The public is continuing to watch the fallout from the recent FTX collapse with bated breath. According to on-chain analysis from Lookonchain [@lookonchain], an entity known as FTX Accounts Drainer has been actively transferring Ethereum funds out of FTX wallets.

What you'll learn 👉

Significant Ethereum Movements

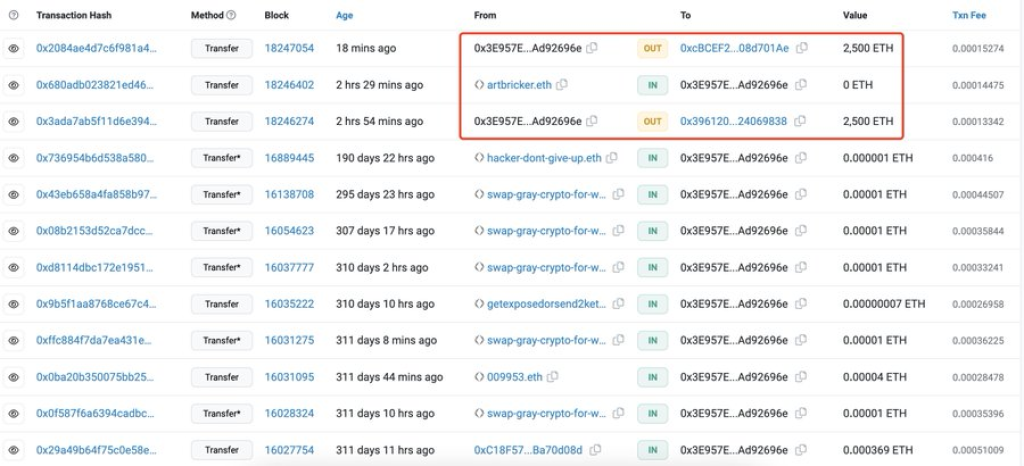

Over the past three hours, FTX Accounts Drainer has moved over 5,000 ETH (worth approximately $8.37 million) out of FTX accounts. Additionally, Lookonchain reports that across 13 different addresses, FTX Accounts Drainer still has control of 180,735 ETH – valued at around $302.5 million at current prices.

This latest on-chain activity indicates that the process of securing and dispersing assets from the failed exchange is still very much ongoing. The identity and intent behind FTX Accounts Drainer remain shrouded in mystery, while substantial sums of money are still entangled in FTX’s intricate web of wallets and accounts.

Potential Implications and Speculations

There are several potential implications of moving such large sums of ETH from FTX wallets at this time. It could signify attempts by bankruptcy administrators or regulators to secure and consolidate crypto assets, possibly in preparation for potential distribution to creditors. Alternatively, someone with access to the wallets might be improperly attempting to drain funds, pointing to possible insider theft or embezzlement by rogue actors.

The transfers could also be part of ongoing investigations, with authorities analyzing transactions to uncover links between FTX and other entities, or the ETH could be being prepared to liquidate into fiat currency to fund operations or pay back customers/lenders. There is also a possibility that the transfers are red herrings, meant to divert attention from other related activities.

Conclusion: Unfolding Developments and Market Vigilance

As proceedings advance in FTX’s bankruptcy case, the unfolding drama continues to captivate the crypto world. The magnitude of the recent transfers suggests that important developments are unfolding behind the scenes. As the bankruptcy proceedings progress, on-chain movements will likely continue to provide clues about the disposition of FTX’s remaining assets, keeping the crypto community and stakeholders on high alert for any new developments or revelations.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.