The past year has seen an explosive growth of the global cryptocurrency industry mainly punctuated by the emergency of Decentralized Finance platforms. Saving, borrowing, and lending DeFi protocols like Ledn.

What you'll learn 👉

The Crypto Lending and Borrowing Sector

DeFi lending platforms are fully decentralized and coded to manage transactions. While the platform is built on a tamper-proof code, the code can be accessed by anyone. DeFi lending protocols do not rely on middlemen and financial regulators like the case in centralized financial systems.

Crypto loans simply mean loans offered to borrowers and backed by crypto assets as collateral. The user can take out a loan in fiat currency using crypto assets in form of Bitcoin (BTC), Ether (ETH), or Litecoin (LTC), among others as collaterals.

The borrowed amount is deposited in the borrower’s account after both the lender and borrower consent to the set interest rate and other conditions. There are three main players in a crypto lending and borrowing ecosystem;

👉 The lenders/ investors who lend out their assets.

👉 The crypto lending platform connects the lender and borrower and handles all transactions related to lending and borrowing.

👉 The borrowers are individuals and firms seeking additional liquidity. It could be an individual or firm seeking funding.

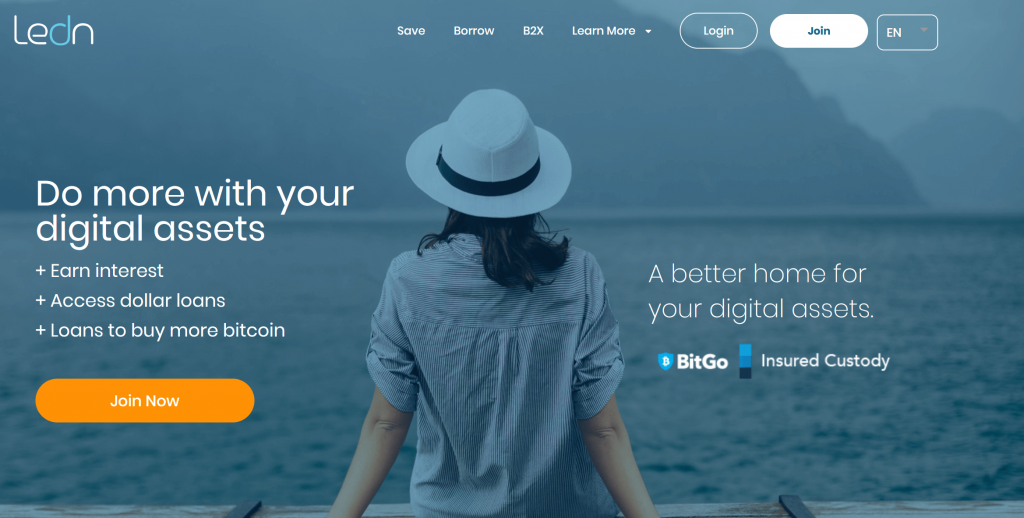

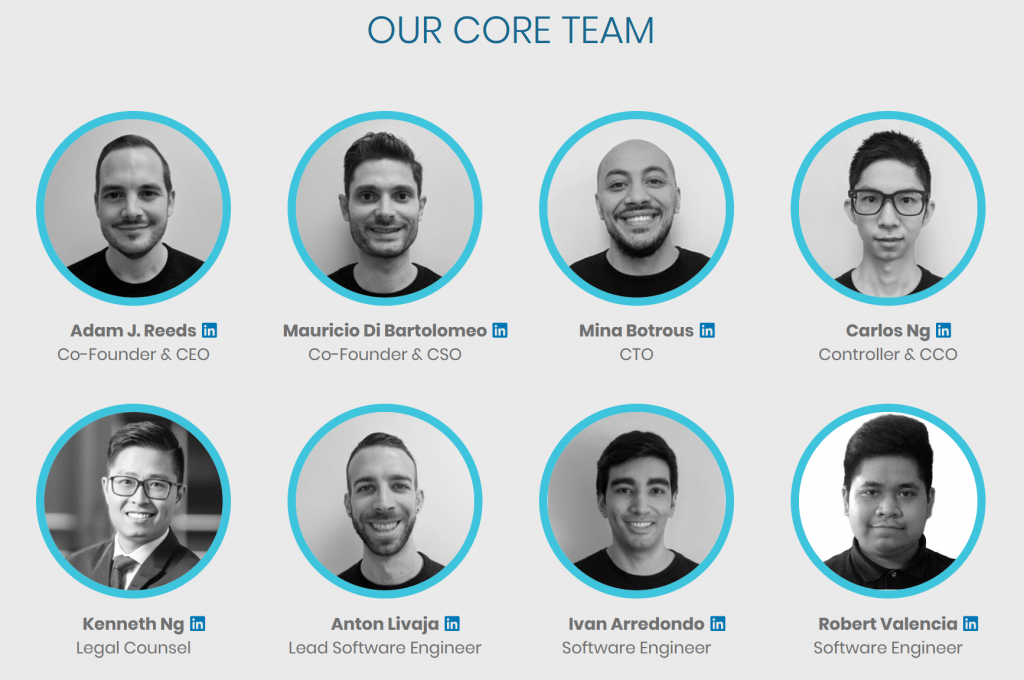

Ledn is one of the leading cryptocurrency lending and borrowing platforms that allow crypto holders to save digital assets and access crypto loans. The product was launched by Adam Reeds and Mauricio Di Bartolomeo in 2018 and has since launched three flagship products. Since its inception, the company has raised $3.9 million through a seed round.

The company has its headquarters in Toronto, Ontario, and mainly focuses on building world-class financial products

Ledn’s three flagship projects are;

👉 Bitcoin-backed loans

👉 Bitcoin and USDC crypto savings accounts

👉 Bitcoin balance doubling service

