There’s no shortage of options for beginners looking to find a place to buy cryptocurrencies, like Ethereum and Bitcoin. Two of the most often recommended options are Gemini and Coinbase, and there is a good reason for that. In this „Gemini vs Coinbase“ review, we’ll show you the differences between the two options. We hope that we will help you make an informed decision of which is best for you.

What you'll learn 👉

Coinbase vs Gemini: Key Information

| Site | Visit Gemini | Visit Coinbase |

| Company Launch | 2015 | 2012 |

| Company Location | New York, USA | California, USA |

| Site Type | Cryptocurrency Exchange | Easy Buy/Sell Methods |

| Available Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH) | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) |

| Buy Methods | Bank Transfer | Bank Transfer, Credit Card, Debit Card |

| Sell Methods | Bank Transfer | Bank Transfer, PayPal |

| Fees | Low | Medium |

| Security | Great | Great |

| Community Trust | Great | Great |

| Verification Required | Yes | Yes |

| Customer Support | Good | Good |

Two Different Ways to Purchase Cryptocurrencies

You can use both of these sites to purchase cryptocurrencies. However, they work differently.

Coinbase is a stable and well-designed platform that directly facilitates the sale of Bitcoin, Ethereum, and Litecoin to their users. You can think of Coinbase as a “cryptocurrency retail store”, because when you purchase cryptocurrency from their site, there is a set price at the time of your purchase.

Most other sites where you can purchase cryptocurrency operate as an exchange, and they work similarly to a stock exchange or a forex.

There are a few key advantages in Coinbase’s system of selling cryptocurrency:

- When buying cryptocurrencies with bank transfers, users can instantly lock in their purchase price. However, these purchases require processing time.

- After verifying their accounts, users can purchase cryptocurrencies instantly with credit and debit cards. (Check below to see verification note).

We’ll show you the steps for buying cryptocurrency on Coinbase to help illustrate these advantages. After that, we’ll show you the steps for buying cryptocurrency at traditional exchanges.

Purchasing Cryptocurrencies via Bank Transfers on Coinbase

- Create and verify your account at Coinbase.

- Purchase Litecoin, Ethereum, and Bitcoin at their set price.

- After a few days of processing time, you will receive the agreed upon amount of cryptocurrency that you bought.

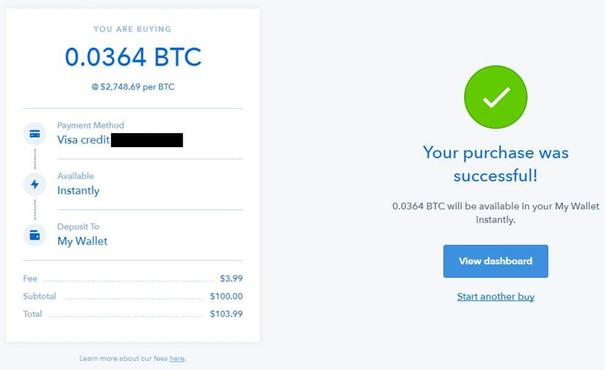

Purchasing Cryptocurrencies with a Credit Card on Coinbase

- Create and verify your account at Coinbase.

- Purchase Litecoin, Ethereum, and Bitcoin at their set price and receive them instantly.

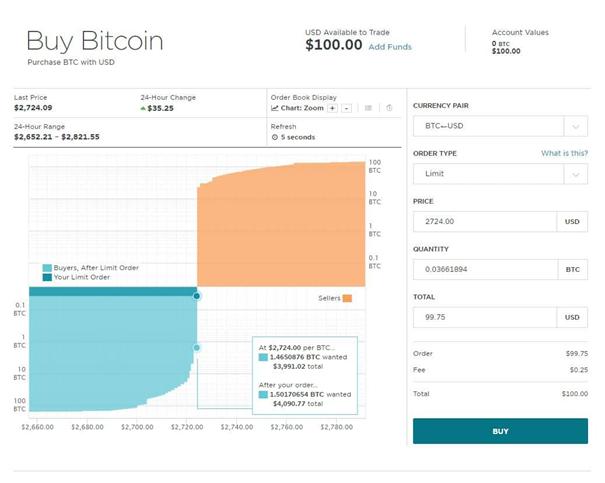

Purchasing Cryptocurrencies from Most Traditional Cryptocurrency Exchanges

- Create and verify your account on an exchange.

- Deposit FIAT currency to the exchange via bank transfer. This usually takes 1-5 business days.

- Place an order on the exchange’s market.

- You receive your cryptocurrency when your order has filled.

As you can see, when buying with credit cards Coinbase will allow you to receive your cryptocurrency faster than traditional exchanges. Also, unlikely traditional exchanges, Coinbase allows you to lock in your price immediately.

Gemini on the other hand, falls somewhere in the middle between Coinbase and traditional exchanges. Gemini is a cryptocurrency exchange. However, they allow users to immediately trade for cryptocurrency when depositing via bank transfers. In other words, you can start trading before your deposit is fully processed, but you won’t be able to withdraw your cryptocurrency before your deposit is fully processed.

Purchasing Cryptocurrencies via Bank Transfers on Gemini

- Create and verify your account at Gemini

- Deposit FIAT currency to the exchange. The deposit will be instantly available for trading.

- Place an order on the exchange’s market.

- You receive your cryptocurrency when your order has filled.

- Once your bank transfer has been fully processed, you can withdraw your cryptocurrency.

This process allows you to lock in your price faster than on traditional exchanges.

*Verification – Reputable sites that allow you to purchase cryptocurrencies in exchange for FIAT currencies require you to verify your identity. The verification is required in order to comply with regulatory bodies and laws where these sites operate. Keep in mind that, when creating a traditional stock brokerage account, similar verification would also be required.

Two Trusted Companies

Both companies are based out of the U.S. and serve U.S. customers, which means that both companies are regulated by various U.S. government and regulatory bodies.

Gemini was founded by Tyler and Cameron Winklevoss (Co-Creators of Facebook) in 2015. Despite launching more recently than most of their competitors, they’ve quickly built a great reputation in the community and they consistently have some of the largest daily Bitcoin trading volume of all exchanges. As a New York based cryptocurrency exchange, Gemini is fully regulated by the New York State Department of Financial Services (NYSDFS). This requires them to meet capitalization, consumer protection, anti-money laundering, compliance, and cyber security requirements set by the NYSDFS.

Coinbase was launched in 2012 in San Francisco, California. Since their launch, they’ve served over 8 million customers (currently users from 32 countries can use their services, including the United States) and helped users exchange over $20 Billion worth of digital currency. They have also received investments from Bank of Tokyo, Blockchain Capital, Alexis Ohanian (Reddit Co-Founder), and various other trusted investors. As a company operating in the United States, Coinbase is required to comply with U.S. laws and regulations, including state money transmission laws and regulations, the USA Patriot Act, the Bank Secrecy Act, and is registered with FinCEN as a Money Services Business. These laws and regulations force accountability onto Coinbase. This is something that may be lacking from some of their offshore competitors in other countries with less strict regulations.

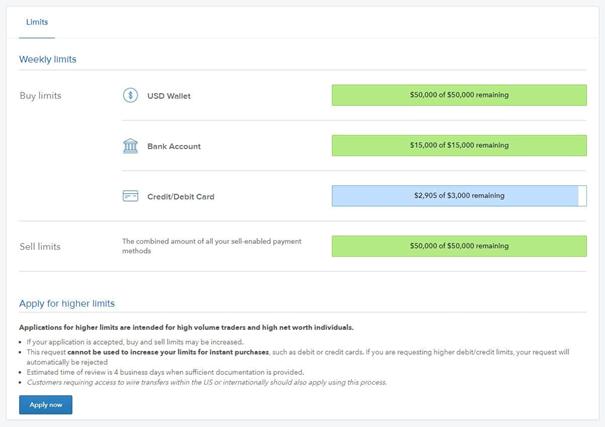

Buying Limits

Coinbase does not clearly define limits for new users on their site. Instead, limits can vary depending on account verification, buying history, and account age.

In our personal experience, credit card limits were initially set to only $60 per week, while bank transfer limits were quickly set to $5,000 per week.

One more thing worth noting is that your personal limits will be shown on your account’s verification page.

Gemini has predefined buying limits to $500 if using bank transfer.

For those who are looking to immediately lock in a price for more than $500, Coinbase will most likely provide more than Gemini limits.

Both sites offer wire transfers for users looking to deposit larger sums. However, you may have to apply or contact them directly.

Supported Countries

Gemini services customers in the United States, Singapore, South Korea, Hong Kong, Puerto Rico, United Kingdom, and Canada.

Coinbase serves customers in the United States, United Kingdom, Australia, Austria, Sweden, Switzerland, Netherlands, Norway, Denmark, Finland, Slovenia, Spain, Malta, Monaco, Cyprus, Czech Republic, Singapore, Slovakia, Portugal, San Marino, Poland, Latvia, Liechtenstein, Ireland, Italy, Greece, Hungary, Canada, Croatia, Belgium, and Bulgaria.

Safety of Funds

Both sites follow industry best practices for securing cryptocurrency funds, and they also segregate customer funds from company operational funds. The majority of cryptocurrency funds are stored in secure offline cold storage wallets, rather than hot wallets.

Available Cryptocurrencies

Coinbase allows their users to purchase and sell Bitcoin, Litecoin, Ethereum, and Bitcoin Cash.

Gemini, on the other hand, only supports trading for Ethereum and Bitcoin.

Gemini Fees vs Coinbase

Gemini is perfect for those whose goal is to save as much as possible on fees.

Gemini does not charge fees for deposits or withdrawals. But they changed their fee structure in 2019 and now Gemini has the least favorable combined fees for retail customers. Gemini’s fees come in at a whopping 2%, or 200 basis points.

Coinbase charges around 3.99% for credit/debit card purchases and 1.49% for bank transfer purchases.

| Purchase Method | Coinbase Fees |

| U.S. Bank Account | 1.49% ($0.15 minimum) |

| Coinbase Wallet (U.S. Dollars) | 1.49% |

| Credit Card or Debit Card | 3.99% |

Customer Support

Customer support is an issue plaguing many cryptocurrency companies. However, Coinbase and Gemini both do a pretty good job in this department.

Coinbase customer support is handled through email, and in our personal experiences, we’ve typically received responses from support within 24-72 hours. They also have an extensive FAQ for general questions.

Gemini also handles their customer support through email, and response times seem to be very similar to Coinbase. The company has quickly built a great reputation, partly due to their above average customer service.

Coinbase vs Gemini: Which is Better?

Both sites are secure and trustworthy, which means that the battle of Gemini vs. Coinbase comes down to your needs and preferences. Is Gemini better than Coinbase?

Coinbase is the best option for those who are looking to quickly buy cryptocurrency or want to use a credit card.

On the other hand, Gemini used to be the best option for those who want to save the most on fees. Nowadays, that is not the case anymore so Coinbase wins this duel cut and dried.

Gemini or Coinbase: Pros and Cons

If you are not fond of neither of these exchanges, here is a list of potential alternatives: Cex.io, PrimeXBT, PrimeBit, Deribit, Coinbase Pro, Coinmama, Changelly, Bitpanda, Bitfinex, Kraken, Bittrex, Bitstamp.

In case you want to compare Cex.io or Coinmama with other exchanges, have a look at our guides where we do just that: