Currency.com Review – Fees, Supported Coins & Countries, Deposit & Withdrawal Methods

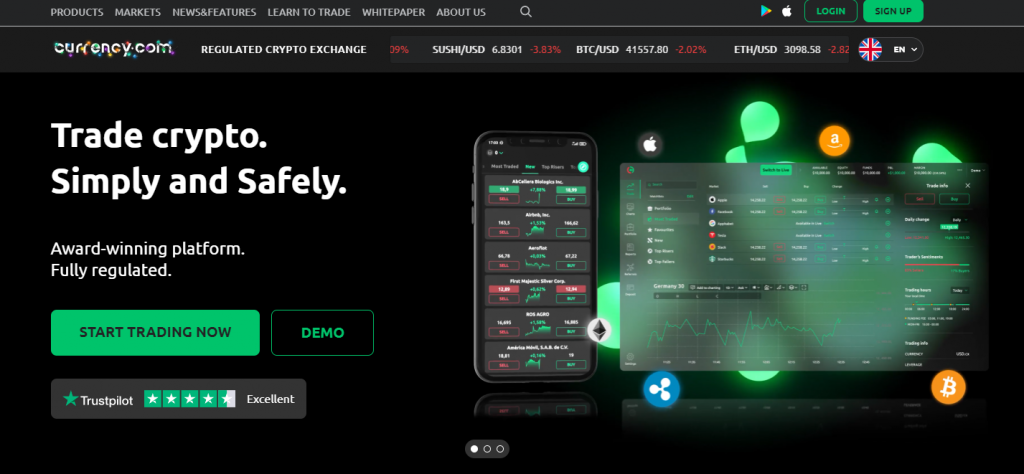

Currrency.com is another exchange that is worthy of review. It was founded in 2018 by Ivan Gowan and Mark Berger and claimed to be the long-awaited tool to democratize finance. It is a well-rounded platform that has won many awards even though it has only been in existence for less than four years.

In this article, we will consider whether or not it has lived up to its words. We will also consider its various features, merits, and demerits and lead you towards deciding if you would like to try it out or not.

What you'll learn 👉

OVERVIEW

- It has a demo account that users can practice with before going trading live.

- It goes beyond cryptocurrencies and offers over 2,000 tokenized assets.

- It has negative balance protection, which insures users against massive losses.

- It has a mobile app that works well on major operating systems.

- The customer service section is impressive and is present on many social media platforms.

- It is big on customer education with its ‘Learn to Trade’ section.

- It is simple to use and extends its reach worldwide, with a few countries exempted.

SERVICES AND FEATURES

👉 BUY AND SELL CRYPTO

The exchange allows users to buy Bitcoin, Ethereum, and Litecoin directly with bank cards. The fiat currencies that can be used to buy the coins are the United States Dollars, Euros, and Russian Ruble. Those are not the only currencies on the platform.

Others can be traded against one another in the ‘Markets’ function of the exchange. You can also make wire transfers in USD, EUR, GBP, RUB, and BYN to provided bank accounts. After that, you can use the deposited funds to purchase cryptocurrencies.

👉 SPOT EXCHANGE

The spot exchange feature is best enjoyed on the currency.com app and opens up users to the possibility of not only swapping crypto for crypto but also swapping crypto for popular equities, commodities, and indices through tokenized assets.

The spot exchange feature contains a fairly basic chart with detailed information about the coin to be traded as well as the prevailing market sentiment on that coin at the time of trading. This helps traders to make well-informed trading choices to get the best from the markets.

👉 FUTURES TRADING

This feature allows traders to trade on leverage to maximize their gains. There are six leverage options on the website, namely x2, x5, x10, x20, x50, and x100. Users are also warned of the risks they expose themselves to by trading on leverage.

👉 TOKENISED ASSET TRADING

These assets are tokens pegged to the value of a particular financial asset. Therefore, their prices closely match the price of the assets they are pegged to. Thus, trading tokenized assets offer a way to benefit from the price changes of a particular asset without having to own such an asset.

On currency.com, there are over 2,000 tokenized assets up for trading, with more to come. These tokenized assets cut across all sections of the financial markets, with commodities, shares, indices, currencies, and even government bonds joining the party.

CURRENCY.COM SUPPORTED COINS AND ASSETS

There are 25 different coins that are currently traded on currency.com. They are Bitcoin, Ethereum, Litecoin, Ox, Uniswap, Dogecoin, Bitcoin Cash, Shiba Inu, Ripple, Aragon, Polygon, Decentraland, OmiseGo Network, Aave, Yearn.finance, Chainlink, UMA, Sushiswap, Ocean Protocol, Compound, Basic Attention Token, Synthetic, Kyber Network Crystal v2, Binance Coin, and Band Protocol.

Apart from cryptocurrencies, there are many tokenized commodities, indices, currencies, and shares on sale. Some examples are:

- Tokenised Commodities: Gold, Silver, Natural Gas, Brent Oil, Copper, US Cotton, Palladium, etc.

- Tokenised Indices: US100, SP45, US500, INDIA50, DE40, VXQ21, etc.

- Tokenised Shares: BIDU, AAPL, BABA, TSLA, MSFT, MRNA, BLUE, SAVA, etc.

- Tokenised Currencies: EUR/USD, USD/JPY, EUR/GBP, USD/CHF, etc.

CURRENCY.COM DEPOSITS AND WITHDRAWALS

DEPOSITS

Apart from cryptocurrencies, users can deposit USD, EUR, BYN, GBP, and RUB into their currency.com accounts to make transactions. The accepted deposit methods are credit cards, debit cards, and bank transfers. Deposits must be made from banks accounts registered in your name. Depositing through third-party accounts is strongly discouraged and may lead to suspension of your account.

Depositing funds into your account is a straightforward process. You just log into your account, click on ‘Deposit’ and choose the corresponding tokenized currency. The minimum amount that can be deposited along with the fees for each of the deposit methods is stated in the table below:

| CURRENCY | MIN DEPOSIT | MAX DEPOSIT | FEE |

| USD | 20 for bank cards.50 for bank transfers. | N/A | 3.5% commission. Transfers are free |

| EUR | 20 for bank cards.50 for bank transfers. | N/A | 3.5% commission. Transfers are free |

| GBP | 20 for bank cards.50 for bank transfers. | N/A | 3.5% commission. Transfers are free |

| RUB | 1,500 for bank cards.3,500 for bank transfers. | N/A | 3.5% commission. Transfers are free |

| BYN | 50 for bank cards. Bank transfers are not supported. | N/A | 3.5% commission. |

WITHDRAWALS

The withdrawal methods are similar to the deposit methods. However, you can only withdraw funds into an account you’ve deposited from, as a rule. Each currency has its withdrawal limits and fees, as the table below emphasizes:

| CURRENCY | MIN WITHDRAWAL | WITHDRAWAL FEE |

| USD | 10 for bank cards.50 for transfers | 3% + 3 USD for bank cards.0.15% for bank transfers |

| EUR | 10 for bank cards.50 for transfers | 3% + 3 EUR for bank cards.0.15% for bank transfers |

| GBP | 10 for bank cards.50 for transfers | 3% + 3 GBP for bank cards.0.15% for bank transfers |

| RUB | 750 for bank cards.3,500 for bank transfers | 3% + 200 RUB for bank cards.300 RUB for transfers |

| BYN | 25 BYN | 3% + 7.5 BYN for Visa cards.3% + 9 BYN for MasterCard. |

Cryptocurrency deposits and withdrawals follow the standard crypto protocols.

CURRENCY.COM TRADING FEES

SPOT TRADING FEES

There are various sections to the fee schedule for spot exchange. They are:

- When the crypto trading volume is less than 50,000 dollars or its equivalent, the trading fee is a flat 0.2%

- When the crypto trading value is more than 50,000 dollars or its equivalent, the trading fee is custom.

- Tokenised shares, ETFs, Indices, and commodities attract a fee of 0.05%

- Tokenised bonds are charged 0.03%

- Tokenised currencies are traded for free

- Company tokens are free when you buy but come with a 1.5% sell fee.

FUTURES TRADING FEE

- Trading BTC/USD, BTC/EUR, ETH/USD, ETH/EUR, on leverage comes with a 0.06% fee

- Trading other cryptos on leverage comes with a 0.075% fee.

- Tokenised assets and currencies are traded on leverage for free.

DOES CURRENCY.COM REQUIRE KYC?

As is typical with all regulated exchanges, Currency.com requires KYC verification from users before they access the full functions of the website. However, they still allow users to make deposits up to the equivalent of 1,000 Euros and trade for 15 days before verification is enforced. If you have not completed the verification process after 15 days have passed, your account will be suspended until you complete the verification.

