As with every income in life, cryptocurrency income is also taxed in many nations. This is especially true when it comes to the USA. The IRS is notified with every action within US jurisdiction and that means every American is liable for their crypto income and taxing it. In 2014, the IRS decided that cryptocurrency is more like a stock rather than a dollar. This means that instead of getting taxed like someone who holds a currency that gains value, you are taxed as someone who holds a stock that gains value.

The reason why crypto is seen as an asset instead of a currency is mainly due to the volume it has. With tens of billions of dollars traded each day, it is one of the biggest markets in the world for investors. This presents a gift for the IRS since even if you buy and sell within 10 minutes, you are due a tax if you made any income, same as buying and holding for years and then selling. The IRS could tax all those buy and sell moves done every single day and gain a lot more compared to a regular currency holding.

Decentralization is at the core of Bitcoin, which sounds like you could try to avoid paying taxes. However, IRS checks with every single exchange that deals with Americans, this means they have the list for it as well. They even send letters of warning for every single person who fails to notify their crypto income. This means if you do not want to pay huge fines to IRS for failing to report your crypto income, you need to notify it correctly and pay accordingly. The alternative is hiding it, and if it is found out by the IRS then you would be taxed and fined multiples of that amount instead of just the tax itself.

What you'll learn 👉

Free vs paid crypto tax calculators

Most places offer both free and also premium tax calculations. This way if you are a newbie starting now, you get to use free ones and test how you like them. Even as a veteran when you want to change your tax calculator, you get to test the free versions before you decide to pay for one. You can use as many as possible until you find the one you love. Nevertheless, it is quite important to realize the premium versions could be much better than the free versions. This means while you may not enjoy the free version, you may like the premium version of the same website.

If you are a trader that makes a lot of buys and sells, free versions will not cut it, you will have to pay for a premium one depending on how much you trade. Prices range from $50 at the start level to as much as $200 even $389 in one place. Usually, the end level that includes everything and is unlimited is around the $170-$200 range. Which is something not that expensive if you are trading enough to justify it.

Best free crypto tax software

Koinly

Starting with one of the “fun” ones. Koinly is famous for its Twitter mentions and being all-around entertaining places to work with. Also, their pricing has a free calculator for 10k transactions, which no other place offers. Of course, they do not give the other parts away instead. So instead of having 25 transactions for free with everything included, you get 10k transactions with limited knowledge. Depending on your preference, this could be a good thing or a bad thing. They have over 6k coins and tokens all stored in their system and you can check as further deep into your pocket as you can imagine. Definitely one of the better free ones. The good luck for someone who uses free calculators is that Koinly is not considered best for the paid version, definitely a challenger but not up there yet. This puts it at a great spot to be one of the best at free, not so much for paid and that is why this makes them even better at free version to get more customers.

Zenledger

If you are looking for the “middle of the road” then Zenledger is exactly what you are looking for. The free version doesn’t have too much to offer like Koinly, it has only 25 transactions and no DeFi projects. In any case, they still offer very detailed reports on all the limited things they offer. Which makes it a lot easier and a lot quicker if you do not have too much to check. Once again if you are a big-time trader then the free version will not cut it, yet for people who rather buy and hold, or newbies then this is a perfect place to start. It doesn’t offer too much volume support, but it offers every single thing you will need for that low volume. Obviously, you will need to start paying if you also start trading, but the free version does what it is supposed to very well.

