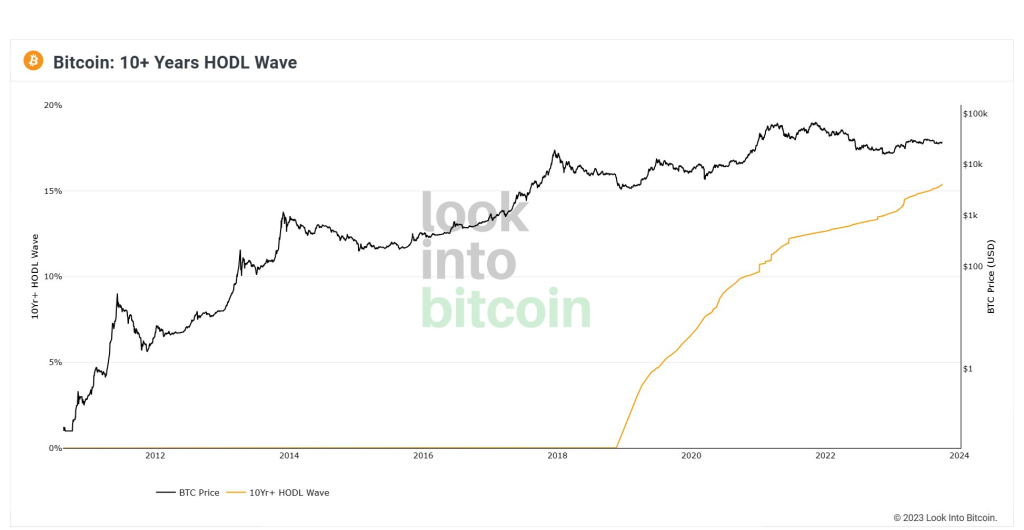

Recent analysis shared by Crypto Rover shows a significant amount of bitcoin has sat untouched for over a decade, amounting to billions in lost or stranded holdings. Approximately 15.39% of the total bitcoin supply has not moved in 10 years, according to new data.

With nearly 19.4 million BTC minted so far, that dormant portion totals around 3 million lost or inactive coins. Extrapolating further, analytics firm Chainalysis estimates as much as 25% of existing bitcoin, or around 4.85 million BTC, has likely been lost permanently.

At Bitcoin’s current price, that immobilized 25% alone represents over $100 billion worth of coins, technically still in circulation but inaccessible in practice. Between misplaced keys, faulty storage, and the death of holders, events can easily cause bitcoin to be marooned forever.

The cryptocurrency’s decentralized design means no mechanism exists to recover stranded holdings. And that number creeps higher as incidents accumulate over time involving early, now-valued coins.

Proper key management and storage procedures have vastly improved since Bitcoin’s beginnings. But mistakes and accidents continue, especially among less technical holders.

The extreme dormancy figures serve as stark reminders to take precautions through backups, multi-signature security, and custodial services. Taking responsibility via diligent controls remains essential.

Of course, not all inactive coins are necessarily lost – some likely belong to long-term holders who intentionally keep supply off the market. Yet the numbers still highlight the unavoidable leakage from improperly handled keys that can render holdings trapped.

As more options emerge to self-manage keys securely, irrevocable losses may wane somewhat. But Bitcoin’s immutable finality means past casualties remain locked away indefinitely.

Meanwhile, the rate of new bitcoin creation constantly decreases over time based on programmed halving events. Today, roughly 900 BTC are generated daily through mining. But that number gets slashed in half every four years—the next halving occurs in April 2024.

This gradual reduction in issuance leads to an estimated final bitcoin being mined around the year 2140 once the maximum 21 million supply is reached. The extended timeline highlights Bitcoin’s deliberate and controlled minting that cements its scarcity.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.