Cryptotaxcalculator.io Review – Cryptocurrency Tax Software For Automatic Reporting

What you'll learn 👉

What is Crypto Tax Calculator?

Cryptotaxcalculator.io is one of the leading crypto tax software solutions, with over 52,000 users and growing. In this Crypto tax calculator review, we will examine the platform’s features, ease of use, and assess whether Crypto tax calculator is safe to use for calculating and filing your crypto taxes.

With over 1,706 coins and tokens supported across 100+ blockchains including Ethereum, Solana and Arbitrum, cryptotaxcalculator.io aims to provide comprehensive support for all types of complex crypto transactions like DeFi, NFTs and DEX trading. But is crypto tax calculator review trustworthy when it comes to handling sensitive financial data? And how does it compare against other crypto tax software in terms of pricing and customer experience?

Keep reading our in-depth cryptotaxcalculator.io review to find out if this cryptocurrency tax calculator is right for you, from import and reporting tools to security features and pricing plans.

| 📝 Topic | Details |

|---|---|

| 💼 CryptoTaxCalculator.io Overview | A platform tailored for easy tax calculation of cryptocurrency transactions, ideal for investors, traders, and accountants managing crypto activities across various exchanges and blockchains. |

| 🔍 Features | 1. Transaction Auto-Categorisation Algorithm: Automates transaction categorization. 2. Smart Transfer Matching: Matches transfers across accounts for accurate tax calculations. 3. DeFi and DEX Integrations: Supports Decentralized Finance and Exchanges. 4. NFT Trading: Facilitates Non-Fungible Tokens trading. 5. Smart Error Handling Suggestions: Offers solutions for transaction data errors. 6. Mining, Staking, Lending, Airdrops: Handles transactions related to these services. 7. Margin Trades and Futures: Supports margin and futures trading. 8. Asset History Ledgers: Maintains transaction history for auditing. 9. On-chain Wallet Sync: Synchronizes with on-chain wallets for transaction overview. 10. Exchange API and CSV Imports: Allows data import from exchanges. 11. Smart Suggestions: Provides various transaction-related suggestions. |

| 💲 Fees | Offers four plans for personal accounts: Rookie ($49/year), Hobbyist ($99/year), Investor ($189/year), and Trader ($299/year), with prices varying by country. |

| 🌍 Supported Countries | Supports numerous countries including Australia, UK, Canada, USA, South Africa, Austria, Belgium, Germany, Spain, Finland, France, Greece, Ireland, Italy, Japan, Netherlands, Norway, New Zealand, Portugal, Sweden, and Singapore. |

| 🔄 Supported Exchanges and Wallets | Compatible with over 100 exchanges and wallets, including major ones like Binance, Coinbase, Kraken, and many others. |

| 👍 Pros | User-friendly interface, detailed and accurate tax reports, supports a wide range of taxable services including mining, staking, DeFi, and NFTs. |

| 👎 Cons | Advanced features like borrowing, lending, mining, and staking are only available in the more expensive plans (Investor and Trader). |

Make sure to check out our guides on other tax calculators:

- Cryptotax.io Review

- Binance Tax Calculators

- Best Coinbase Tax Calculator

- CryptoTrader.Tax app review

- Cointracking.info Review

- Bitcoin.Tax vs CoinTracking vs CryptoTrader.Tax

- ZenLedger Review

- Tax Loss Harvesting

- How to Avoid Paying Taxes on Crypto

- Koinly Review

- Crypto.com Tax Tool Review

- Free Crypto Tax Calculators

- Bitcoin Tax Free Countries

Crypto Tax Calculator Features

Crypto Tax Calculator offers various useful features to its users.

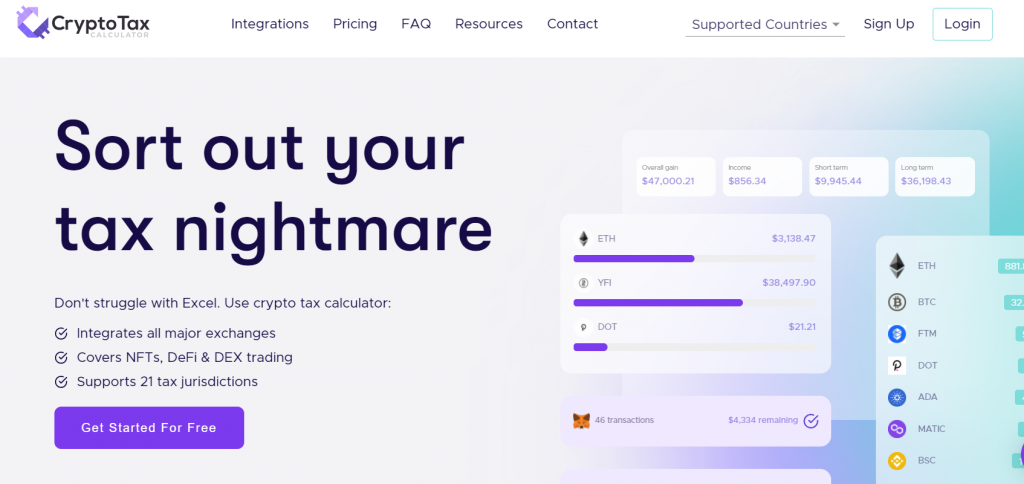

Firstly, the platform looks user-friendly, and it is easy to use. Once you open their website, the buttons you can choose from are integrations, pricing, FAQ, resources, contact, supported countries, and the login button.

Moreover, the main features of the Crypto Tax Calculator are powerful & accurate tax reports and easy-to-understand tax calculations.

The tax reports created on The Crypto Tax Calculator are very detailed and have all the relevant information. The platform tries to make them as accurate as possible since they include complex tax scenarios such as DeFi loans, DEX transactions, gas fees, leveraged trading, and staking rewards.

Can you just imagine gathering all this info by yourself? It can be very overwhelming, and The Crypto Tax Calculator does it for you, which is pretty cool. However, the tax process can be very complex (in any country), especially with cryptocurrencies (still one of the unknown areas when it comes to calculating taxes).

As per their website, “drag and drop the exchange data into our app, and we do the rest.”

The Crypto Tax Calculator also offers features not related directly to crypto taxes, such as mining, staking, DeFi, Liquidity providing, and many others. But, more about them later in the article.

Supported countries

The number of supported countries on the Crypto Tax Calculator grew in time. At the time of writing, these are the countries and their respected abbreviations: Australia (AU), UK (GB), Canada (CA), USA (US), South Africa (ZA), Austria (AT), Belgium (BE), Germany (DE), Spain (ES), Finland (FI), France (FR), Greece (GR), Ireland (IE), Italy (IT), Japan (JP), Netherlands (NL), Norway (NO), New Zealand (NZ), Portugal (PT), Sweden (SE), and Singapore (SG).

To be honest, the platform is still growing, so I expect this list to be more extensive in the upcoming months. In other words, do not be disappointed if your country is not on the list.

On the top right corner of the Crypto Tax Calculator’s home page, you can select some country, and the page will automatically update and show what is supported for that country (for example, when you choose Canada, the page will update with “Integrates all Canadian exchanges” message).

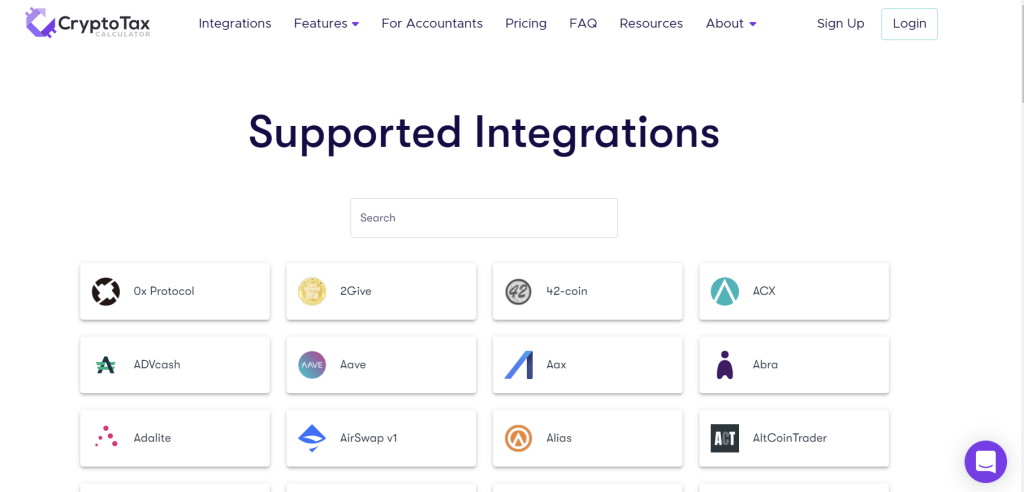

Supported exchanges

In the latest version of the platforms, the number of exchanges and wallets that Crypto Tax Calculator operates on is over 100 so there are hundreds of exchanges. Literally, all the major ones are supported by the Crypto Tax Calculator such as Binance, Binance.US, BitFinex, BlockFi, Coinbase, Bybit, Crypto.com, Kraken, Huobi, Ledger Wallets, Uniswap, Yoroi, Gate.io, HitBTC, FTX, Conjar, CoinSpot, Swyftx, Poloniex, Liquid, KuCoin, and many others.

However, if the exchange you are using is not on the list, feel free to contact their customer support and ask them how to import your data needed for the tax report.

Supported wallets

As already mentioned, The Crypto Tax Calculator supports more than 100 exchanges and wallets. Therefore, it is pretty challenging to find a wallet that the platform does not keep. Here are some of the most important ones: MetaMask, MyEtherWallet, Coinbase Wallet, Math Wallet, Magnum Wallet, Midas Wallet, Lumi Wallet, Mycelium Wallet, FreeWallet, Guarda Wallet, Crypto.com Wallet, Cobo Wallet, Carbon Wallet, Blockchain Wallet, Bitgo Wallet, and many others.

Other supported services (mining, staking, DeFi, Liquidity providing, NFTs, etc.)

Another positive thing I can say about the Crypto Tax Calculator is that it supports various services which are subject to taxes as well, such as mining, staking, DeFi, Liquidity providing, NFTs. Unfortunately, Crypto investors quite often forget that they need to pay taxes for the incomes of those services too.

On the Crypto Tax Calculator website, there is a very nice example of how staking is taxed (in general, I like examples since they can show you how something actually works). It basically says:

“Steve holds 100 ETH in a pool for the purpose of staking. His pool reaches consensus, and he receives an additional 0.001 ETH as a reward. The additional 0.001 ETH was worth $5 at the time he received them. The $5 worth of coins received is considered income for tax purposes. In the future, if Steve exchanges the coins, the CGT he pays will be calculated with the cost base being $5.”

How does Crypto Tax Calculator work?

We got to the focal point of the article in which I will try to explain how does Crypto Tax Calculator actually works.

Crypto Tax Calculator works by connecting to a user’s exchange data by using an Application Programming Interface (API) or Comma Separated Values (CSV) files. Trust me, and the process is more straightforward than it sounds.

Once the platform imports data sources, it will automatically start the process of generating the tax report based on the specific obligations related to the user. So, basically, the whole process is automated.

What I found very interesting about the Crypto Tax Calculator is that the team is in contact with experienced accountants and software engineers so that the user experience constantly improves.

At this point, it is good to note that all opinions and suggestions written in this article are not considered financial advice.

Read also:

- Holding Periods And Crypto Taxes: Long Term Vs Short Term Capital Gains

- Mastering The Art Of Calculating Your Crypto Taxes: Fifo, Lifo, And Beyond

- Form 8949 And Schedule D: Mastering The Art Of Crypto Tax Reporting

Crypto Tax Calculator Pricing

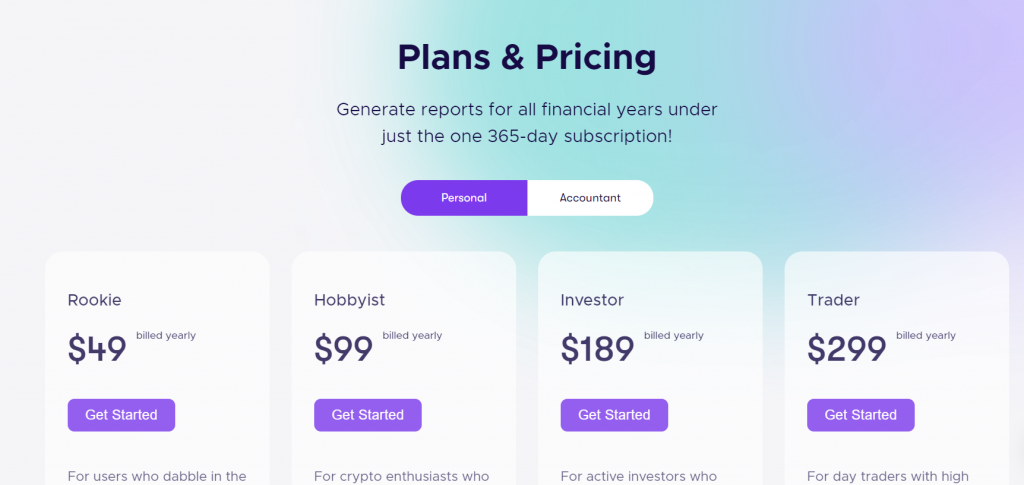

Crypto Tax Calculator offers four different plans for personal accounts. You need to pay for the plan in order to get your crypto tax reports. The platform’s pricing works with the yearly subscription method.

So, four types of plan are Rookie ($49/year.), Hobbyist ($99/year.), Investor ($189/year.), and Trader ($299/year.). If you are into borrowing, lending, mining, and staking, you probably need some of the more expensive plans. Otherwise, if you are on the platform just for the tax reports, Rookie or Hobbyist plans are suitable for you.

Keep in mind that the prices listed above are for US citizens. If you select another country, the currency will change (for Germany, it will be in euros, for example).

If you are an accountant, you can also work with the Crypto Tax Calculator for $499/year. The platform offers you ten clients and up to 100,000 transactions per client. All plans have a 30-day money-back guarantee.

It is worth noting that The Crypto Tax Calculator offers a free-trial period (30 days) as well. Thus, you have the possibility to get to know the platform and see whether it suits your needs before you actually pay for the subscription.

Crypto Tax Calculator Mobile App

Crypto Tax Calculator has a standalone mobile app as well, available on both iOS and Android systems. The app has all of the functions as the web version.

Is Crypto Tax Calculator legit? Is Crypto Tax Calculator Safe?

Yes, the Crypto Tax Calculator is an entirely legit tool. Moreover, it seems that the platform has a lot of users, and more importantly, constantly improves since the team is very ambitious. So, I predict a bright future for the Crypto Tax Calculator.

Just ask yourself a question, do you have some accountant that can help you with your crypto tax obligations, or do you have the patience to calculate taxes and create reports yourself? If the answer to both questions is no, then you should at least take a look at the Crypto Tax Calculator.

Conclusion

Crypto Tax Calculator is a tool that can make your life easier when it comes to crypto tax reports. The most important question you should ask yourself is, “Do I really need to use a tool like this?”. I think you will quickly find out an answer to that question once you read this article.

The critical thing to note is that if you decide to sell your cryptocurrencies for fiat money, you need to pay taxes in your respected country. However, you should do your own research and find out whether you have a need to use platforms like this, or not really.

FAQ’s

Let’s have a look at some frequently asked questions about the Crypto Tax Calculator and crypto taxes in general.