Incorporated and regulated under the Federal Laws of Canada, Ledn complies with the highest consumer protection and privacy standards. In addition, to guarantee the safety of its members’ assets and further boost investors’ confidence, Ledn has partnered with BitGo, one of the most qualified custody services for digital assets.

The assets stored with BitGo are covered by one of the most comprehensive insurance policies in the digital assets industry. Below is a deeper dive into Ledn’s three flagship projects

Read also:

Bitcoin-backed Loans

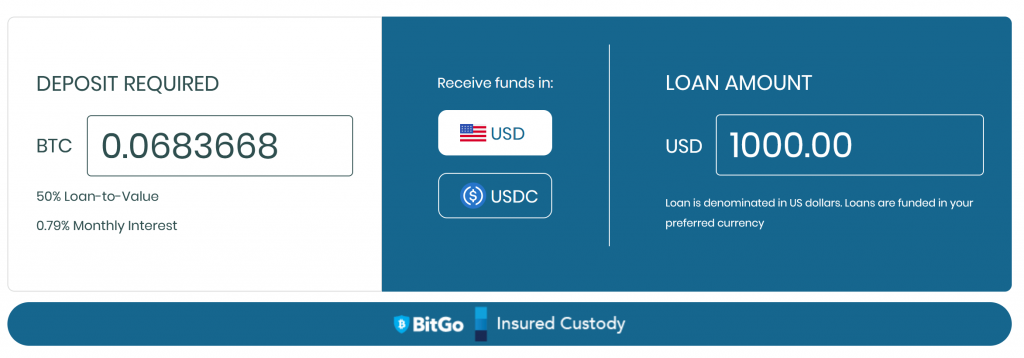

Ledn loans feature allows Bitcoin holders to access liquidity without having to sell their coins and using Bitcoin as collateral. There are a number of advantages that come with Ledn’s Bitcoin-backed loans. First, the entire process is first and convenient and funds are made available to the borrower within 24 hours of approval.

Since as a Bitcoin holder you don’t need to sell your token, you get to benefit from any price and value increase of the lock. After full loan repayment, the owner gets back the collateralized Bitcoin plus the appreciated amount during the lock-up period.

The assets locked up in a collateral pool are kept in BitGo, a world-leading custody service for Bitcoin. The assets are further ensured by a comprehensive insurance policy.

The loans are also very flexible in terms of repayment installments and loan periods. Long-term loans are repaid in 12 months but the borrower can apply for an extension of this period. In addition, the borrower can make a lump sum repayment of the loan without following the monthly payments schedule, and without attracting penalties.

Ledn Bitcoin-backed dollar loans attract a 12% annual interest and the borrower needs to maintain a maximum loan-to-value (LTV) ratio of 50%.

The Procedure to Apply for Ledn Bitcoin-Backed Loan

While the application process is relatively short and simple, borrowers are required to undergo a verification process that requires them to share information and upload a number of documents to complete the KYC process. Documents required include;

- A copy of a government-issued ID card

- A proof-of-address document

- A selfie of the borrower holding his/her government-issued ID

- Bank account details where the funds are disbursed.

