As the cryptocurrency market experienced a period of downtime over the past four days, three savvy Ethereum (ETH) traders have allegedly sold a combined total of 26,946 ETH, worth approximately $95.7 million. According to Spot on Chain, these strategic moves have allowed the traders to secure an impressive $39 million in profits, raising questions about the potential for an ETH recession.

What you'll learn 👉

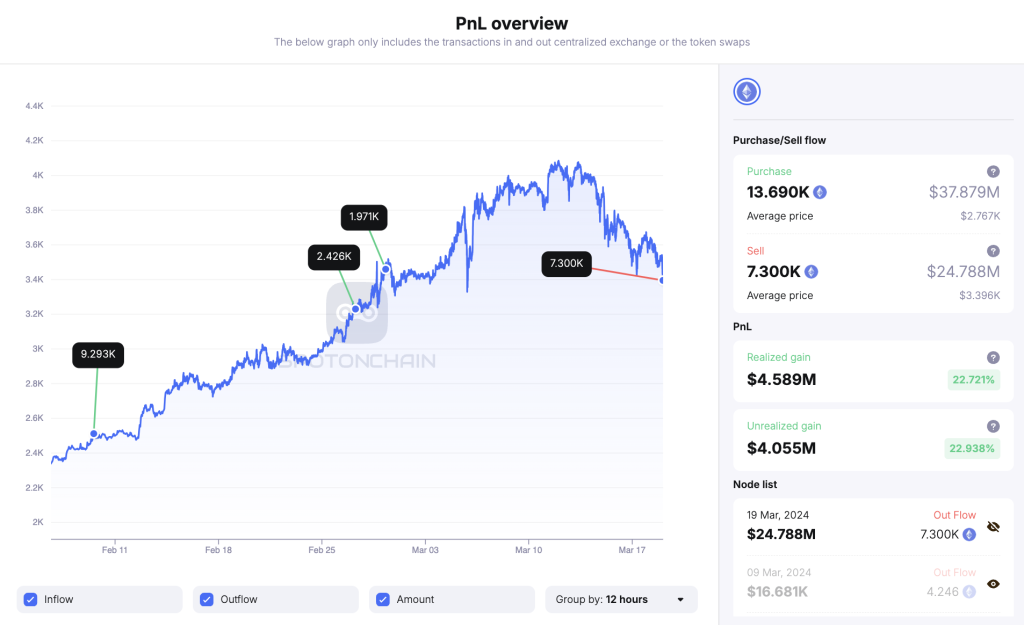

Binance Trader 0xb82 Sells 7,300 ETH for $24.4M

One of the most notable transactions came from trader 0xb82, who sold 7,300 ETH for $24.4 million in stablecoins via the Binance exchange just an hour ago.

The trade was executed at an average price of $3,339 per ETH, resulting in a $4.59 million profit, representing a 22.7% return on investment. This marks the trader’s fifth successful ETH trade.

Trader 0xebf Closes Position with $25.3M Profit

Another prominent trader, identified as 0xebf, deposited their last 8,870 ETH, worth $33.1 million, to Binance at a price of $3,733 on March 16. By closing the trade at this point, the trader realized an estimated total profit of $25.3 million, an impressive 55.8% return on their investment.

0xa43 Sells 10,776 ETH for $38.2M USDT

The third trader in the spotlight, 0xa43, sold 10,776 ETH for 38.2 million USDT on March 15 at an average price of $3,544. This strategic move allowed the trader to secure a $9.14 million profit, representing a 31.5% return on their investment.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Implications for Ethereum’s Market Outlook

The substantial profits realized by these three traders during a period of market downtime have raised concerns about the potential for an Ethereum recession. As large holders take advantage of short-term price fluctuations to lock in profits, it could signal a lack of confidence in ETH’s near-term prospects.

However, it is essential to consider that these trades represent a relatively small portion of Ethereum’s overall market capitalization. While the actions of influential traders can certainly impact market sentiment, it is crucial to analyze broader market trends and fundamentals before drawing definitive conclusions about Ethereum’s future performance.

The transactions highlighted by Spot On Chain underscore the importance of monitoring whale activity in the cryptocurrency market. Large holders, often referred to as whales, have the power to significantly influence asset prices through their buying and selling activities.

You may also be interested in:

- Dogecoin Breaks Macro Downtrend, Analyst Shares Why is DOGE Different From Other Meme Coins

- Bitcoin Enters “Danger Zone” as Halving Approaches, Analysts Eye FOMC Meeting For BTC’s Next Move

- XRP Navigates Market Waves As Polkadot Eyes Bullish Horizon; Is BlockDAG The Next 1000x Crypto Marvel?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.