What you'll learn 👉

Risk-free and high-yield tool to store your coins

All financial systems need creditors and debtors, and with crypto going mainstream, there is a need for platforms providing crypto loans. Nexo entered the scene in 2017 to satisfy this demand creating a platform for instant crypto-to-crypto and crypto-to-fiat loans. Crypto cards are now a big part of crypto markets.

And the business model is working. The DeFi company has already processed more than $5 billion, gaining over 1.5 million clients.

Nexo provides its services in over 200 countries and offers over 45 FIAT and digital currencies. On top of that, the company is partners with Credissimo, a leader in the European FiTech space. Malta regulates Nexo, a country known for its friendly banking regulatory status.

Nexo’s main selling point is that users can access collateralized crypto-backed loans without selling their crypto. The company also provides clients with a high-yielding savings account to earn up to 12% in yearly interest.

Security is a priority at Nexo’s. The company complies with all the laws and standards of the Securities and Exchange Commission (SEIC) and the European Banking and Financial Service Regulators’ guidance. So clients can be sure, their crypto is safe.

Nexo, in simple terms, makes securing a crypto loan easy and automated. Crypto-backed loans are available for many crypto collaterals, such as Bitcoin, Ethereum, Nexo, Binance coin, Litecoin, Ripple, etc.

Nexo.io Mastercard at a Glance

The Nexo credit card fits in perfectly with the services provided by the company. And has since its release seen a lot of adoption.

The crypto credit card provides access to your crypto funds without clients having first to sell and withdraw them.

The Nexo card works just like any credit card does. Users can use it to make payments and receive a 2% cashback, an incentive for customers to use the card.

Customers can depend on the funds they hold in their Nexo account secure from $500 to upwards of $2,000,000 in credit. And just like with any credit card, if the users default on their payment, they’ll see a reduction in their collateral.

And the Nexo card is backed by Master Card, which earns users all the exclusive features they offer.

Nexo Card vs. Coinbase Card vs. Crypto.com Card

Nexocard

Pros:

- Mastercard backs the Nexo card, so it’s accepted by over 40 million merchants worldwide.

- With the Nexo app, you can manage the card. and accessed from, such as single-tap card freezing and instant notifications for all transactions.

- 2% cashback on every purchase.

- Virtual cards so that users can enjoy safe online shopping.

- There can be tax-related benefits to using your crypto holdings as collater instead of selling your crypto every time.

- No monthly, annual, or withdrawal fees (depending on your tier).

Cons:

- Borrowers can only use it on the Nexo platform.

- The Nexo card is still in the early access phase.

Crypto.com

Pros:

- No annual or monthly transaction fees.

- No withdrawal fees.

- Instant access and process funds.

- A complete reimbursement each month on subscriptions such as Amazon Prime, Netflix, and Spotify and discounts on Air BnB if you hold a good enough tier.

- An 8% cashback on what you spend.

Cons:

- High staking requirements to access higher card tiers.

- Low monthly ATM limits if you’re holding a lower-tier card.

Coinbase

Pros:

- Quick and easy to spend your crypto.

- Accessible connection to your Coinbase crypto wallets.

- Available in UK, Europe, and the US.

- Clients have all the advantages of a Visa Card.

- Clients can earn up to 4% in cash backs.

Cons:

- Clients pay a card issuance fee of £4.95 or €4.95.

- The cryptocurrency exchange fee is 2.49% which is very high.

- No PIN code to access the Coinbase Card app, which leaves clients a lot more vulnerable.

Nexo Card Fees

The Nexo cards excel at allowing users to withdraw their funds at any time with no fees charged. The only fees that clients incur are the brokerage fee when doing transactions from a crypto exchange wallet. And clients don’t even need to worry about account maintenance, as no fees are charged for that.

There are no monthly or inactivity fees to worry about.

Nexo Card Limits

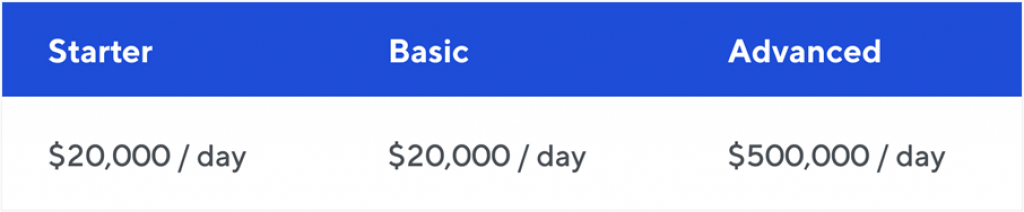

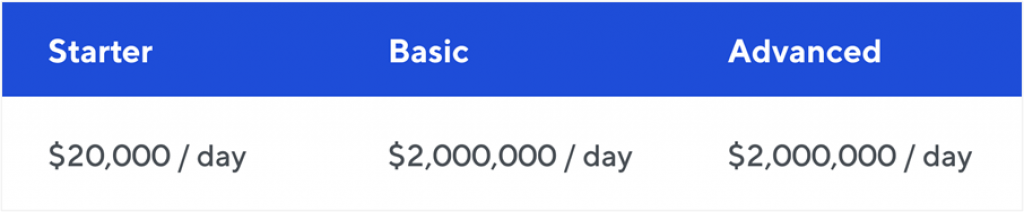

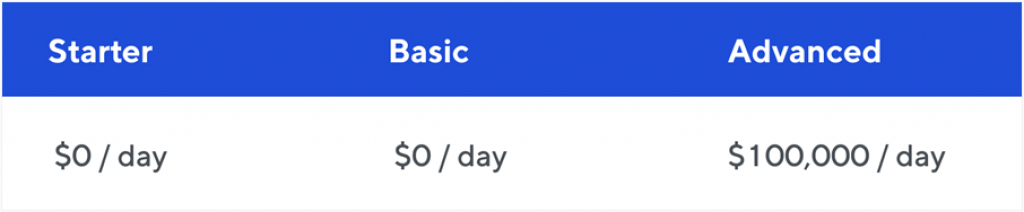

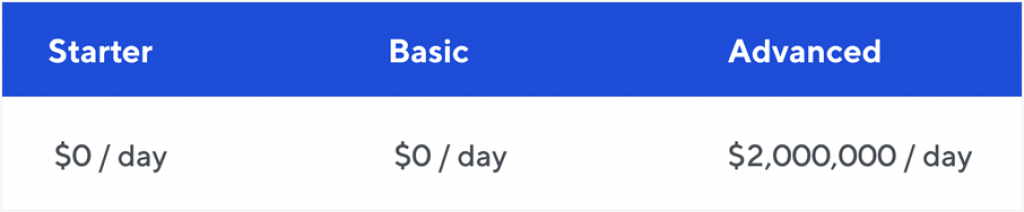

The client’s withdrawal limits are based on the verification level you have done on the platform. These are Starter, Basic and Advanced.

1. Limits for Cryptocurrency withdrawals:

- Saving Wallet

- Credit Line Wallet

2. Limits for Fiat Currency withdrawals

- Savings Wallet

- Credit Line Wallet

Users Loyalty tier, you will receive between 1 and 5 monthly crypto withdrawals for free.

Users Loyalty tier, you will receive between 1 and 5 monthly crypto withdrawals for free.

And free-of-charge fiat withdrawals, crypto and fiat transfers into your Nexo Wallet, and credit line withdrawals. The company will not charge you any credit line origination, forex, and exchange fees.

KYC and signup process

Fortunately, registering with Nexo is as easy as it gets. The KYC takes only about two minutes.

All you’ll need to provide is a photo of a government ID, such as a passport or driving license. And remember, the name has to match with the one you provided on the verification form.

Rewards structure

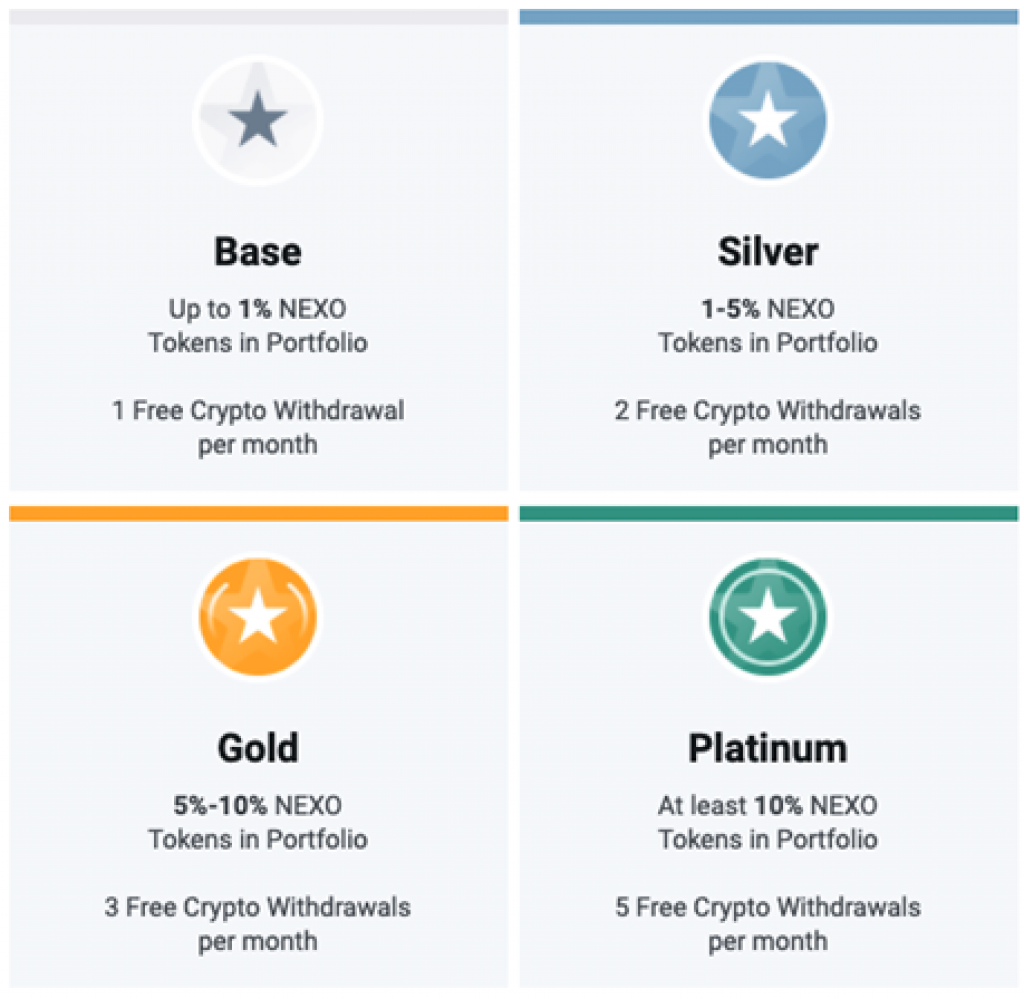

Nexo has a Reward structure, divided into a four-tier system comprising Base, Silver, Gold, and Platinum levels. The benefits received depend on how much NEXO Tokens are in your Portfolio Balance.

The criteria for each tier are the following:

- Base: The user doesn’t have any NEXO Tokens

- Silver: At least 1% of the Portfolio Balance is in NEXO Tokens

- Gold: At least 5% of the Portfolio Balance is in NEXO Tokens

- Platinum: At least 10% of the Portfolio Balance is in NEXO Tokens

The Loyalty program tier offers benefits and gives you greater rewards the more NEXO Tokens you hold while reducing your borrowing rates for the Instant Crypto Credit LinesTM. Users will also increase the yields with the Earn on Crypto & Fiat suite and how many free crypto withdrawals are available each month.

Advantages of Using the Nexo Card

The main selling point of the Nexo Card is that it allows users to spend their crypto without having first to sell their crypto holdings. This is toppled with an instant 2% cashback on all purchases and a wide array of flexible payment options.

And more than 45 million merchants accept payments with the Nexo crypto card. The company also provides users the possibility to access virtual cards, so to cut expenses even more.

With the Nexo card, users also enjoy no fees on any international transactions, and yes, that includes any “hidden fees.”

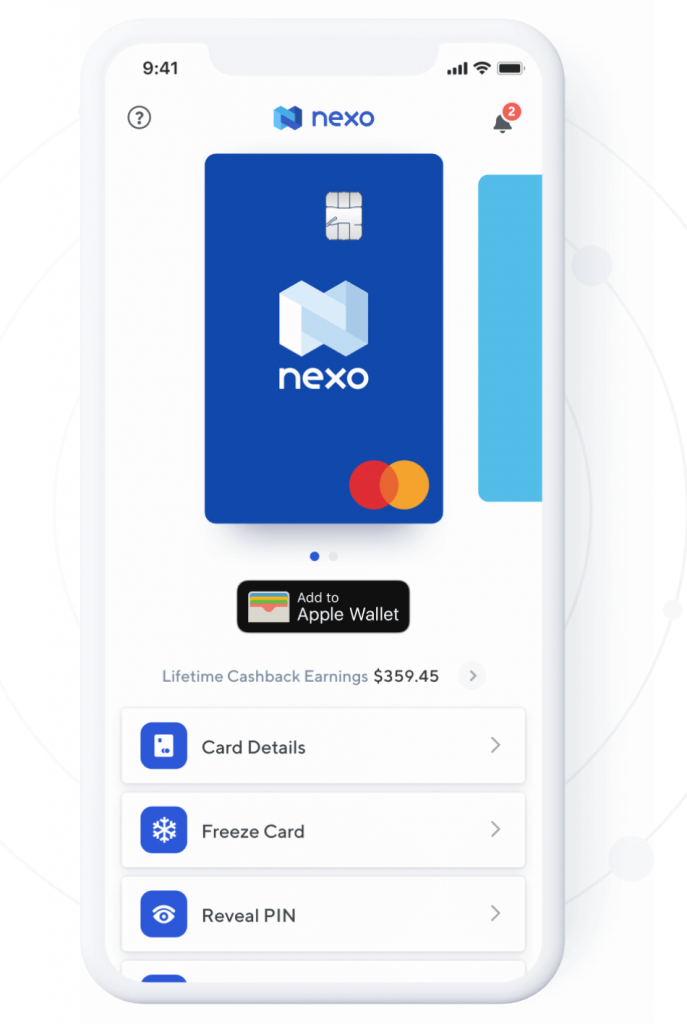

Nexo Card comes with all of the features customers would expect from any reputable credit card. With their Nexo App, you can:

- Easily freeze or unfreeze your Nexo Card

- Have full control of your account security, see and change your PIN at any supported ATM

- Create virtual cards free of charge to make a secure online purchase

- Monitor all transactions in detail and in real-time

The main goal of the Nexo Card is to make crypto user-friendly and accessible. All the options stand out for their simplicity. You can also use the card without bank transfers.

With its card, Nexo is offering clients to spend their digital assets without having to sell them.

To learn more about crypto debit and credit cards, read the guides below:

- AdvCash Card Review

- Bitpay Card Review

- Spectrocoin Card Review

- BlockFi Card Review

- Binance Crypto Debit Card Review

- Wirex Review