If you’ve been searching for a platform that offers a blend of versatility and user-friendliness, AvaTrade might just be the solution you’ve been waiting for. From robust charting tools to a variety of supported platforms, this review will delve deep into what makes AvaTrade a top choice for traders around the globe.

Read on to discover the ins and outs of trading fees, platform features, and much more, as we unravel the full scope of what AvaTrade has to offer.

| Feature | Summary |

|---|---|

| 📊 Charting | AvaTrade provides robust charting tools, including 90 technical indicators. The interface is well-designed and allows for easy chart editing. |

| 💻 Supported Platforms | AvaTrade offers a variety of trading platforms such as Web Trader, Mobile App, Desktop Trader, MetaTrader 5, and MetaTrader 4. |

| 📱 AvaTradeGo | AvaTradeGo is a user-friendly mobile app available on Google Play and App Store. It offers unique features like market trends and community sentiment. |

| 💰 Trading Fees | AvaTrade charges commissions for trading. Fees vary depending on the account type and trading instrument. |

| 💳 Deposit and Withdrawal Fees | No deposit fees are charged. Withdrawal fees may vary. The minimum deposit is usually 100 GBP. Withdrawals take 1-2 business days. |

| 🛡️ Regulation | AvaTrade is regulated by multiple authorities, providing a level of trust and security for traders. |

| 👆 User-Friendly | The platforms are intuitive and easy to use, with mobile apps for iOS and Android that are highly rated. |

| 📚 Research and Education | AvaTrade offers research and educational tools like an economic calendar and trading calculator. |

| 🌍 Multiple Languages | The website supports 22 languages, making it accessible globally. |

| 📉 Limited Investment Products | AvaTrade may offer fewer options for investing in non-derivative assets like ETFs or stocks. |

| 🛑 Non-Trading Fees | Inactivity fees are charged after three months of inactivity. |

| 📈 Chart Analysis | The chart analysis system could be improved with more options for price comparison and annotations. |

Trading platforms you can trade various types of assets are a dime a dozen in today’s markets. As such, it can be difficult to discern which ones are legitimate and which ones offer better terms of doing business than the others.

Today we’ll be analyzing a platform called AvaTrade and determining its qualities and what it brings to the average trader’s table.

In recent years, AvaTrade added support for crypto CFDs and in combination with its leverage trading abilities, this platform swiftly became one of the alternatives to the popular cryptocurrency margin platforms.

As we usually do with our reviews, we will start this AvaTrade review with a quick rundown and tabular overview of the major features, pros & cons of the platform.

What you'll learn 👉

AvaTrade at a glance

| Broker | Avatrade |

| Regulation | ASIC (Australia), IIROC (Canada), FSP (S Africa), FSA (Japan), CBI (EU), FSRA (Middle East) |

| Headquarters | Ireland |

| Minimum Initial Deposit | $100 |

| Demo Account | Yes |

| Asset Coverage | CFDs, ETFs, Forex, Cryptocurrency, Shares, Bonds Commodities, Indices |

| Leverage | 30:1 |

| Trading Platforms | Proprietary Web, Mobile Apps, Meta Trader 4, Zulu Trade, Mirror Trader |

| Deposit/Withdrawal Options | Boleto, Credit Card, FasaPay, Moneybookers, Neteller, Skrill, Wire |

| Mobile trading | Android & iOS |

According to the Financial Instruments list on the AvaTrade website, it offers the following CFDs for trade:

| Feature | AvaTrade |

|---|---|

| Demo account | Yes |

| Forex: Spot Trading | Yes |

| Currency Pairs (Total Forex pairs) | 60 |

| CFDs – Total Offered | 681 |

| Social Trading / Copy-Trading | Yes |

| Cryptocurrency traded as actual | No |

| Cryptocurrency traded as CFD | Yes |

What is AvaTrade’s location and is it regulated?

AvaTrade is a platform that has provided brokerage services since 2006, amassing a respectably-sized user base of more than 200 thousand individuals with its straightforward, fair business values and practices.

This fully regulated broker is located in Dublin, Ireland (under the regulations of the Central Bank Of Ireland), and has a presence in Europe, South Africa, the Middle East (Abu Dhabi), the British Virgin Islands, Australia, and Japan. The platform mostly deals with forex and CFDs on stocks, commodities, indexes, forex, and cryptocurrencies. AvaTrade records monthly trade volumes of cca. 2 million trades, through which experienced trader exchanges around 60 billion pounds during that same timeframe.

AvaTrade is regulated by the Central Bank of Ireland and licensed by MiFID in the European Union. It is also regulated by ASIC in Australia, the Financial Services Commission (FSC), and Financial Services Agency (FSA) in Japan, as well as by the B.V.I Financial Services Commission in the British Virgin Islands.

Regardless of the regulator, AvaTrade offers negative balance protection in every country where it conducts business.

Is AvaTrade legit? As of 2016, AvaTrade is part of the South African market under the name “Ava Capital Markets Pty Ltd”, regulated by the South African Financial Sector Conduct Authority (FSCA No.45984). The company also has sales centers in Dublin, Abu Dhabi, Paris, Milan, Sydney, Tokyo, Madrid, Mongolia, Beijing, Nigeria, Santiago, and Johannesburg.

What can you trade on AvaTrade platform?

AvaTrade offers several types of tradable assets on the platform:

| ASSET | TRADABLE SECURITIES |

| US Stocks | 38 |

| UK Stocks | 5 |

| Spain Stocks | 6 |

| Germany Stocks | 10 |

| France Stocks | 5 |

| Italy Stocks | 5 |

| Bonds | 2 |

| ETFs | 5 |

| FX Pairs | 54 |

| FX Options | 51 |

| Commodities | 17 |

| Indices | 19 |

| Cryptocurrency | 10 |

- Stocks – trade CFDs of the world’s biggest companies‘ stocks. Corporations like Apple, Google, Amazon, Facebook, Tesla, Microsoft, Boeing, Netflix, Coca-Cola, and many more that are listed on platforms like NYSE or NASDAQ can also be found here, with leverages of up to 20:1 on offer.

- Forex – lets investors trade 50+ fiat currency pairings, including EURUSD, USDJPY, GBPUSD, USDCAD, USDCHF, AUDUSD, and others. Leverage of up to 400:1.

- FX options – Trade the mentioned base currency pairs and create any combination of calls and put options in one account. Buy options to hedge risk or take a view, and sell options to generate income. This type of trading is handled through AvaTrade’s AvaOptions platform.

- Indices – lets investors speculate on the world’s top financial markets and keep abreast of the top stock markets. S&P 500, NASDAQ 100, FTSE 100, IBEX 35, MIB 40 and more can be found at AvaTrade. Leverages of up to 400:1.

- Commodities – AvaTrade supports the trading of commodities such as precious metals (gold, silver, copper, palladium, platinum), energies (brent crude oil, natural gas, heating oil, gasoline), and agricultural products (corn, cocoa, cotton, soybeans, sugar, wheat).

- Bonds and treasuries – AvaTrade offers a focused and wide range of US, European and Asian government bonds (also known as treasuries or securities) to trade as CFDs on Meta Trader 4. Trades have no commissions and the leverage goes up to 20:1.

- ETFs – a variety of Exchange Traded Funds can be traded on AvaTrade. Funds like MSCI Brazil Index Fund, MSCI South Korea Index Fund, Dow-Jones U.S. Real Estate Index Fund, and the Energy Select Sector SPDR, that track indices, bonds, and commodities, are all available. Leverage goes up to 20:1.

