Even before Brian Armstrong revived his $1 million Bitcoin thesis, a different signal was already flashing across the market. While Bitcoin’s long-term outlook is still looking good, shorter-term capital has been moving towards names like Minotaurus (MTAUR), a presale gaming token that’s growing step by step while broader market stories are moving slowly. That’s why Armstrong’s latest comments hit so hard.

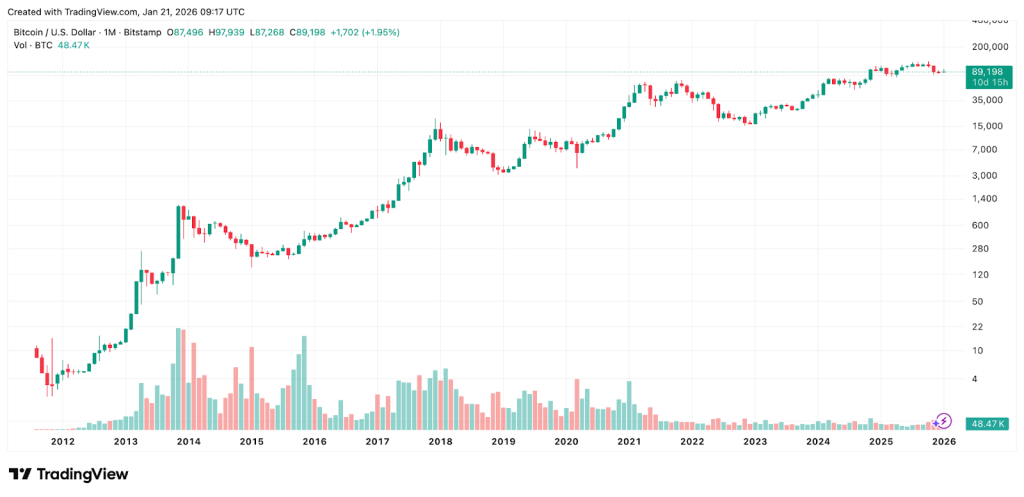

Coinbase CEO Brian Armstrong is sticking to his guns on Bitcoin’s most ambitious forecast, telling Bloomberg once again that BTC is still on track to hit $1 million by the end of the decade. The claim might seem a bit out of place compared to the recent price action and political chaos, but Armstrong’s main message hasn’t changed. He thinks Bitcoin isn’t just a short-term position, but a long-term change in the way the global economy works.

But the market’s also telling a different story at the same time. Since Bitcoin’s potential is seen over the long term, market participants are looking at faster timelines. That’s why MTAUR keeps popping up in conversations that weren’t meant to include it.

$1 Million Bitcoin Price by 2030

Back in 2023, Armstrong first mentioned the $1 million Bitcoin price target. Now, with ETFs back to normal and more regulatory pressure, he says the thesis is still solid. He says weekly volatility is just noise. When there’s a lack of something, that’s a signal.

Bitcoin’s fixed supply of 21 million coins, along with growing interest from institutions and governments, is the foundation of his long-term strategy. With more than 93% of BTC already mined, Armstrong sees adoption pressure rising against a static issuance curve. He believes this dynamic inevitably pushes prices higher over time.

He also said that not getting any exposure at all is risky. He says that even a small allocation now could make a big difference over the next ten years.

Armstrong’s optimistic view of Bitcoin’s price is quite different from Coinbase’s current regulatory stance. The exchange recently stopped supporting a Senate market-structure bill that it had been working on, saying that it was protectionist and would help traditional banks.

He says lobbying groups worked to make it easier for established companies to stay in the game and limit competition from new crypto companies. The main source of friction is stablecoins. Banks say that yield-bearing stablecoins could speed up deposit outflows. Armstrong doesn’t buy into the comparison. He points to Coinbase’s full-reserve model and the lack of fractional lending risk.

In his view, the conflict isn’t about safety, but about keeping the market lead.

Where MTAUR Fits Into the Picture

While Bitcoin’s price is changing over the long term, Minotaurus (MTAUR) is changing a lot more quickly. That’s exactly why it’s getting so much attention.

MTAUR coin is priced near 0.00012641 USDT right now, which is already up 215% across the presale stages. The public listing price is confirmed at 0.00020000. The next tier is set to activate in just over 8 hours, and the raise has reached 3,070,752 USDT, representing 47.70% of its 6,440,000 USDT target.

This isn’t a macro hedge or a regulatory bet. It’s a staged pricing structure, where progression is mechanical rather than narrative-driven. Right now, 100 USDT is equal to about 791,072 MTAUR, and if the listing price holds, that’ll go up to 158.21 USDT. Coinsult and SolidProof have finished their audits, allocations are set, and the momentum is driven by math, not ideology.

You can find the real-time counter, bonus terms, and check MTAUR price on the official Minotaurus site.

Armstrong’s all about having patience and staying true to what you believe in, even when it takes a while to get there. It seems like MTAUR buyers are working with a different timeline and price steps that are already set.

Bitcoin might still be the way to go. But as regulatory battles drag on and long-term forecasts stretch into the next decade, assets like Minotaurus are absorbing the capital that refuses to wait. It looks like the market is learning to run on more than one clock at a time.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.