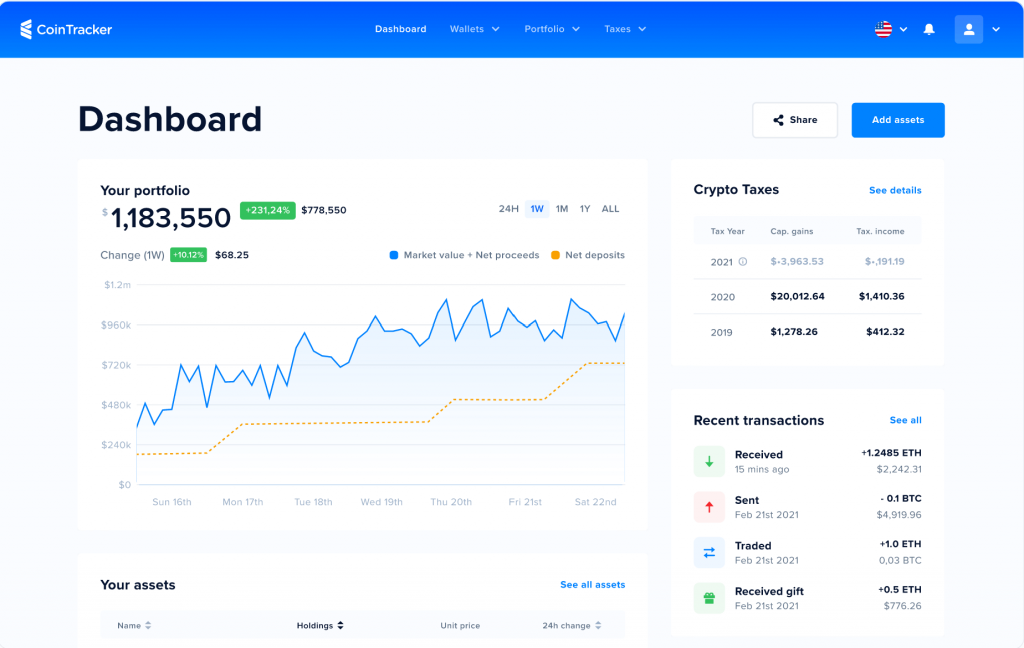

Cointracker

One of the oldest tax calculators in the crypto world. Cointracker came into the scene in early 2017. They managed to help so many with the 2017 ATH period and then the following 2018 crash as well. This is why they are usually the most used ones in the tax calculating world. For a very long time, they offered free services for a large portion of the traders unless you traded multiple times a day for long time. However, their free version is a lot limiting these days. Cointracker free calculator lacks DeFi calculations as well, which in today’s world is not something people could be fine with considering how many of us invest in the DeFi world. If you are a long-term investor with no DeFi investment then you can’t get any better than cointracker. Their paid version is so unlimited, they have options for as high as $3k for full service. Obviously, that is for people who trade tens of thousands of times per day, and not a very common thing. The free version on the other hand can handle only 25 transactions per month. Which is usually the industry standard to offer for the free version in almost every place.

Coinpanda

Coinpanda is a newer place that is not known as much as the other options. This gives them more incentive to offer more stuff for free services. They have only 25 transactions like others, which is not ideal for a new place. In contrast to the disappointing amount of txn they offer, they do offer it for 7k+ different coins and also offer it with full depth and detail. One report from here and you are ready to send in your tax to pay. As long as you are not planning on trading much, then it could be good to test it out. Since it is a new one, there are more known and popular options for the free version, so this is a place which you can test when you are in-between options.

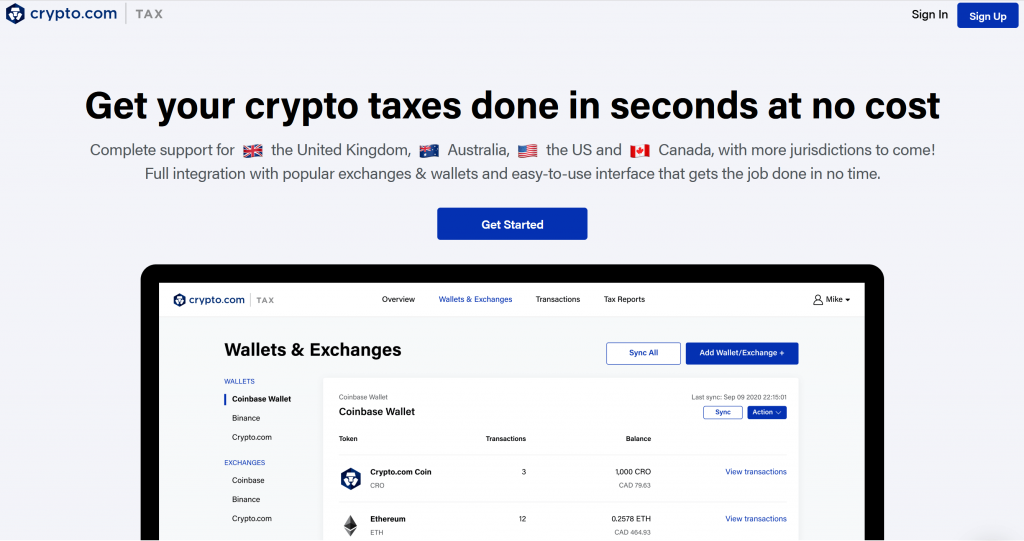

Crypto.com Tax

We all know crypto.com, we all know what they stand for and what features they have as a whole. But did you know that they also offer tax calculations and reporting as well? You can connect almost any exchange to their tax calculator, and with a simple dashboard, you get to see what you owe, why you owe it, and how you can report it. Even if not the best place, they are one of the easiest to navigate and use. This is why most newbies prefer their free version since it is so easy to use. They are also entirely free and do not charge anything for any amount of transactions. Which makes them the only one on the list that is entirely free for what they are offering. Obviously, other places do offer more features, which is why making this one free makes sense. However, the bigger feature options are available for the paid versions of other places, whereas this is fully free of charge and offers much more than free options of other places.

FAQs

Make sure to check out our guides on other tax calculators: