The price of Onyxcoin has been moving sideways since its mid-April spike, with many investors wondering what’s next for the token. Despite a few impressive breakouts this year, there’s a strong case to be made that the XCN price is still undervalued.

Here are four key reasons why Onyxcoin could have much more room to grow.

What you'll learn 👉

Onyxcoin Has Few Competitors in Its Niche

One of the main reasons the Onyxcoin price could still be cheap is that it operates in a relatively underexplored segment of crypto: payments and trade finance. While this space is projected to become a multi-trillion-dollar market by 2028, very few crypto projects are building specifically for it. Ripple’s XRP, Stellar’s XLM, and XinFin’s XDC are some of the few players here, and even among them, regulatory battles have created uncertainty for investors.

XCN, on the other hand, stands out for having a clearer legal standing and a more flexible technical design. With fewer direct competitors, the token is positioned to benefit as adoption in this niche increases. As global demand for seamless cross-border payments and decentralized finance grows, Onyxcoin may become a major player in the space, and that’s not yet fully reflected in the XCN price.

Strong Market Activity and Correlation With Bitcoin

Despite its modest price movement lately, Onyxcoin still maintains a healthy level of market strength. Its market cap sits around $600 million, and daily trading volume often exceeds $45 million. These numbers suggest that XCN is not a forgotten microcap. Investors are actively watching and trading this token, which helps reduce risks associated with low-volume assets.

Earlier in 2025, when Binance listed XCN futures, daily trading volume surged from around $25 million to over $600 million in just a few days. That explosion in volume showed there’s real demand and interest behind the project. Also, XCN tends to follow major crypto trends. When Bitcoin or Ethereum rally, Onyxcoin often moves in the same direction. But it doesn’t always need the market’s help.

Back in January, the XCN price spiked by nearly 2,000% in two weeks. In April, the token jumped almost 300% even while other altcoins stayed flat. These rallies show it has the power to outperform the broader market.

Community and Developer Growth Back the Hype

XCN isn’t just driven by whales or exchange hype, it has a real community behind it. By April 2025, Onyxcoin had built a combined following of about 500,000 across Twitter and Telegram. On-chain data supports this too, with nearly 4,000 active addresses daily and trading volume close to $591 million.

Behind the scenes, developer activity has picked up as well. GitHub contributions doubled in a short span, showing that the protocol is actively evolving. The price surges this year weren’t random, they came alongside real ecosystem growth, new tools, and community expansion. When crypto price action is backed by real user adoption and builder engagement, it tends to be more sustainable.

New Technology, DAO Deals, and Long-Term Potential

One of the most overlooked reasons the XCN price might be undervalued is the ongoing protocol development and governance shifts. OnyxDAO recently resolved disputes with Tron founder Justin Sun and HTX Global, successfully bringing them into the DAO’s ecosystem. That’s a major reputational win and opens up future opportunities for staking and governance collaboration.

The rollout of the new XCN Ledger and Layer-3 infrastructure this year was another big milestone. It means the project now has stronger scalability solutions and a clearer direction as a Web3 infrastructure platform. Other upgrades like sXCN (its liquid staking system) and the Goliath Project are focused on making the token more useful across DeFi, payments, and staking.

Read Also: This One Resistance Is the Key to SUI’s Next Leg Up: Analyst Reveals Target

There are also incentive programs now live, such as OIP-51 for Onyx Core Nodes—and strategic partnerships like the one with Chain.com, which allows real-world payments using XCN. These developments make XCN more than just a speculative asset.

It’s worth noting that some metrics like the Network Value-to-Transaction ratio suggest the token could be temporarily overvalued. But when you zoom out and look at the long-term tech roadmap, community strength, and adoption play, the foundation for growth is solid.

Growth Potential This Cycle

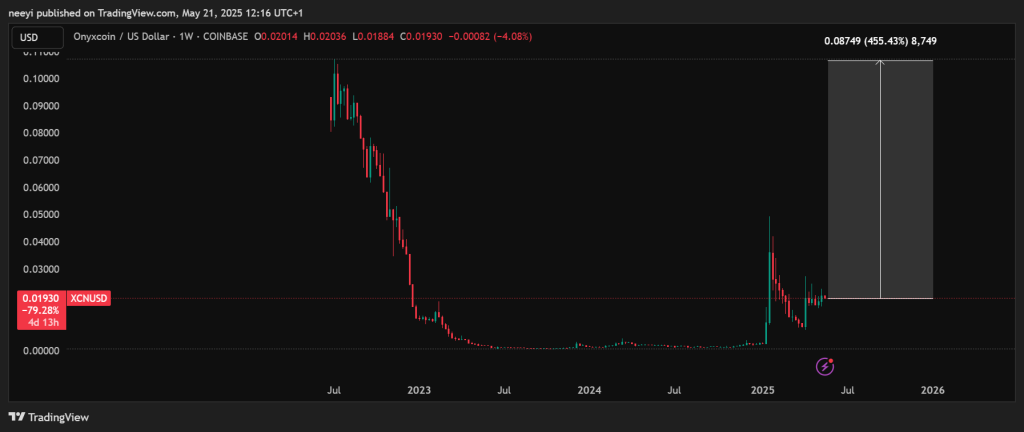

At its current level, a return to Onyxcoin’s last all-time high would require a 450% increase. That shows just how far XCN has fallen from peak levels—and how much potential it still holds. If the project continues gaining traction and delivering on its roadmap, the XCN price could easily surprise investors again this cycle.

In a crypto market full of hype-driven moves, Onyxcoin stands out as a token with real progress, a strong user base, and a clear focus. That’s why many believe the current XCN price is still undervalued.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.