CURRENCY.COM SUPPORTED COUNTRIES

Currency.com has near-global coverage, with only about 25 countries currently included in its prohibited jurisdictions list. It also excludes countries listed on the Financial Actions Task Force list of high-risk jurisdictions from accessing its services.

In the United States, Currency.com is registered as a Money Service Provider with the United States FinCEN. However, the license does not cover all the states in the US. The following are the states in which Currency.com is currently permitted to operate:

Arizona, California, Colorado, Mississippi, Kentucky, Massachusetts, Utah, Missouri, North Dakota, Montana, Pennsylvania, Wisconsin, Wyoming.

In terms of countries supported and ease of service for crypto enthusiasts, there are better options than currency.com. One of them is Gemini, an exchange that is a one-stop shop for cryptocurrency trading in the United States and other countries. Coinbase is also another well-rounded crypto exchange available in most states in the US.

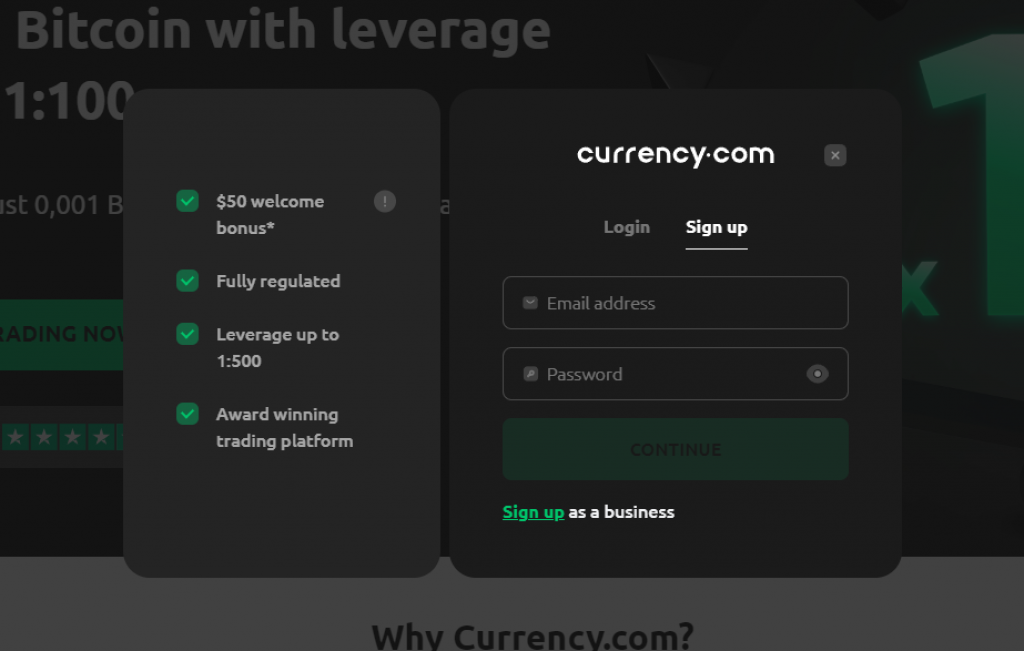

HOW TO START WITH CURRENCY.COM

REGISTRATION

This is the first step towards transacting with Currency.com. To register your account, follow the steps below:

- Put your active email address in the column provided.

- Create and confirm your strong password.

- Enter your current residential country as well as your nationality

- Provide your identification details

- Commence and pass the blockchain test (for Belarusian citizens).

- Select your currency preference.

Once you’re done with that, the next step is to verify your account

VERIFICATION

The verification process involves verifying both your identity and your address. The documents required for identity verification include an International Passport, Driver’s License, Residence Permit, or other Government-approved identification documents. The documents must be up-to-date, clear, and contain all the required information.

For address verification, bank statements, utility bills, and other appropriate documents are accepted. They must be clear, recent, and be written either in Russian or English. Once you upload these documents, sit back and wait for your approval to be confirmed via email. It usually gets approved within 24 hours, except there is a need for additional documents to be submitted.

DOES CURRENCY.COM HAVE A NATIVE TOKEN?

When this article was written, Currency.com did not have a native token, nor have there been plans to introduce it in the near future.

IS CURRENCY.COM LEGIT AND SAFE?

Currency.com enables the safety of users’ funds in various ways. These ways include:

- Enforcement of two-factor authentication for users to prevent unauthorized entry.

- Users‘ fiat funds are stored in bank accounts detached from the operating accounts. These stored funds are not spent or borrowed so as to mitigate against unforeseen losses.

- Chats and emails containing users‘ personal information are protected with encrypted data technology.

IS CURRENCY.COM REGULATED?

Currency.com is very legit as it is regulated under a number of governmental authorities. It has the following licenses:

- A license to operate virtual assets-related activities under the supervisory council of the Republic of Belarus.

- A license to use distributed ledger technology under the Gibraltar Financial Services Commission.

- A license to operate as a Cryptoplatform under the Government of Saint Vincent and the Grenadines

- A license as a Money Service Provider under the US FinCEN.

CONCLUSION

Currency.com is one of the most comprehensive brokers in the world right now, with support for almost every aspect of the financial markets. It also goes easy on beginners, providing a demo account as well as a fully-equipped academy to guide them in decision-making

✅ If you are an expert trader, you would also love the comprehensive analysis and technical tools provided on the trading interface. It just seems that the exchange has something for everyone.

❌ It has some cons too, of course, and we have also covered those in the article. The decision is now left for you, the reader, to take all this information in and determine if Currency.com is an exchange you can work with. If it is, enjoy! If not, you can check out other exchanges analyzed on this website.

Read also:

- Is ZT safe?

- VCC Exchange Review

- FTX Leveraged Tokens Explained

- The Fastest, Cheapest & Safest Ways to Send Crypto Between Exchanges

- Is Probit legit?

- Bitstamp Review

- BitForex Review

- Bityard Exchange Review

- Zaif Review

- Is Bitvavo legit?

- BitKub Review

FREQUENTLY ASKED QUESTIONS

WHAT FIAT CURRENCIES DOES CURRENCY.COM SUPPORT?

There are five main fiat currencies supported by the platform. They are the United States Dollars, Euros, Pound Sterling, Russian Ruble, and Belarusian Ruble. Other fiat currencies are only available for trading and can’t be withdrawn or deposited.

DOES CURRENCY.COM HAVE FIAT DEPOSIT?

Yes, it does. Apart from cryptocurrencies, users can deposit USD, EUR, BYN, GBP, and RUB into their currency.com accounts to make transactions. The accepted deposit methods are credit cards, debit cards, and bank transfers. Deposits must be made from banks accounts registered in your name. Depositing through third-party accounts is strongly discouraged and may lead to suspension of your account.

Depositing funds into your account is a straightforward process. You just log into your account, click on ‘Deposit’ and choose the corresponding tokenized currency. The minimum amount that can be deposited along with the fees for each of the deposit methods is stated in the table below:

| CURRENCY | MIN DEPOSIT | MAX DEPOSIT | FEE |

| USD | 20 for bank cards.50 for bank transfers. | N/A | 3.5% commission. Transfers are free |

| EUR | 20 for bank cards.50 for bank transfers. | N/A | 3.5% commission. Transfers are free |

| GBP | 20 for bank cards.50 for bank transfers. | N/A | 3.5% commission. Transfers are free |

| RUB | 1,500 for bank cards.3,500 for bank transfers. | N/A | 3.5% commission. Transfers are free |

| BYN | 50 for bank cards. Bank transfers are not supported. | N/A | 3.5% commission. |

CAN I TRADE WITH LEVERAGE ON CURRENCY.COM?

Yes, you can trade with leverage up to x100 on Currency.com

WHERE IS CURRENCY.COM EXCHANGE BASED?

The exchange is mainly based and registered in Belarus, with tentacles stretching to other parts of the world, including some states in the US.

HOW DO I GET CRYPTO ON CURRENCY.COM?

The exchange allows users to buy Bitcoin, Ethereum, and Litecoin directly with bank cards. The fiat currencies that can be used to buy the coins are the United States Dollars, Euros, and Russian Ruble. Those are not the only currencies on the platform. Others can be traded against one another in the ‘Markets’ function of the exchange. You can also make wire transfers in USD, EUR, GBP, RUB, and BYN to provided bank accounts. After that, you can use the deposited funds to purchase cryptocurrencies.

HOW DO I WITHDRAW MONEY FROM CURRENCY.COM?

To withdraw assets, click the ‘Withdraw’ tab next to the asset you want to withdraw and follow the steps accordingly. You can only withdraw fiat into an account used for previous deposits.

IS CURRENCY.COM A BROKER?

Yes, it is. In fact, it is one of the best broker sites, especially as it has implemented tokenized versions of practically every type of financial instrument in the markets.