Savings Accounts

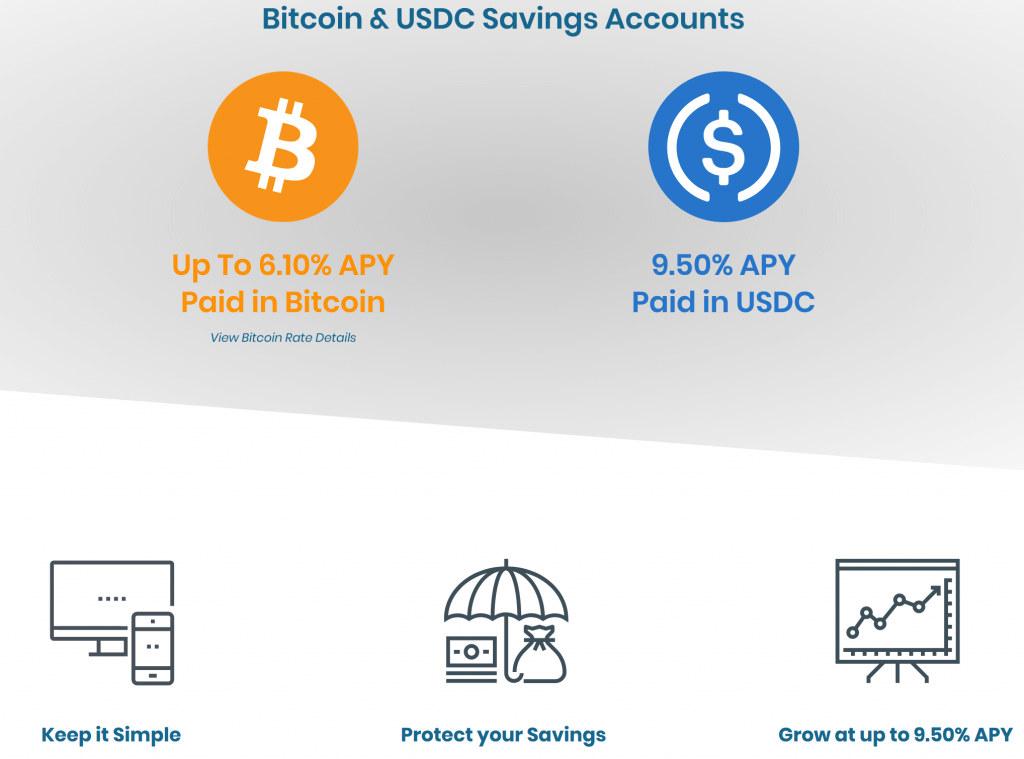

Ledn users can earn up to 6.10% and 12.50% annually on their Bitcoin and USDC respectively. To power its savings products, Ledn has partnered with Genesis as its main market maker and primary borrower.

Ledn’s savings accounts do not need a minimum balance and there are no term requirements for locking up the assets. In addition, the user can access the collateralized assets at any time. The savings are kept in digital currencies and therefore protected traditional money-market waves of inflation.

Savings locked up in savings accounts grow exponentially because the interest is compounded monthly.

Ledn Savings Account Interest Rates and Fees

Ledn savings accounts earn a percentage yield or APY of 6.10% and up to 12.25% on Bitcoin and USDC respectively. There are no trading fees charged when moving Bitcoin within the Ledn ecosystem.

However, a 10 USDC fee is paid when withdrawing USDC. This fee is used to pay the miners used to process the transaction on the Ethereum blockchain.

Bitcoin Loans and Volatility in Bitcoin Prices

How does Ledn manage Bitcoin price changes in relation to assets kept in savings accounts? In case of a drop in the price of Bitcoin, the platform reconciles by asking borrowers to deposit more collateral in the wallet to raise the minimum loan-to-value (LTV) ratio to the required 50%.

Alternatively, borrowers can pay off some principal amount to raise the LTV ratio. In the event that the borrower does not take any action, the platform may sell off some of the collateral Bitcoin to reconcile the borrower’s loan account to the right LTV ratio.

The borrower benefits in case Bitcoin appreciates at price. In this case, the assets pledged as security for the loan increase in value as the market value of Bitcoin goes up during the lock-up period.

How does Ledn earn money?

Ledn has partnered with Genesis Capital as its main borrower, which borrows the assets saved in savings accounts. In this case, Ledn earns interest from the assets lent out to Genesis Capital. The platform also earns from loans backed by Bitcoin locked in its custody in a 2:1 ratio.

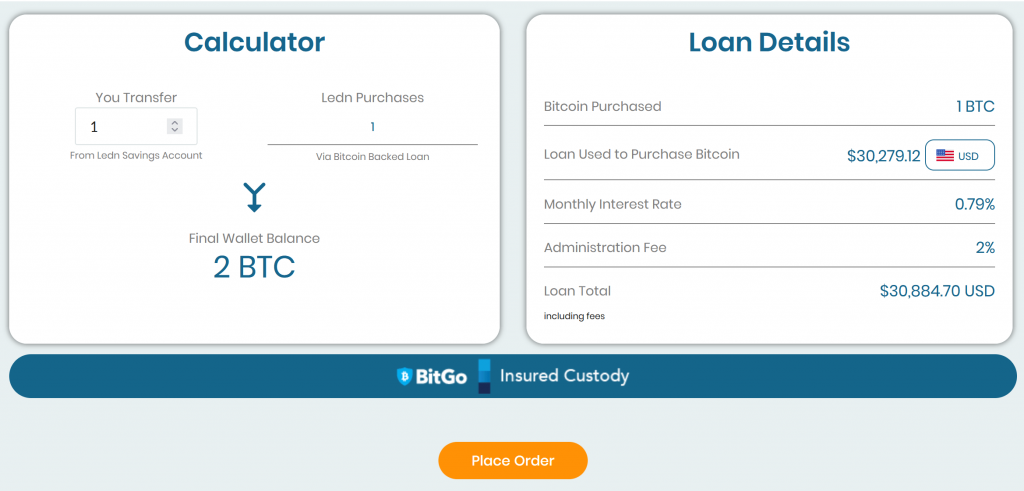

B2X-the Bitcoin Balance Doubling service

Ledn B2X feature allows users to double their Bitcoin holding by using the borrowed assets to purchase more Bitcoins into their wallets. For investors, this product is only feasible if Bitcoin goes up.

This product was launched to allow Bitcoin holders to get the most out of their assets. It was targeted at bullish investors to anticipate the price of Bitcoin to maintain its upward momentum.

The Risk-Quotient of B2X

As earlier indicated the viability and profitability of the B2X loan strategy depends on the price of Bitcoin. It is a profitable strategy if the price of Bitcoin is going up. On the contrary, an investor is exposed to double risk if the price of Bitcoin slumps.

Like in the event of Bitcoin-backed loans, users are asked to deposit additional Bitcoin, pay off some principal amount, or have part of their assets liquidated to maintain the required LTV ratio.

Is My Money Safe and insured?

Ledn has put in place stringent account access protocols to secure users’ assets. The company has also partnered with the world’s leading digital asset custody service for the storage of members’ assets.

However, risks also abound. The assets deposited in the savings accounts are classified as investments and therefore carry investment risks. Since Ledn does not offer deposit accounts, the company is not covered by Federal Deposit Insurance Corporation (FDIC) or Canada Deposit Insurance Corporation (CDIC) regulations.

The CDIC does not also cover the USDC kept in the savings accounts. These assets are also not covered by any deposit-protection insurance policy.

Ledn Security

Ledn has put in place strict internal policies to secure the platform, users’ personal data, and their assets. The platform does not store or download user information on internal servers but uses private networks which are inaccessible by public IPs.

Users’ accounts are secured by HTTPS and passwords and private and sensitive information is encrypted with AES-256. Other security features include two-factor authentication for login.

Country Restrictions

B2X services are restricted in the following countries;

- Iran

- Libya

- North Korea

- Syria

- United States

- Uruguay

Is It Worth It?

Ledn charges a much higher interest of 12% relative to many of its competitors. This is a big drawback. In addition, the platform’s B2X product that seeks to help Bitcoin holders double their holdings only works for bullish holders that anticipate Bitcoin to maintain an upward trajectory. This may not be and has not been the case even in recent days as Bitcoin showed an up and downward trend.

While Bitcoin has attracted massive interest from institutional investors, the largest cryptocurrency is risking falling under the control of a few high-net investors who then explore its growth for personal advantage. In recent days, Bitcoin has especially been at the mercy of Tesla and its founder Elon Musk, who has swayed the coin’s price due to his flip-flop attitude.

Musk has ruled the bitcoin and cryptocurrency world from his Twitter handle and caused massive price shifts in either direction.

For crypto holders seeking to maximize interest earnings from their assets, Ledn offers good rates on both Bitcoin and USDC. Another big limitation with Ledn is that it offers a limited variety of cryptocurrencies, allowing users to save and borrow only in Bitcoin and USDC.

Ledn alternatives

As earlier noted, Ledn operates in crowded crypto savings, lending, and borrowing environment. Leon’s top competitors include BlockFi, Linus, Outlet Finance, Gemini, and Coinbase.

BlockFi

BlockFi allows investors to access high yields especially, small Bitcoin holders. The platform especially offers high interest to investors with 5 Bitcoins. On the other hand, those with more than 5 Bitcoin earn less than 2.0% in interest. Interest tends to drop as one’s deposits increase.

