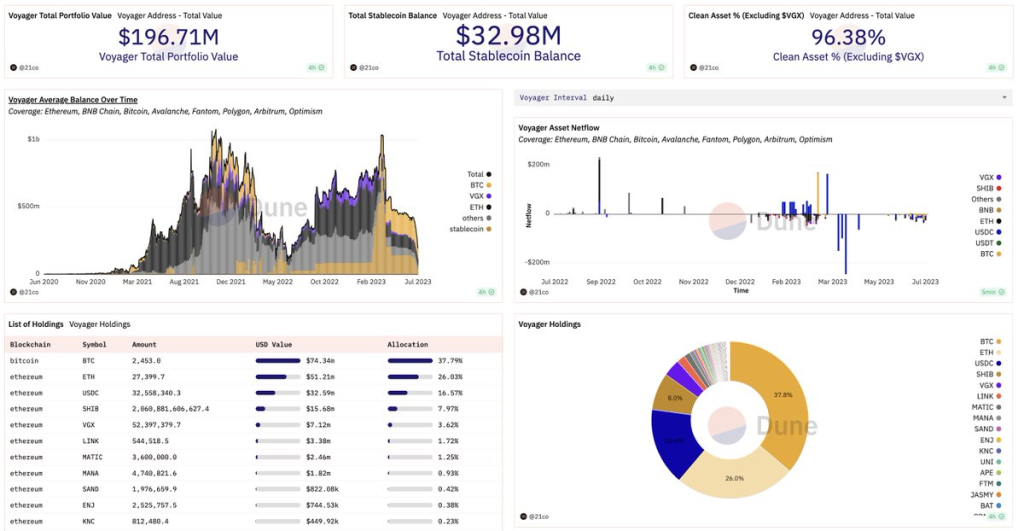

Since Voyager Digital re-opened withdrawals on 23 Jun, over $229M has been transferred out from the platform, revealing a significant loss of user funds. Despite the outflow, Voyager still holds $196M in its tagged wallets, with notable holdings including 74M BTC, $52M ETH, $32M USDC, $15M SHIB, and $7M VGX.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The situation at Voyager Digital has been tumultuous since it filed for bankruptcy protection in July 2022, citing market volatility and a default on a loan to crypto hedge fund Three Arrows Capital (3AC). Despite attempts to sell its assets to Binance.US and FTX, both endeavors have failed.

As the company winds down operations, customers can expect an initial recovery of 35-36% of their cryptocurrency deposits. However, any additional distribution beyond this initial amount hinges on future litigation outcomes. Comparatively, Voyager Digital’s recovery rate is significantly lower than that of other bankrupt crypto platforms like Celsius, where creditors will receive an estimated 70% of their holdings.

The potential for Voyager Digital’s recovery rate to increase lies in the success or failure of defunct crypto trading firm Alameda Research’s attempt to claw back $446 million from Voyager’s estate. The outcome of this legal battle could significantly impact the final recovery rate for affected users.

In the face of these challenges, Voyager Digital plans to self-liquidate its assets and proceed with the wind-down of its operations. With the cryptocurrency industry’s ever-evolving landscape, the fate of Voyager Digital serves as a cautionary tale for investors, highlighting the importance of due diligence and risk management when entrusting funds to platforms in this space.