There are many crypto exchanges. Some are good, and others aren’t. In general, we all know that big exchanges such as Binance and Coinbase are reliable, but what about smaller ones?

Well, today, we’ll be taking a look at a relatively unknown exchange called Hoo Exchange, so let’s get right into it.

What you'll learn 👉

Who’s Behind Hoo?

Forgive the pun. His name is Ruixi Wang, a Chinese entrepreneur and crypto investor. Wang got into Bitcoin in 2013 and soon later started a blockchain explorer called BtcMini. He wanted to help people learn more about crypto and join the community. Unfortunately, the project never took off, and he declared bankruptcy soon later.

Wang then joined a Bitcoin mining company called BitFountain. And when in 2015, the owner of BitFountain scammed clients and ran away with thousands of BTC, Wang bought the equipment and became a miner himself.

A year goes by, and Wang purchased a Chinese digital currency cloud mining and trading platform named PoW8.com. And in 2017, Wang started an ICO platform called icooo.com. But the company got shut by the Chinese Government only three months later. Talk about bad timing.

Then in May 2018, Wang founded the Hoo Wallet. And also acquired Chance and OAX exchanges to incorporate them within Hoo. And finally, in June of 2019, the Hoo Exchange went online in Hong Kong.

Looking at Wang’s short biography, it’s clear that he’s a veteran in the crypto space. He’s been in the market for years now, founding many projects, some successful others not. But with Hoo Exchange it seems that he’s learned his lessons.

What are the features of Hoo Exchange?

OTC Platform – Off-exchange transactions for big sales and purchases

Hoo lets users buy and sell crypto on their OTC platform, which means off-exchange. The advantage of OTC trading is that it can be at a fixed price. Having a big sale or purchase order on the cryptocurrency exchange would likely move the price by a lot.

Spot and Margin Trading – Buy or Sell tokens.

Hoo provides users with what you would expect from a reputable exchange, both spot, and margin trading. Traders can choose from around 400 tokens (507 trading pairs) on it.

Another exciting feature that sets the Hoo exchange apart is the Innovation Hub. Here, users can explore startup and small-cap crypto projects that have a lot of potential. Sometimes finding the hidden gem that can 100x your investment. But keep in mind that these cryptos are a lot riskier to get into.

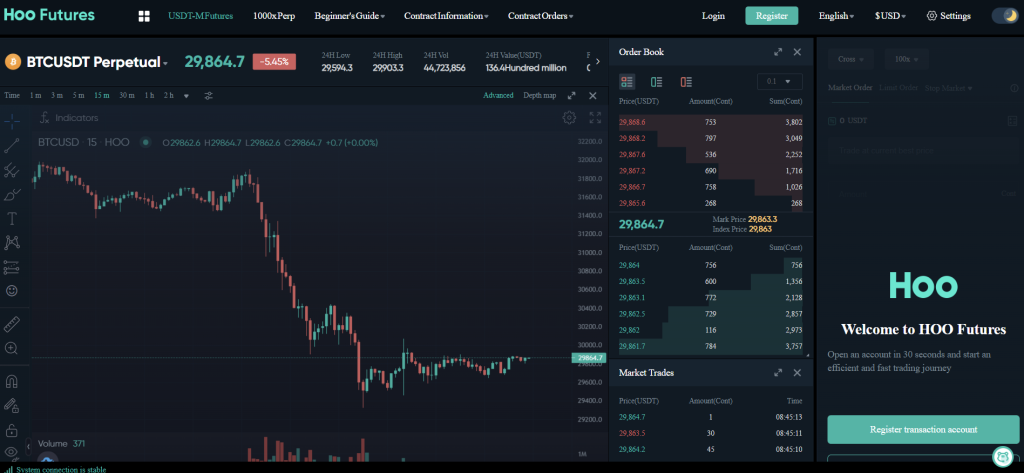

Futures Contract – Trade in the derivatives market

Users can also access perpetual futures on the Hoo exchange to its users.

Hoo Option: Hedge your investments with options trading.

And on the Hoo Exchange, traders can also buy or sell cryptocurrency options. What’s best is that Hoo Option provides its buyer a right to refund, dividend, gain, or market order.

HooSwap and HooPool

HooSwap is an Automated Market Maker (AMM) that unlike many competitors, it’s built on the centralized Hoo Exchange. With HooSwap, a user can instantly and without fee exchange his crypto.

User can also become a liquidity provider to this crypto trading desk with Hoo Pool and, of course, earn rewards for doing so.

Hoo Earn

With HooEarn, users can earn passive income by investing in various savings plans. Hoo offers users three types of saving strategies.

- Flexible – Deposit and Withdrawal are available anytime

- Locked – Users can use only withdrawal at the end of the lock-in period

- Dual Currency – Two tokens have to be deposited

Hoo Mining

Hoo Mining is a mining service that makes mining more accessible for everyone. Hoo sells to users second-hand mining machines and helps them manage their operations.

Hoo Custody – Custody services for other exchanges and cryptocurrency wallet

Hoo Custody is an asset security management service. It mainly works with OTC platforms, crypto exchanges, wallets, investment firms, and hedge funds. And over 20 public blockchains and thousands of tokens have opted for their services. However, Hoo custody is only available to clients with a monthly capital flow of more than 16,000 BTC.

Hoo Labs

With Hoo Labs, traders can participate in a crypto startup project. By getting in before everyone else, investors can see enormous gains. And yes, of course, considerable losses.

Hoo Smart Chain – A decentralized blockchain for the development of dApps

Hoo Smart Chain is a decentralized blockchain network that allows smart contracts. The network has a PosA consensus mechanism, combined with Proof of Stake (PoS) and Proof of Authority (PoA) protocols. The smart chain can process 500 TPS (Transactions Per Second) with a block time of 3 seconds. And on it, users can access cross-chain asset transfer.

The project is competing with giants like Ethereum and Cardano. So users are able to use the network to create DApps (Decentralised Applications), yield farming, gaming, etc.

Although it is good to remember that the project is still tiny, being the 2546th biggest by market cap.

User Interface

Hoo Exchange is available on the web and mobile app for iOS and Android devices. On mobile, users can expect an interactive and fast experience.

Some issues come up with the web interface, the website is slow to load, and some sub links don’t seem to work.

Hoo Exchange Fees

Trading fees

The trading fee for spot and margin trading is 0.2% of the transaction value. But the fee that may seem high gets lower the more points you collect and the higher VIP level you are.

I cannot say I like this kind of system as the fee structure is complex to understand and may even be deceiving.

Withdrawal fees

Hoo Exchange does not charge any withdrawal. But you will be charged a network fee when withdrawing. Simply put, network fees are owed to the miners of the crypto/blockchain, and not to the exchange itself. These fees vary depending on how many people are using the network. But usually they are less than withdrawal fees.

Deposit Methods

The Hoo Exchange, of course, lets you deposit crypto and FIAT currency. Howsoever, you can only deposit FIAT via wire transfer and not by credit or debit card.

The fact that FIAT deposits are possible makes it a platform ideal for beginners. Users can deposit various fiat currencies such as South Korean Won, US Dollar, and Chinese Yuan. South Korean Won is being used the most.

Are US investors allowed?

It is unclear whether Hoo Exchange permits US investors or not. In theory, you can use it as a US citizen, and there is no explicit prohibition in their Terms and Conditions. But as the exchange is relatively unknown, we urge any US investors to trade at their own risk.

HOO Tokenomics

HOO is the native governance token of the Hoo Exchange. The initial supply was 1 billion, but in February 2021, the Hoo Exchange announced burned 900 Million unissued tokens. So as of now, the maximum supply is 100 Million.

HOO Token Holders can enjoy the following benefits:

- Coin Burn – 20% of the total platform fee is used to buy back and burn HOO tokens

- VIP privileges – HOO token holders earn VIP points

- HOO Token holders get discounts on the token listing fee

Hoo Exchange- the verdict

I am very skeptical of Hoo Exchange. There is little information about the development team on their website. And by little I mean almost none, I cannot even find their names. So how can we trust a team that we don’t even know?

The customer service is also not reachable, which when dealing with money is a mortal sin. A small and new exchange like Hoo should take all the necessary measures to feel trustworthy. But, unfortunately, the opposite is true.

Even their website portal is full of bugs and malfunctions, not a good look. The whole experience is dreadful. And what’s worse is that it cannot handle big amounts of internet traffic. But to be fair, their mobile app works a lot better and has a slick design.

Another problem that often comes up with the exchange is the long withdrawal times. And that’s a big issue. Because when I want my money, I want it as quickly as possible.

The exchange itself lists a wide array of tokens. And with the Hoo Labs option, investors can find small-cap gems that much easier. An excellent choice for traders looking for the thrill of coins that can make or break a portfolio. Some 100x their money in a couple of months. Others lose it all. So if you intend to explore the mad world of small-cap crypto investing, then make sure you know the risks.

Another positive aspect about the Hoo Exchange is all the additional services offered. For example, with the Hoo Earn option, investors can earn that sweet, sweet crypto passive income by depositing their funds.

And if you feel like digging deeper into the crypto world and you, the Hoo Swap might be what you’re looking for. The service allows users to swap their tokens fee-free. These swaps are ideal for investors using a lot of different tokens.

On top of that, two other options that may interest high-income clients are Hoo Custody and Hoo Mining. Hoo Custody is an asset security service used by institutions. While Hoo Mining sells second-hand mining equipment and helps manage the operation.

The HOO blockchain is an interesting project, but is competing with giants in the space like Ethereum even realistic? We’ll have to wait and see, but the odds are not in their favor.

Ultimately Hoo Exchange is an average platform with bad website design. Honestly, I cannot recommend using the platform for anything more than „fun“ amounts. And as of, now the exchange does not seem particularly trustworthy. Hopefully that changes in the future.

My advice is to stick with exchanges that already have a proven history of satisfied clients. And if you choose to go with a smaller exchange, don’t invest more than you are willing to lose. You don’t want to lose your funds to a scam or hack do you? So always make sure that the platform is trustworthy.

Read also:

- KuCoin Review

- CEX.IO Review

- Gate.io Review

- BitMart Review

- Coinmama Review

- BitPanda and Bitpanda Pro Review

- Wootrade Review

- LBank Review

- Is Azbit Exchange Legit & Safe To Use?