BlockFi’s products include portfolio-backed loans, interest-earning accounts, and fee-free trading. The platform offers trading in various products like cryptocurrencies, USD, and stablecoins.

Users can deposit their assets in interest-bearing accounts and benefit from monthly yields. These accounts function similarly to savings or investment accounts. BlockFi users can also use the platform to exchange or trade different cryptocurrencies without fees.

Linus

Linus is a high-yield savings account that allows users to change deposits into cryptocurrency and benefit from high APY compared to traditional savings accounts. There are no fees involved and the platform is very easy to manage.

Linus uses Open Finance protocols to allow retailers to maximize yields from their savings. Currently account holders earn 4.50% in APY with an initial deposit of $500 for every new account. Users are however not required to maintain a minimum balance.

Linus is not a traditional savings account but instead an investment product. However, it is not regulated or insured by FDIC because it does not offer deposit accounts. This means the assets in savings are not protected or insured in case of a slump or economic downturn.

Outlet Finance

Outlet Finance is a fintech company that uses blockchain to generate high-interest rates for its members. Users deposit dollars and earn dollar-based interest. The company was founded in 2019 and is backed by Consensys, a leading blockchain company. The dollar lent out is used to buy Ethereum and other cryptocurrencies.

Outlet Finance is simply a blockchain-based automation layer on top of a P2P lending platform and the funds deposited into the platform are converted into stablecoins with their value pegged to the dollar. The platform uses Ethereum smart contracts with the Celsius Network to lend dollars and generate interest of up to 90%.

Gemini

Gemini has its headquarters in New York and of a handful of cryptocurrency exchanges authorized to operate in the U.S. The company was founded by Cameron Winklevoss and Tyler Winklevoss and is currently ranked among the top 15 cryptocurrency exchanges by trading volume.

As opposed to several cryptocurrencies that are restricted in the U.S, Gemini is available in all the 50 U.S states. The platform is also accessible to more than 50 countries worldwide. Gemini is regulated by the New York State Department of Financial Services (NYSDFS).

Gemini offers both a simple trading interface for those who are new to cryptocurrency and the ActiveTrader platform for more experienced crypto traders. The platform is known for having strong safety features plus insurance cover to protect members’ assets.

Coinbase

Coinbase is a leading cryptocurrency exchange platform in the U.S and a recent standard on-ramp for new crypto investors. The cryptocurrency offers various products like custodial accounts for institutions, cryptocurrency investing, a wallet for retail investors, an advanced trading platform, and its own U.S. dollar stable coin.

The company was founded in 2012 and is licensed and regulated in the U.S and initially started as a Bitcoin trading platform but soon added other cryptocurrencies in response to the expanding DeFi space that has led to the emergence of several cryptocurrencies. Tokens listed on Coinbase include Ethereum, Litecoin, Bitcoin Cash, and XRP to name a few.

Ledn Raises $3.4 Million CAD

In February 2021, Ledn raised USD 2.7 million or CAD $3.4 million in seed funding. The company intends to use proceeds from the round to fund its expansion activities for its digital assets. The funding round was led by White Star Capital, a New York-based private equity and venture capital firm that invests in tech companies that are still in their early stages of development.

The VC has a special fund called Digital Asset Fund that invests in blockchain-enabled networks and crypto-based businesses. Other companies that participated in the latest and the company’s third funding round include Coinbase Ventures, Darrow Holdings, Kingsway, CMT Digital, and Global Founders Capital. The latest funding round brings the company’s total funding to $4.7 million CAD since its inception.

Ledn says it intends to use its Bitcoin-backed loans to reinvent the cryptocurrency sector.

Ledn Mobile App

Ledn released its mobile app in January 2021 allowing its users to access their accounts from anywhere. The app is available to both Android and iOS users. The app is still new and the company is still working on additional features to improve its capability and reliance.

Ledn User Experience

Ledn offers fast access to loans by Bitcoin holders which ensures easy access to liquidity. In addition, the company has an intuitive feature-rich trading platform that is easy to use by both new and experienced crypto users.

Ledn.io Ideal User

Ledn is mainly designed for people seeking to earn interest from their Bitcoin holdings without having to liquidate their assets. The platform is also ideal for borrowers seeking credit to boost their liquidity. Finally, Ledn is good for investors seeking fiat loans using crypto assets as security for the loan.

Conclusion

With the DeFi space still growing, saving, lending, and borrowing protocols like Ledn are expected to take center stage. Ledn has already made its impact in the market with its revolutionary products.

In case you are looking for more cryptocurrency lending and borrowing platforms, below is our list of reviews: