What you'll learn 👉

What is Avalanche?

The Avalanche blockchain has seen enormous growth over the past few years, establishing itself as one of the leading smart contract platforms in the industry. With its focus on speed, low fees and scalability, Avalanche has attracted major projects building decentralized applications across DeFi, NFTs and more.

As the Avalanche ecosystem continues to expand rapidly, more developers, investors and users are examining the most promising projects being built on the network.

This article explores some of the most impactful and innovative projects currently under development on Avalanche. It focuses specifically on projects in the decentralized finance (DeFi) space, as Avalanche has become a popular home for DeFi protocols looking to take advantage of its near instant finality and ultra-low transaction fees.

| 🪙 Coin | Details |

|---|---|

| 🔄 GMX | A decentralized crypto derivatives exchange offering a variety of trading options like perpetual futures and options. Known for its high capital efficiency and low slippage. |

| 🌐 Trader Joe | The leading decentralized exchange on the Avalanche blockchain. Features include yield farming, staking, and a launchpad for new projects. |

| 💰 Benqi | A prominent lending and liquid staking protocol in the Avalanche DeFi ecosystem, enabling users to earn interest on their assets and achieve high capital efficiency. |

| 🎨 Joepegs | An NFT marketplace created by the Trader Joe team, facilitating the buying, selling, and trading of NFTs on the Avalanche blockchain. |

| 🖼️ Kalao | An NFT marketplace on Avalanche, notable for its metaverse integration and focus on a seamless, user-friendly experience for NFT enthusiasts. |

| 🎮 The Legend of Aurum Draconis | An old-school RPG set in the blockchain world, offering unique gameplay with blockchain-based items and characters. It provides a distinctive gaming experience on the Avalanche network. |

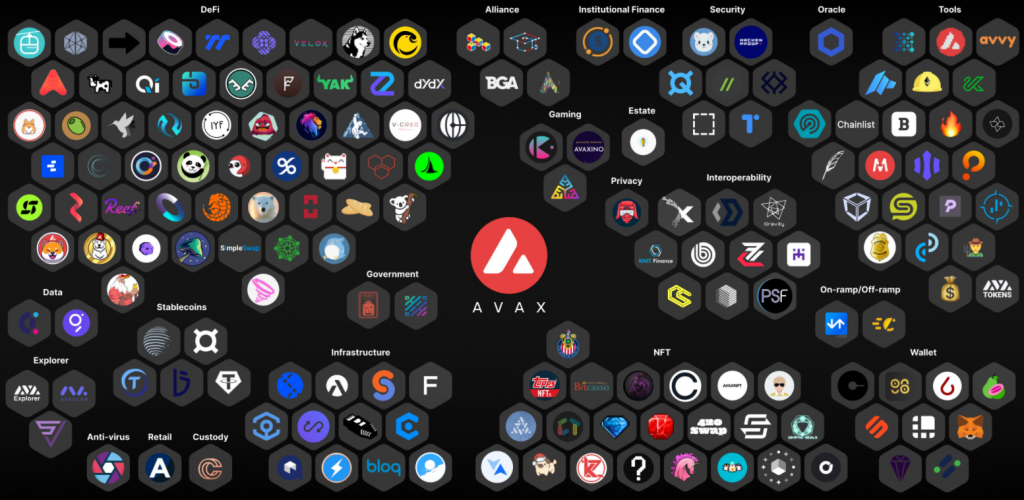

Here is the picture that shows the complete breakdown of the Avalanche ecosystem:

Avalanche’s native token is AVAX and at the time of writing the coin sits among top20 coins in the world as per Coinmarketcap.

Read also:

- Best Projects On LayerZero: Top DeFi Coins to Invest in On LayerZero

- Best Projects on Base: Top DeFi Coins to Invest in On Base

- Best Projects on Arbitrum – Top DeFi Coins on Arbitrum To Invest In

Top AVAX projects

As noted above, the focal point of this article will on the best projects on Avalanche. I have investigated 7 projects in total that stood out when compared to other projects built on the Avalanche blockchain. So, without further ado, let’s jump into details.

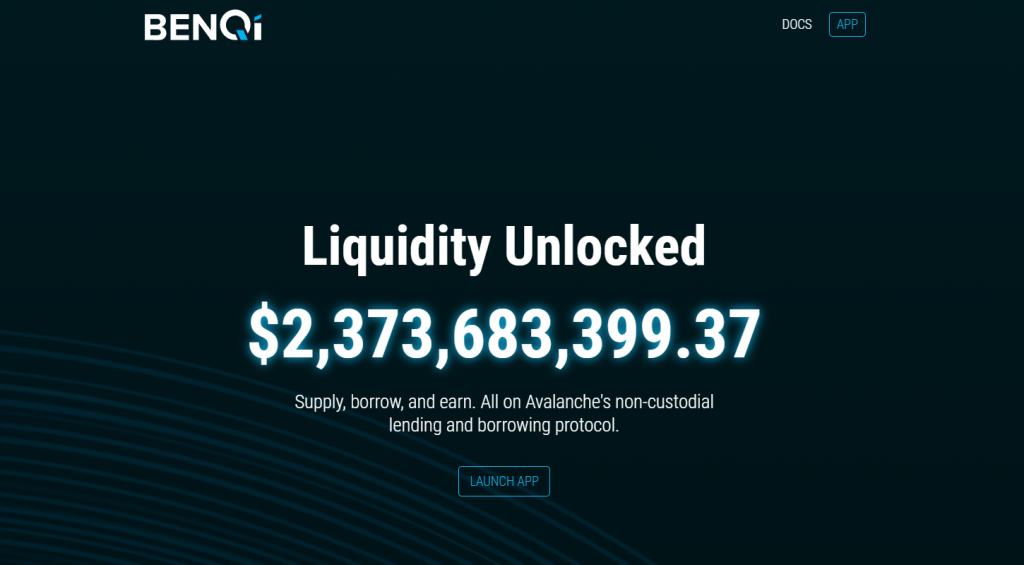

BenQi

BenQi is probably the most popular project of the whole Avalanche network. We can define BenQi as a money market protocol that offers users to endlessly lend, borrow and earn interest with their own digital assets. Moreover, Ava Labs (the company that created the Avalanche network) has invested in BenQi.

Earning interests is the main service of BenQi. You can stake various coins such as AVAX, WBTC, WETH, LINK, USDT, USDC, DAI, and QI. QI is actually BenQi’s native token. Of course, before earning interest, you have to deposit the desired coin. Your coins can be also used as collateral to allow the user to borrow other assets.

The security and safety of the platform seem to be on a high level since it offers continuous audits and security measures to protect the protocol.

Kalao.io

Kalao is one of the biggest NFT ecosystems built on the Avalanche network. The main focus of the platform is a cost-effective and easy-to-use Marketplace. The ultimate goal of Kalao is to accelerate the adoption of VR technology in order to “develop virtual worlds and sustain the digital transformation of business use cases.”

On Kalao, you can create, purchase, sell, and collect NFTs. Since it was built on the Avalanche network, Kalao offers speed, low network fees, and security to deliver seamless experiences. Moreover, you can exhibit your artwork, sell luxury goods, use the event ticketing framework, and broadcast live in a virtual environment with Multiplayer participation.

Ryval Market

Ryval Market is one of the newest and most innovative projects on the Avalanche blockchain. It is defined as the stock market of litigation financing. The goal of the project is to allow its users to buy and sell tokens that represent shares in litigation and access a multi-billion dollar investment class that was allegedly unavailable to the public in the past.

I did say that the project is innovative even though there are other litigation investment platforms. However, Ryval Market will the first one where you will be able to turn the asset into a digital asset. If you want to participate in these digital assets you will need to provide the backing to pursue the litigation.

Penguin Finance

Penguin Finance is my favorite project from the ones explained in this article. The main focus of the platform is on yield-farming and staking. If you decide to deposit your tokens to the Penguin platform, you will be rewarded – half of the supply will be distributed as incentives via the Penguin Igloos (yield farming pools) and the Penguin Nests (staking).

PEFI is the native token of the Penguin Finance platform. You can purchase PEFI from Trader Joe, Pangolin, or Lydia. If you stake PEFI, you will get iPEFI – your receipt for staking PEFI in the nest. Your iPEFI will remain the same, it is the ratio that will constantly increase.

Furthermore, you can stake different LP token pairs in Igloos (farms) to earn PEFI and other Avalanche-native tokens.

TraderJoe

Yet another exciting project of the Avalanche DeFi ecosystem is TradeJoe. TraderJoe is a decentralized exchange that is one of the biggest trading platforms on the Avalanche network.

Traders who decide to use TradeJoe will be rewarded with its native token – JOE. Moreover, they will become a liquidity provider. With more people joining the platform, there will be more transactions and therefore, more rewards for liquidity providers.

To be honest, if you want to use TradeJoe, it is probably best to just stake JOE since this will get you the highest income. However, besides trading and staking, you can also farm and lend on TradeJoe.

YieldYak

As the name suggests, YieldYak is a yielding platform that operates on the Avalanche blockchain. With YieldYak, everything is in their community, so it is a community-driven project. YieldYak’s community has built and maintained one of the best, cheapest, and most diverse auto-compounder on the Avalanche network.

The platform allows you to automatically compound instead of having to re-stake your assets manually every time to get the best APY. In other words, the auto compound is the most important feature of YieldYak. Farms auto compound every few minutes or hours. This is a nice feature since it reduces the price volatility risk.

The native token of the platform is mYAK and you will earn it as a staking reward that you can later use for other farming.

Grip Finance

Yet another exciting project built on the Avalanche network is Grip Finance. It is a decentralized options protocol. The main purpose of Grip Finance is to use it to hedge your digital assets by trading Put and Call Options contracts.

Grip Finance was built by a team from South Africa. The team around Grip Finance built a lending platform with embedded Options Contracts. Their plan is to add more exciting features in the future.

In April of 2021, it was announced that Grip Finance will be the part of Encode Avalanche Club in which 10 projects in total were chosen in the 10-week pre-accelerator round.

KNIT Finance

KNIT Finance is the last (but not least) project that operates on the Avalanche network that we will explain in this article. It is another decentralized protocol that you can use to create cross-chain wrappers for the top-200 assets.

The platform initially integrated Binance and Ethereum network, but recently decided to integrate the Avalanche network as well. The purpose of the integration is to allow users to move wrapped AVAX and PNG tokens across multiple chains like Ethereum, Matic, Polkadot, BSC, and more.

KNIT Finance has a few goals – Maximize DeFi yields with multi-chain APY optimization, Maximize collateral security using the insured custody, and lock DPoS Assets in order to get incentives as well.

The main features of the platform are Liquidity staking, Cross-Chain Ports, and Multiple Wallet Support. The whole ecosystem is sustained through fees, but (at least based on the KNIT Finance’s website), these fees are low.

Read also:

- Solana vs Avalanche

- Best Avalanche Wallets

- How To Transfer Coins From ETH To Avalanche Blockchain?

- Solana vs Polkadot

- Dharma.io Review

- Best Low Cap DeFi Coins

- How To Send Coins From ETH to XTZ?

- How to buy coins on Pancakeswap?

FAQs

Let’s look at some frequently asked questions when it comes to Avalanche blockchain.

What coins are on Avalanche?

There are more than 150 coins used in the Avalanche ecosystem. The list is long but the most important coins include Tether (USDT), Avalanche (AVAX), Chainlink (LINK), Dai (DAI), TrueUSD (TUSD), SushiSwap (SUSHI), Ren (REN), Reef (REEF), Frax (FRAX), Frax Share (FXS), Anyswap (ANY), Bifrost (BFC), Orion Protocol (ORN), TrueFi (TRU), Aleph.im (ALEPH), TrustSwap (SWAP), AllianceBlock (ALBT), and many others.

What are the best projects on Avalanche?

There are various projects built on the Avalanche blockchain. Based on our thorough investigation the best projects on Avalanche are BenQI, Kalao.io, Ryval Market, Penguin Finance, TraderJoe, YieldYak, Grip Finance, and KNIT Finance.

Why are fees on the Avalanche network so small?

The whole fee system is based on the number of validators. If the price of AVAX for instance goes up, that means more validators (holders) which means more scalable transactions, which results in lower fees.

Who has the best dex on Avalanche?

The best DEX on Avalanche is GMX. Please read our detailed GMX Review.