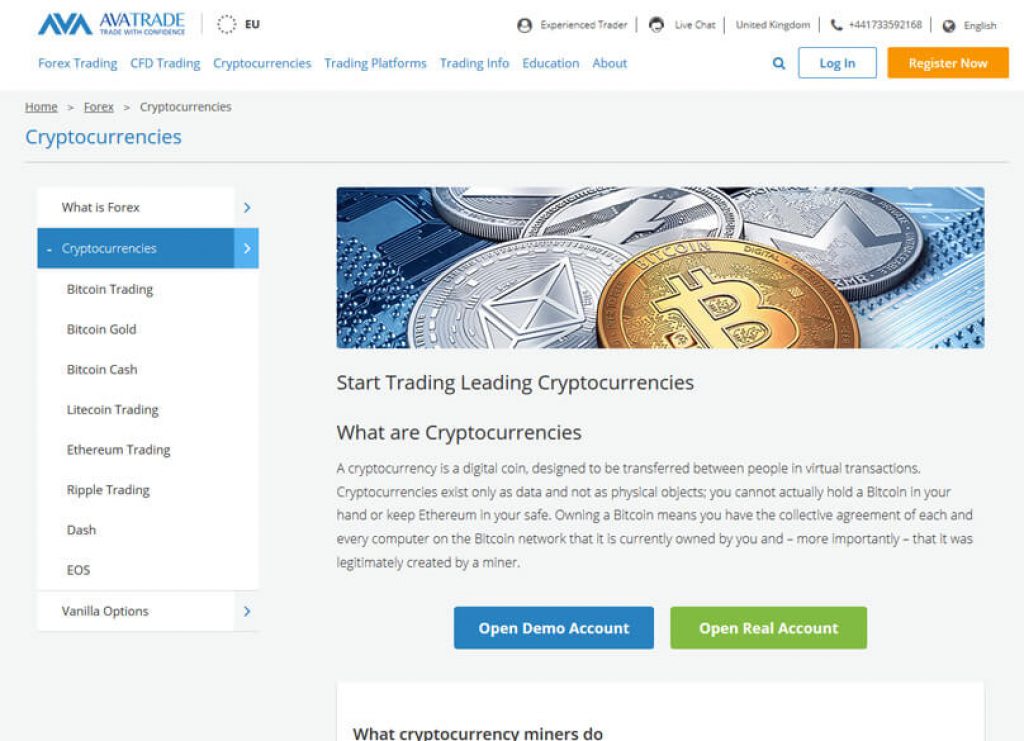

Trading cryptocurrencies on AvaTrade

AvaTrade offers an experienced trader the opportunity to trade some “top-rated” cryptocurrencies (not actual coins, but CFDs) like Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Bitcoin Gold, Dash, EOS, and Ripple.

All the trades you make are made in the form of CFDs (Contracts For Difference). This allows you to buy/sell instruments tied to the asset, without actually owning the asset. A trader can sell the instrument later on for a profit, with margin trading enabled (margins vary depending on the asset; can go up to 400:1). Crypto trading margins are limited to 2:1 due to ESMA regulations.

AvaTrade Deposits

To make a deposit, log into your account and go to the “Deposit” section. From there, you can choose from one of the deposit methods that include credit cards, wire transfers, and e-payments.

Those from Australia or the EU should note that e-payment options are not available for them. Canadian clients cannot make a deposit (nor do they have a minimum deposit) via credit card. Customers who are not from the EU or Australia can choose from e-payment options, such as Neteller, Webmoney, and Skrill. It’s recommended to use personal financial accounts for deposits; depositing from other people’s accounts is possible but will require additional verifications.

AvaTrade Withdrawals

As for withdrawals, naturally, you’ll have to have a verified account to be able to complete them. Requests are processed within 24 hours and you are required to withdraw the funds via the same method you used to deposit them.

With credit and debit cards, you need to withdraw 200 percent of the original deposit made with that card before changing the method. Withdrawals made via third parties have this limit set at a lower than 100 percent of the original deposit.

Deposit processing times differ depending on your deposit method. Before you go ahead and fund your account, make sure that the verification process of your account is completed and that all of your uploaded documents have been approved.

AvaTrade minimum deposit

The minimum deposit you can make is 100 units of your account’s chosen fiat currency (USD/EUR/GBP/AUD). If you use a regular credit/debit card, the payment should be credited instantly (or up to one day after deposit if it’s your first ever). E-payments (i.e. Moneybookers (Skrill), Webmoney, Neteller) will be credited within 24 hours, deposits by wire transfer can take up to 7 business days, depending on your bank and country. Wire transfers may take up to 10 business days to arrive.

As for withdrawals, the time it takes to complete a withdrawal will depend on the method used. In most cases, they will be processed and sent within one or two business days. Following processing, e-money withdrawals can take up to 24 hours, credit/debit card withdrawals can take up to five business days, and wire transfers can take up to 10 business days, depending on the bank and country.

