Coinbase Card Review – Fees, Withdrawal Limits, Supported Coins, Cashback

Coinbase is one of the largest crypto exchanges in the world. It has been around for a while, being launched on June 20, 2012, and currently is the second-largest crypto exchange in terms of spot trading volume.

Being an old-timer, the exchange continually makes itself relevant by introducing innovative ways to make it easier to buy, sell, understand, and use cryptocurrencies. In April 2019, Coinbase launched its crypto debit card, one of these ways. We will talk at length about that card in this article and explain how it can be helpful for you.

What you'll learn 👉

INTRODUCTION: What is the Coinbase debit card?

The Coinbase debit card is the result of a collaboration between two financial giants – Coinbase and Visa. It was launched on April 11, 2019, and was first open to only European citizens before being extended to US citizens on October 28, 2020.

It was introduced to make it easier to spend your crypto on everyday purchases, facilitating mainstream crypto adoption. You don’t have to preload the card before using it because it’s connected to your Coinbase account. This makes it more unique than many other cards of the same type.

PROS

- It acts as the middleman between your coinbase account and the real world. Therefore, there is no need to fund the card separately.

- It builds on the reputable security features that Coinbase offers and adds an AES 256 level encryption to boost security further.

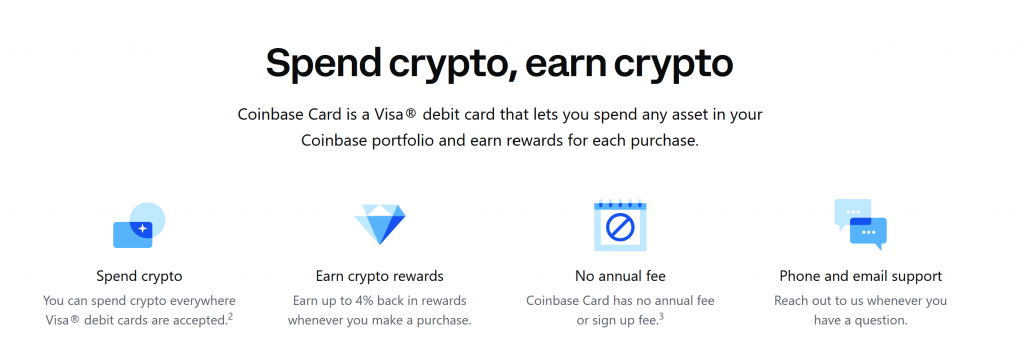

- It provides rewards for users in terms of cashback up to 4% on every crypto purchase (1% for Bitcoin and 4% for Stellar Lumens)

- It has wide coverage with support in over 30 countries, the US included.

- It gives the user much purchasing power with a €10,000 daily spending limit(or $2500 for US citizens).

- It is easy to use, even for beginners.

CONS

- There is a 2.49% liquidation fee on top of the standard transaction fees when you make purchases with any other cryptocurrency apart from USDC.

HOW THE COINBASE DEBIT CARD WORKS

The Coinbase card connects to your personal Coinbase account. Therefore you can only have one card per account. There are no annual or sign-up fees, but there is an issuance fee of £4.95(or €4.95 or $4.95). Once you get your card, you can activate it with the Coinbase app or the website using the activation code in the letter accompanying your card.

How can you use the Coinbase card to:

- Spend Crypto? Presently, there are 100+ cryptocurrencies supported on the Coinbase Debit card. When you make a crypto purchase, the selected crypto is instantly converted to the native currency(Pounds or Euros or Dollars), and a cashback is given as a reward.

The coinbase debit card is also connected with Google Pay and Apple Pay, facilitating even faster crypto payments with the touch of a button.

- Earn Crypto? The rewards system in the Coinbase debit card works regardless of the cryptocurrency you spend. However, it gives you the option to toggle between what kind of rewards you want. You can either choose to get 4% cashback in XLM tokens or 1% cashback in BTC.

Rewards are sent to your account within 1-5 days of your transaction, depending on the payment merchant. However, ATM withdrawals are not eligible for rewards.

COINBASE DEBIT CARD SUPPORTED COINS

The vast array of cryptocurrencies is one of the exciting things about the Coinbase debit card. Because the card is linked to your Coinbase account, you can use the card to make payment in any of the cryptocurrencies supported on Coinbase. At present, there are 108 coins, and still counting. The only issue is that you would have to pay a conversion fee(2.49%) for any crypto purchase involving coins other than USD Coin(USDC).

GENEROUS CRYPTO REWARDS

As a Coinbase card user, you can earn up to 4% in cashback rewards. The rewards come in two ways: earn 1% cashback as BTC or 4% cashback as XLM. The cashback is sent directly to your Coinbase account in a matter of days.

COINBASE CARD FEES

The fee structure on Coinbase Card is in two categories:

For US residents:

- There is no issuance fee

- There is a 1% charge on withdrawals that exceed the daily limit of $2500.

- There is a 2% fee on transactions that take place outside the US

- There is a 2.49% liquidation fee on all other cryptocurrencies transactions apart from USDC.

For residents in the UK and EU:

- There is a plastic card issuance fee of €4.95 or £4.95

- ATM withdrawals are free up to €/£ 200 per month. After that, a 1% fee is charged on the requested amount

- International cash withdrawals are free up to €/£ 200 per month. After that, a 2% fee is charged on the requested amount.

- International purchases come with a 3% fee in addition to the requested amount

- Card replacement attracts a fee of €4.95 or £4.95.

INTUITIVE MOBILE APP

The coinbase mobile application, available on iOS and Android, works with the Coinbase debit card to deliver a seamless financial experience. You can use the application to:

- Request for the Coinbase card and use the Virtual card until you get the Physical one.

- Toggle between different crypto assets you’d like to spend and track your crypto assets.

- Toggle between choosing 1% BTC cashback and 4% XLM cashback

- Activate your debit card after you get it

- Integrate Apple Pay and Google Pay with your Coinbase card.

SUPPORTED COUNTRIES

As of writing, the Coinbase debit card is present in the following countries: Austria, Belgium, Denmark, Italy, Liechtenstein, Portugal, Bulgaria, Poland, Greece, Finland, Latvia, Netherlands, Cyprus, England, Norway, Spain, Croatia, France, Estonia, Ireland, Finland, Iceland, Romania, Hungary, Slovakia, Lithuania, Slovenia, Luxembourg, Sweden, the United Kingdom, and the United States. As time goes on, more countries will be added.

It’s important to note, though, that while the Coinbase card can be used at any store where Visa cards are accepted in the above countries, it has some restrictions by law. For example, you can’t use the card at gambling sites, nor can you use it for dating services, wire transfers, firearm-related businesses, etc.

SPENDING LIMITS

As you may have suspected, the spending limits of the card in the US are quite different from that of the UK/EU.

In the UK/EU:

- Daily spending limit: €10,000 or £10,000

- Monthly purchase limit: €20,000 or £20,000

- Yearly Purchase Limit: £100,000 or € 100,000

- Daily ATM withdrawal: £500 or €500

In the US:

- Daily spending limit: $2500

- Maximum Daily ATM Withdrawal limit: $1000

HOW TO APPLY FOR AND VERIFY A COINBASE DEBIT CARD

Follow the steps outlined below:

- Create a Coinbase account if you have not already done that

- Register for and pass the KYC(know your customer) verification

- Apply for the card on the application by going to the PAY tab, selecting APPLY NOW, and signing up. You won’t instantly get the card, though, as you would be added to a waiting list from which select individuals are chosen periodically to get their cards

- Pay the issuance fee of £/€4.95 for UK/EU residents. The fee can be paid in any of the accepted cryptocurrencies from your coinbase account.

- Once you’ve done that, you can begin to use the virtual card, which has the exact details as the physical card. Once your physical card has arrived, you do not need the virtual anymore.

- After being approved, you will receive the card in 7-10 business days. If you do not receive it within that period, log in to your coinbase account and report the card as stolen. You will then be sent another card at no cost

- Activate your card on the app, and you’re good to go!

HOW DOES COINBASE DEBIT CARD COMPARE TO…

BITPAY CARD:

| CRITERIA | COINBASE CARD | BITPAY CARD |

| Supported Crypto | Over 108 cryptocurrencies are supported by Coinbase. | Bitcoin, Bitcoin Cash, Ethereum, Wrapped Bitcoin, Dogecoin, Litecoin, and five USD-pegged stablecoins |

| Supported Fiat | USD, EUR, GBP | USD |

| Card Type | Visa card | Mastercard |

| Contactless Payments | Apple Pay, Google Pay | Apple Pay |

| Fees | No monthly fee. Issuance fee of £/€4.95 for UK/EU residents. Currency conversion fee of 2.49% ATM withdrawal fee could go as high as 2%. | No monthly or maintenance fee. Issuance fee of $10. Currency conversion fee of 3%. ATM withdrawal fee could go as high as $3 |

| Limits | As high as £10,000 daily withdrawal limit | As high as $6000 daily withdrawal limit |

BLOCKFI CARD

| CRITERIA | COINBASE CARD | BLOCKFI CARD |

| Supported Crypto | About 108 cryptocurrencies | Only Bitcoin |

| Rewards | 1% BTC or 4% XLM cashback | 1.5% cashback in BTC |

| Fees | No annual fees. International fees up to 3% | No annual or international fees. |

| Beginner and Special rewards | None | Beginners earn 3.5% cashback up to $100 during the first 90 days they own their card. After crossing a yearly milestone of $50,000, users earn 2% cashback |

| Supported fiat | EUR, GBP, USD | USD |

GEMINI CARD

| CRITERIA | COINBASE CARD | GEMINI CARD |

| Supported Crypto | Over 108 coins traded in the coinbase exchange | Over 40 coins supported in the Gemini exchange |

| Cashback | 1% BTC cashback, 4% XLM cashback. | 3% cashback on dining, 2% cashback on groceries, 1% cashback on other transactions. |

| Fees | No annual fees | No annual fees |

| Card type | Visa Card | Mastercard |

| Supported countries | US, UK, and the EU | US |

CRYPTO.COM CARD

| CRITERIA | COINBASE CARD | CRYPTO.COM CARD |

| Supported countries | United States of America, European Union Countries, United Kingdom | The United States of America, European Union Countries, Singapore. |

| Cashback | 1% BTC cashback, 4% XLM cashback | 1-8% cashback depending on how much Crypto.com coin(CRO) you have. No CRO: 1% cashback5,000 CRO: 2% cashback50,000 CRO: 3% cashback500,000 CRO: 5% cashback5,000,000 CRO: 8% cashback |

| Card type | Visa debit card | Visa Prepaid card |

| Supported coins | 108 coins | 121 coins |

| Supported fiat Currencies | EUR, USD, GBP | Over 20 fiat currencies are supported. |

FREQUENTLY ASKED QUESTIONS

BOTTOM LINE: COINBASE DEBIT CARD REVIEW

The Coinbase debit card is one of the best in terms of security and seamless financial experience. It also supports a vast array of cryptocurrencies and is accepted by merchants in a growing number of countries. The cashback rewards are small compared to other crypto debit cards, and the liquidation fee may also be discouraging to retail traders.

All in all, the fact that it is backed by one of the biggest names in the crypto industry makes it a good recommendation. Still, if you will use this card, be sure to know the risks as we have explained in this article and then decide if it’s the right card for you.

To learn more about crypto debit and credit cards, read the guides below:

- AdvCash Card Review

- Nexo Card Review

- Gemini Card Review

- Bitpay Card Review

- Spectrocoin Card Review

- BlockFi Card Review

- Binance Crypto Debit Card Review

- Blockcard Review