to Solana DeFi activity and volume. Returns are strongest when Solana DeFi activity is high, and trading volumes are rising. On the other hand, rewards can drop during slower periods.

$TAP is Leading the Crypto Presale with High Yields

With its record-high 124% staking yields, revenue-backed model, and built-in buy-back mechanism, Digitap clearly stands out as the best crypto presale to join in 2026. Early adopters holding $TAP can lock in exceptional APRs while supporting a sustainable, growth-driven ecosystem.

Digitap’s presale has achieved strong traction across its live campaign phases. Early investors entered at prices ranging from $0.0125 to $0.0427, benefiting from high-yield staking, real-world payments infrastructure, and revenue-backed tokenomics. These features make $TAP a rare combination of growth potential and passive income.

The ongoing presale continues to attract significant demand, positioning Digitap as one of the fastest-growing fintech-focused crypto launches. With the current entry price of $0.0427 per $TAP, early buyers secure exposure ahead of the public launch, exchange listings, and product rollout.

Why $TAP Stands Out Among Top Yield Tokens

In today’s volatile market, passive income is increasingly driven by real yield rather than speculative price moves. Ethereum’s growing staking queue reflects this shift, as capital flows toward protocols with sustainable reward mechanisms.

Among the tokens discussed, Ethereum offers stable but modest returns, while Starknet, Celestia, and Jupiter provide higher APYs tied to network activity, liquidity, and adoption. These yields fluctuate and carry more risk, requiring active participation to maximize rewards.

Digitap is a top choice to consider with its non-inflationary staking model, revenue-backed rewards, and aggressive APY structure. Having already raised over $3.9 million at a presale price of $0.0427, $TAP combines high yield with strong infrastructure, making it the best crypto to buy for passive income ahead of its public launch.

Discover how Digitap is unifying cash and crypto by checking out their project here:

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.