AvaTrade Fees

AvaTrade offers competitive fees that are, however, subject to frequent changes so it is best you make use of their calculator to see how much will pay in fees for your position held on AvaTrade. They are transparent about this which is a big plus.

| Pros | Cons |

|---|---|

| • Low trading fees | • Inactivity fee |

| • No withdrawal fee | • Administration fee |

All trading on AvaTrade can be subject to charges and fees. AvaTrade reserves the right to cancel any excess trades or exposures that exceed the outlined threshold limits, all canceled trades will be closed at their opening rates.

Below is a tabular overview of fee terms:

| Assets | Fee level | Fee terms |

|---|---|---|

| S&P 500 CFD | Low | The fees are built into spread, 0.5 is the average spread cost. |

| Europe 50 CFD | Low | The fees are built into spread, 1 pips is the average spread cost. |

| EURUSD | High | The fees are built into spread, 0.9 pips is the average spread cost. |

| Inactivity fee | High | $50 per quarter after 3 months of inactivity |

The platform also reserves the right to modify its threshold limits, affected clients will be notified in advance and may be required to reduce their exposure.

Trading fees on platforms such as AvaTrade are influenced by the instrument you trade, leverage you use and duration of your contract. Depending on these three factors, you pay varying amounts of commission to the platform.

You can check out the complete fee structure here.

AvaTrade trading software

The platform itself offers two types of trading software:

MetaTrader 4/5

A popular trading platform that gives the individual all the tools he needs to start trading. Competitive spreads, solid user interface, multiplatform compatibility, a wide variety of time frames/analytical objects/technical indicators that can be applied to some rather interactive charts, and even a trading feedback tool that serves as your own “guardian angel” are there to support quality decision making and improve your trading performance.

Fund your account with as little as $100, download the PC/web/iOS/Android version of the software, and make your first trade. Alternatively, if you still vary of trading with real money you can utilize a demo account which gives you $100 thousand fake dollars to practice trading. Both of these experiences can be enhanced with the help of AvaTrade professionals, advisors, and automated expert advisors. AvaTrade recently upgraded the MT4 trader experience by introducing MetaTrader 5.

Automatic trading platforms like ZuluTrade/DupliTrade

Automated trading platforms enable traders to copy signals or mirror complete trading strategies in order to profit from the experience and knowledge of successful traders. These platforms work with the MT4 and let you use expert advisors as well. You can also use customize APIs to create your own automation solutions for forex trading.

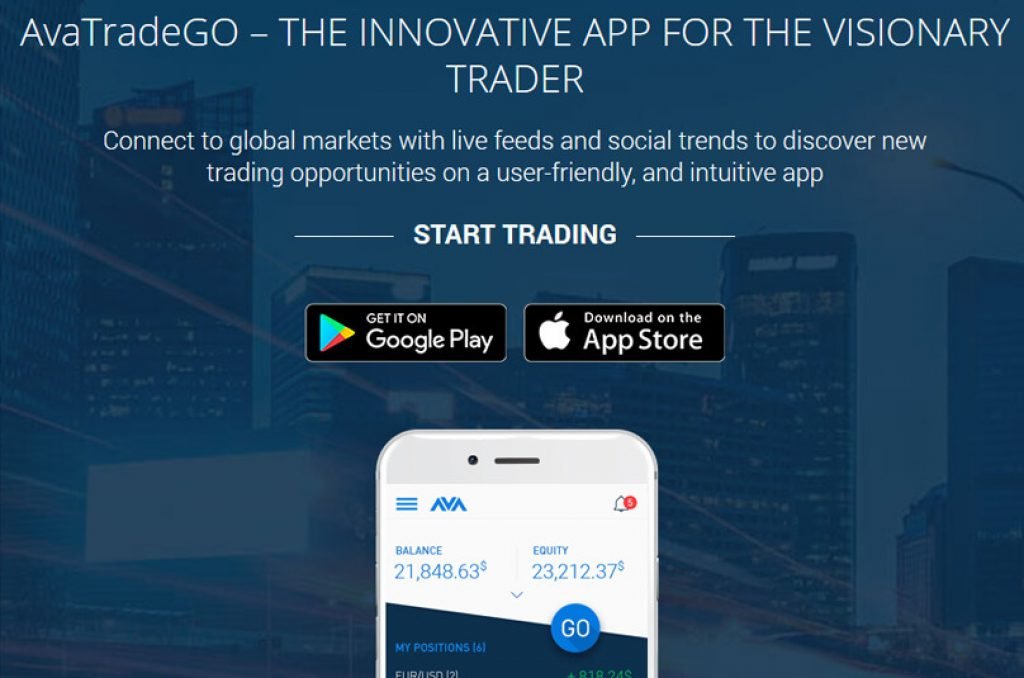

AvaTradeGo – mobile trading app

This is the in-house-built mobile application of the platform. Provides users with trading experience on the go, letting them trade more than 250 instruments all in the palm of their hand. Let’s you manage multiple MT accounts and switch between demo and Avatrade real accounts. AvaTradeGo comes enhanced with a feature called “Market Trends” which lets you track community behavior and gives the platform a social dimension.

Each of these platforms was designed to provide a quality trading experience to traders of all levels of skill and investment.

AvaTrade expert advisors

MetaTrader is quite widespread and popular among traders due to its lag-free operation, simple order execution, availability of safety measures like pending orders, and trailing stop losses. Having mentioned the expert advisors feature a couple of times, I feel like we should explain that as well.

These are basically trading bots that can be either developed on your own through the MQL MetaEditor or purchased from the MetaTrader4 Market. MetaTrader Market presents the largest collection of free and paid expert advisors, economic indicators, as well as trading and financial magazines and books.

Some of the advisors are free, and some are paid, but both can be tested out before purchasing/using to trade.

AvaTrade Website – Is it User-Friendly?

AvaTrade generally offers a solid user interface that should be easily mastered by users of all levels of trading expertise. While the interface is good, information on the website is segmented in a manner that can at times be a bit confusing.

For those who end up overwhelmed by the website, there is a search bar in the upper right which you can use to find the answer to your question. The live chat support button is right above the search bar so you can try and get help from the platform’s operators if the search doesn’t return satisfying results.

The website is available in 29 languages and even the support is multi-lingual. The platform offers quality in-depth guides and explanations for its various aspects and concepts. AvaTrade created an extensive catalog of educational videos that cover topics from beginner lessons to advanced trading tools and strategies.

They even have a free e-book that should teach you everything you need to know before opening your first position on the platform; you can download that here.

AvaTrade also combines in-house research tools and resources with content that can be acquired from third parties. Through integration with SharpTrader (an educational website), users can find daily and weekly technical and fundamental analysis articles and videos published by their team of analysts.

Additional tools like economic calendars, trading calculators, and an autochartist are available on the platform as well. Economic calendars track economic/financial events that are due to happen (or have happened already) and could potentially affect the markets and cause the price of an instrument to move.

Staying in touch with these events can be important as it can help you predict future market performance and profit. Trading calculator’s importance comes down to giving you the potential profits, losses, and costs that a certain trade you want to make might incur. To use it, you’ll have to follow these steps:

- Enter the instrument you wish to trade

- Set your account currency

- Add the preferred leverage

- Decide whether to buy or sell

- Finally, select the platform you are trading on

The calculation outcome will allow you to decide if or when to open and or your position, the margin requirement, the spread, swaps, and other essential info. The final feature we’ll mention is the autochartist which is an award-winning automated technical analysis tool that operates on top of the MetaTrader 4 infrastructure.

The tool continuously scans intraday markets and uses native algorithms to identify future price movement and profit opportunities. This feature is available free of charge for clients who deposit more than $500.

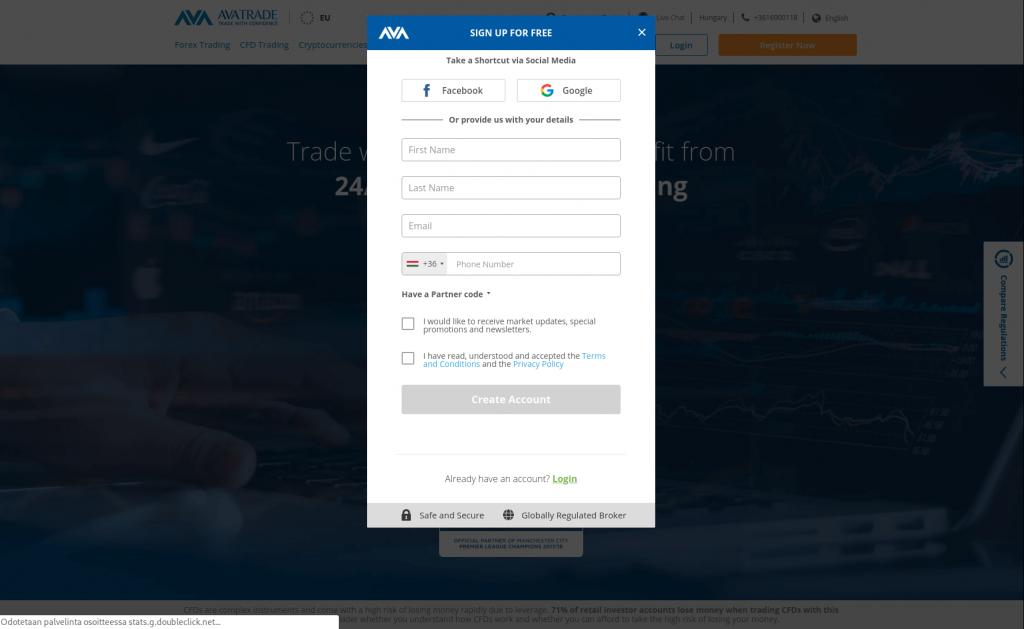

How to use AvaTrade – setting up an account

Creating an account on AvaTrade is made a bit more straightforward if you have a Facebook/Google account. You can click on appropriate buttons for both, depending on the desired social media on which you wish to base your AvaTrade account.

Alternatively, enter your personal data manually if you don’t have the networks mentioned above. The website will require you to enter a phone number which will be used to further secure your account. After you enter your phone number, click on the “Create Account” button.

This will take you to a new screen where you’ll get to customize your personal information. Your date of birth, your location (city, street name, street number, zip code, apartment), your unique account password (will need to include at least 8 characters, lower and upper case letters and a number), your preferred trading platform, and the currency you wish to be used to present you the market/financial data (USD, EUR, GBP and AUD are on offer).

From here, click on the “Next Step” button to move onto the finishing steps of creating your account. You’ll need to pick your principal occupation, your estimated yearly income, and the source of your trading funds.

After reading through the Terms and Conditions of the platform and confirming that you’ve read, understood, and accepted them, tick the appropriate box (below the automatically ticked one that has you declare that you aren’t a citizen/resident of USA) and click on the “Submit” button. This will give you access to your AvaTrade account.

AvaTrade verification process

Your account can be further verified to gain access to the full spectrum of features that the platform offers. A national ID, passport, or a driver’s license can be used to confirm your identity, as well as utility bills, bank statements, VISA statements, household insurance policies, vehicle insurance policies, tax documents etc. Furthermore, wire transfer verifications are required when making deposits via Ingenico.

Finally, additional documents can be requested by your account manager or customer service agent. This person will contact you promptly after you create your account and will offer to help you with your AvaTrade experience from the get-go.

Mine contacted me quite early in the next morning and offered me account managing services as well as answers to any additional questions I had. Beginners will likely find this “roadside assistance” very helpful and it’s definitely a welcome sight to have a company contact the customer directly, instead of it going the other way around.

Types of accounts on AvaTrade

AvaTrade offers accounts from two different legal entities; each of these offers different account types and different features that we felt should be pointed out:

| Ava Trade Ltd | Ava Trade EU Ltd | |

| Account types | AvaTrade Standard Account, AvaTrade Options Account | AvaTrade Retail Account, AvaTrade Professional Account, AvaTade Options Account, AvaTrade Spread Betting Account |

| Assets | FX, CFDs, FX Options | FX, CFDs, FX Options, Spread Betting |

AvaTrade users can upgrade their “retail” accounts into Professional ones. To be eligible for a professional account you will need to meet at least 2 of the following criteria:

- Sufficient trading activity in the last 12 months

You have carried out transactions, in significant size, on the relevant market at an average frequency of 10 per quarter over the previous four quarters (with AvaTrade and other providers). Relevant market – OTC Derivatives such as Leveraged CFDs, Forex, Spread Betting. - Relevant experience in the financial services sector

You work or have worked in the financial sector for at least one year in a professional position, which requires knowledge of the transactions or services envisaged. - Financial instrument portfolio of over €500,000 (including cash saving and financial instruments)

Financial instrument portfolio of over €500,000. Financial instruments include shares, derivatives (only cash deposits made to fund/profits realised from investing in derivatives), debt instruments and cash deposits. It does not include property portfolios, direct commodity ownership or notional values of leveraged instruments.

Professional accounts offer you some useful features like take advantage of pre-ESMA leverages; this includes up to 25:1 on certain cryptocurrencies and up to 400:1 on forex pairs.

AvaTrade islamic account

One interesting option is the ability to create a so-called Islamic account. As Muslim traders who follow Shariah Law have certain prohibitions which prevent them from doing certain types of financial transactions (transactions that include accumulation of interest like SWAPs), brokers started offering special accounts to Islamic investors.

These accounts are similar to regular ones, except they aren’t subjected to any special fees and interests that might clash with Sharia Law. Additionally, Sharia law dictates that the lender must share in the borrower’s risk (whereas the risk falls exclusively on the lender with normal accounts).

Trading of oil, gold, silver, Forex, and indices also have specific requirements which AvaTrade Islamic accounts make sure to fulfill.

AvaTrade Customer Support

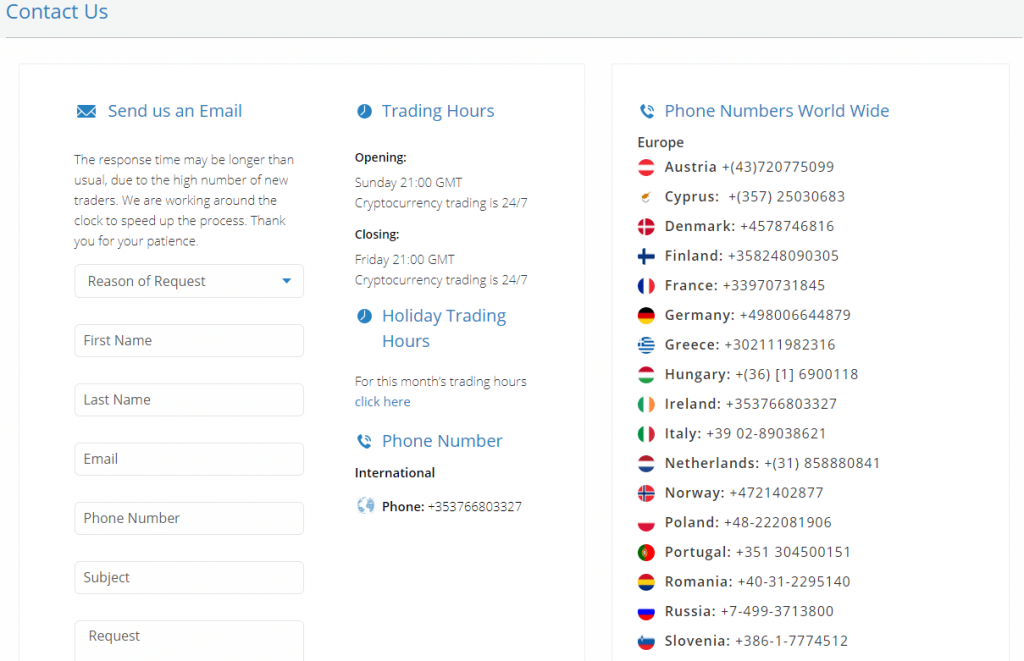

“Customer support is available by email, phone, or live chat. Support is available in multiple languages and local numbers are available in many areas.”

AvaTrade prides itself for its multi-lingual customer support provided in 14 languages, so no matter where you are, you are probably covered. Customer support is available via email, phone, or live chat on the AvaTrade website.

In fact, AvaTrade offers local phone numbers you can call for countries all across the globe.

Team

- Dáire Ferguson, CEO AvaTrade

Mr. Ferguson came to AvaTrade after serving as the European & Asian Senior Treasury Manager at Bristol Myers Squibb, a globally leading pharmaceutical company. Prior to that, he served as Head of Corporate Forex Broker for large international specialist banking and asset management groups in London & Dublin. He joined AvaTrade in 2008 as Director of Trading & Risk Management. Mr. Ferguson holds degrees in Computers and Business from University College Dublin, Ireland and from Lindenwood University, Missouri, USA.

- Sari Hemmendinger, CFO

Mrs. Hemmendinger came to AvaTrade after serving as a Senior Manager at PwC, one of the big 5 global CPA firms. She joined AvaTrade in 2015 as Finance Manager. Mrs. Hemmendinger holds an LLM in Law, a B.A in Accounting and Information Systems and also an Accounting Certification (CPA).

- Turlough McIntyre, VP Risk Management

Mr.McIntyre has over 9 years of experience in the financial markets. He joined AvaTrade in 2011 after holding positions in Allied Irish Bank and a major accountancy firm in Ireland. Mr. McIntyre holds a degree in Single Honours Mathematics from the National University of Ireland, Maynooth, a Master of Science in Finance and Capital Markets from Dublin City University and a Master of Arts in Mathematics from the National University of Ireland, Galway.

- Ian Webb, VP Compliance

Mr. Webb has over 15 years of compliance experience working in the financial services industry. Before joining AvaTrade he spent 10 years at Citco Bank Nederland N.V, serving as Head of Compliance and MLRO. He began his career with Deutsche Bank. Mr. Webb is a Certified Anti-Money Laundering Specialist (ACAMS). He also holds diplomas in Compliance from The Irish Institute of Banking and Financial Regulation from the National College of Ireland.

- Peadar O’Shea, Non-Executive Director

Mr. O’Shea, a former Managing Director at Morgan Stanley in London is an entrepreneur and investor. He spent his professional career at the heart of the global capital markets, initially with the Central Bank of Ireland and culminating as Managing Director with Morgan Stanley’s London Office. He also served on Morgan Stanley’s Global Investment Strategy Group, writing regularly for the firms’ investment research publications. Mr. O’Shea currently serves as an advisory director for a leading hedge fund firm as well as holding several boards and senior advisory positions.

AvaTrade scam or not? Is AvaTrade safe?

The platform is not a scam per se, but there are a lot of testimonials from former customers who claim that they were scammed out of their money. It could be negative reputation damage orchestrated by their competitors, but it could also indicate that there are some questionable activities going on around the company. Better stay on the safe side and invest with eToro.

Partners

The only notable thing to mention here is that AvaTrade is currently partnered with Manchester City, one of the wealthiest and most popular football clubs in the world.

We recommend eToro

This is a high-risk investment and you should not expect to be protected

if something goes wrong.

Take 2 mins to learn more

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Ava Trade review – Final Thoughts

AvaTrade is a brokerage platform that offers an interesting set of possibilities to beginner and experienced traders alike.

Crypto traders, which are our focus, can experience 24/7 trading of a wide range of digital currencies in a regulated, safe, well-established environment. The platform is centralized, which comes with its positives (like being legally backed, fast, and extremely liquid).

While dealing with a centralized company can be a potential security risk, AvaTrade has done everything correctly so far to convince its customers their funds are safe. Platform’s spreads are average-to-competitive, and you’ll find an excellent selection of educational material that’ll guide you through your trading experience.

With the apparent lack of volume discounts, some advanced features, and not a very large amount of assets on offer, some advanced users might not find it suitable for their needs. Overall, if you are a beginner looking to trade CFDs of various assets (including cryptocurrencies), AvaTrade is one of the better platforms out there to fulfill your needs.

In case you are not swayed into registering on AvaTrade, you might be interested in learning more about its direct competitors like eToro, Plus500, IQ Options, or City Index.