Retail money is pouring into the altcoin market, as evidenced by the recent fall in Bitcoin dominance. Regular folks are experimenting with leverage, short selling, and discovering trading bots for the first time. It’s a natural progression for us all.

Eventually, your attention will be spread across multiple exchanges, so how do you track everything efficiently? In the case of a flash crash, how do you exit all your positions across several platforms at the same time? How do you fine-tune your entries and exits ‘on the fly’ to get ahead of the crowd? The answer is automated trading.

Both Coinrule and Cryptohopper provide the basic function of aggregating all your positions in one application. However, they both offer so much more than simple portfolio management. There are trading tools, programmable/automated buy and sell functions, indicators, signals, copy-trading, the lot. You can build your very own trading bot, or buy an off-the-shelf strategy.

Let’s take a look at each platform and compare what you get.

What you'll learn 👉

Cryptohopper

The story goes that Cryptohopper started as a homemade trading bot. The two brothers responsible went on to shape it into a multifunction trading machine. They released it to the public in 2017 and it mushroomed from there, both in popularity and technologically.

Automated software trading robots (bots) were the initial motivation behind Cryptohopper and they are still at the heart of the platform. Cryptohopper enables traders to devise a strategy based on whatever indicators they choose. They can backtest, tweak, test again, and perfect their bots. Once confident, they can let it loose in the real world to trade.

This is all possible across multiple trading platforms. It’s a great setup.

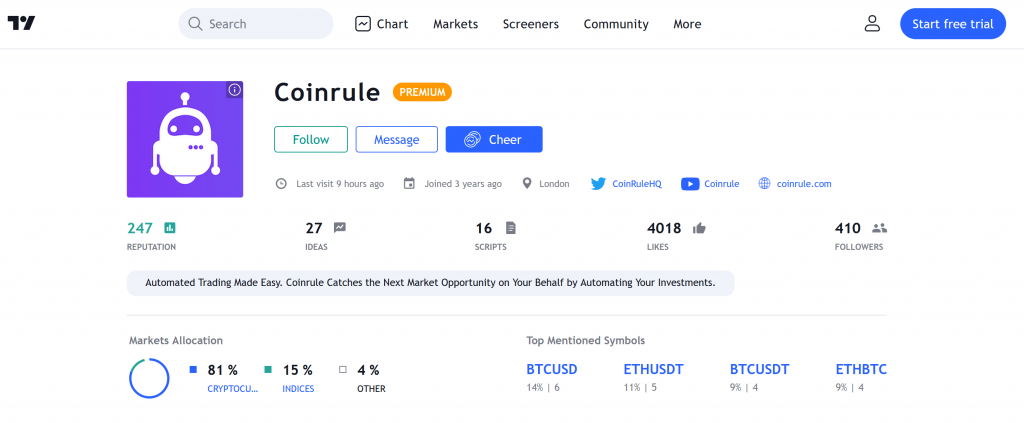

Coinrule

With their head office based in chilly old London, UK, Coinrule offers similar services to automated trading fans. They’re in the business of providing high-quality market data feeds and facilitating superfast trade executions. Coinrule claims that it lets you compete with professional algorithmic traders and hedge funds. Competing is one thing but winning is quite another, as we shall see later.

Setup & Experience Required

As with life, the more you put into it, the more you get out of it. Anyone remotely familiar with home computers will be able to install both of these platforms and use the basic portfolio management functions. To get the best out of them, it helps to have a passion for trading bots.

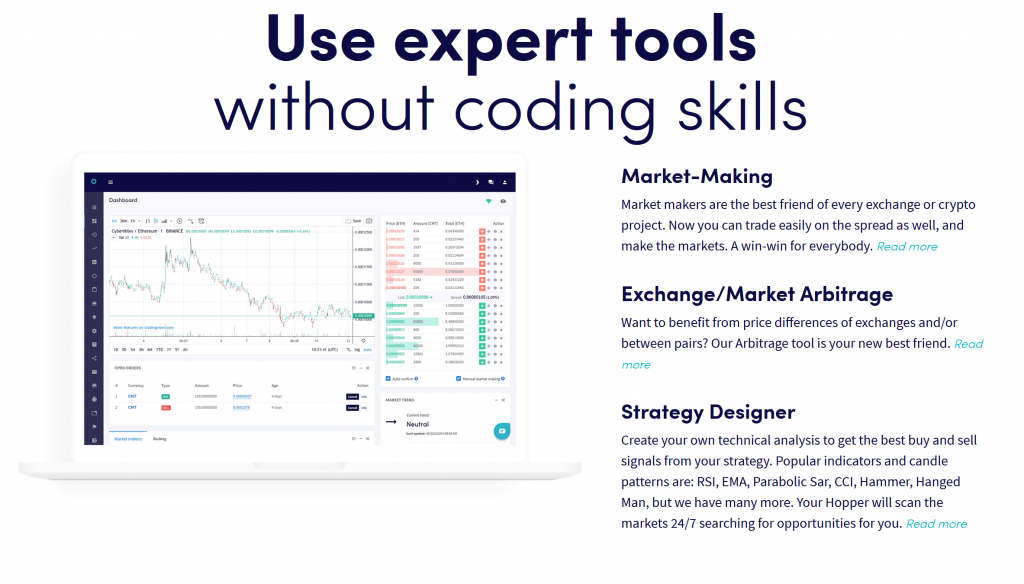

Cryptohopper claims “You don’t need to be an expert to trade like one.” I would disagree, but they do provide some impressive tools for you to try. You can use their features to make your unique trading strategy come to life, or you can buy trading bots already configured. They accommodate traders of every experience level.

Pricing – Coinrule

Starter

- Free

- 2 Live Rules

- 2 Demo Rules

- 7 Template Strategies

- 1 Exchange

- $3k Maximum Monthly Trade Volume

Hobbyist

- $29.99/mo – $359 billed yearly

- 7 Live Rules

- 7 Demo Rules

- 40 Template Strategies

- 2 Simultaneous Exchanges

- Up to $100k Monthly Trade Volume

- Leverage Strategies

- Text Notifications + Live Telegram

- Free Access to Trader Community

- All Indicators and Operators

Trader

- $59.99/mo – $719 billed yearly

- 15 Live Rules

- 15 Demo Rules

- Unlimited Template Strategies

- 3 simultaneous Exchanges

- $1M Maximum Monthly Trade Volume

- Leveraged Strategies

- Free Access to Trader Community

- Live Training Sessions

- All Indicators and Operators

Pro

- $449.99/mo – $5,399 billed yearly

- 50 Live Rules

- 50 Demo Rules

- Unlimited Template Strategies

- Unlimited Simultaneous Exchanges

- $5M Maximum Monthly Trade Volume

- Leverage Strategies

- Live Telegram + Text Notifications

- Free Access to Trader Community

- Live Training Sessions

- Ultra-Fast Execution

- Dedicated Server

- All Indicators and Operators

Pricing – Cyptohopper

Pioneer – Free

- 20 simultaneous trading positions

- Portfolio management

- Manual trading

- All exchanges available

Explorer – $19.00/mo – Free 7-day trial

- 80 simultaneous trading positions

- Up to 15 cryptocurrencies

- Maximum of 2 triggers

- Technical Analysis with 10 min candles

- 1 Trading Bot

- Try 7 days for free!

Adventurer – $49.00/mo

- 200 simultaneous trading positions

- Up to 50 cryptocurrencies

- Maximum of 5 triggers

- Technical Analysis with 5 min candles

- 1 Trading Bot

- Exchange arbitrage feature

Hero – $99/mo

- 500 simultaneous trading positions

- Up to 75 cryptocurrencies

- Maximum of 10 triggers

- Technical Analysis with 2 min candles

- All coins for signals

- Market Arbitrage

- Market Making

- Algorithm Intelligence

Features

Basic automated trading functions are available on both platforms. There are some interesting trade types worth singling out, and we’ll take a look in more detail later. The broader list of features is as follows –

Coinrule

- Automated trades

- Extensive Market indicators

- Multiple exchanges

- No private keys or withdrawal access

- Paper Trading – Demo Account

- Lots of well-written educational material

- Wide range of trading strategies

Cyptohopper

- Automatic Trading

- Exchange Arbitrage

- Market Making Bot

- Grid trading

- Mirror trading

- Algorithm Intelligence (AI)

- Trailing Stops

- Paper trading

- Strategy Designer

- Backtesting

- Copy trading

- Portfolio aggregation

- Market-making

- Scalping

- Trailing stops

- Social Trading community

- Buy strategies and bot templates from our marketplace

Trading tools and strategies

Coinrule

Using some of Coinrule’s best features requires a little knowledge and a modicum of practice. Coinrule is aware of this and has developed a very beginner-friendly approach to creating a trading bot. You can start with a couple of price signals, then perhaps add in a technical indicator rule. By testing each iteration for profitability, you soon start to converge on an effective trading strategy.

Backtesting a strategy requires a TradingView account, which is disappointing. It’s still very straightforward, and there’s a Coinrule tutorial video to explain it. You can select multiple Coinrule strategies directly from the TradingView menu, then test them against historic data from any crypto trading pair.

Once profitable, you can tweak the strategy in all sorts of ways. Maybe adjust the take profit and stop-loss levels, or adjust the estimated exchange fees. You might set rules for Volume and RSI levels. There are dozens of subtle adjustments that can radically change the overall performance. It’s a great way to increase your knowledge of what works and what doesn’t.

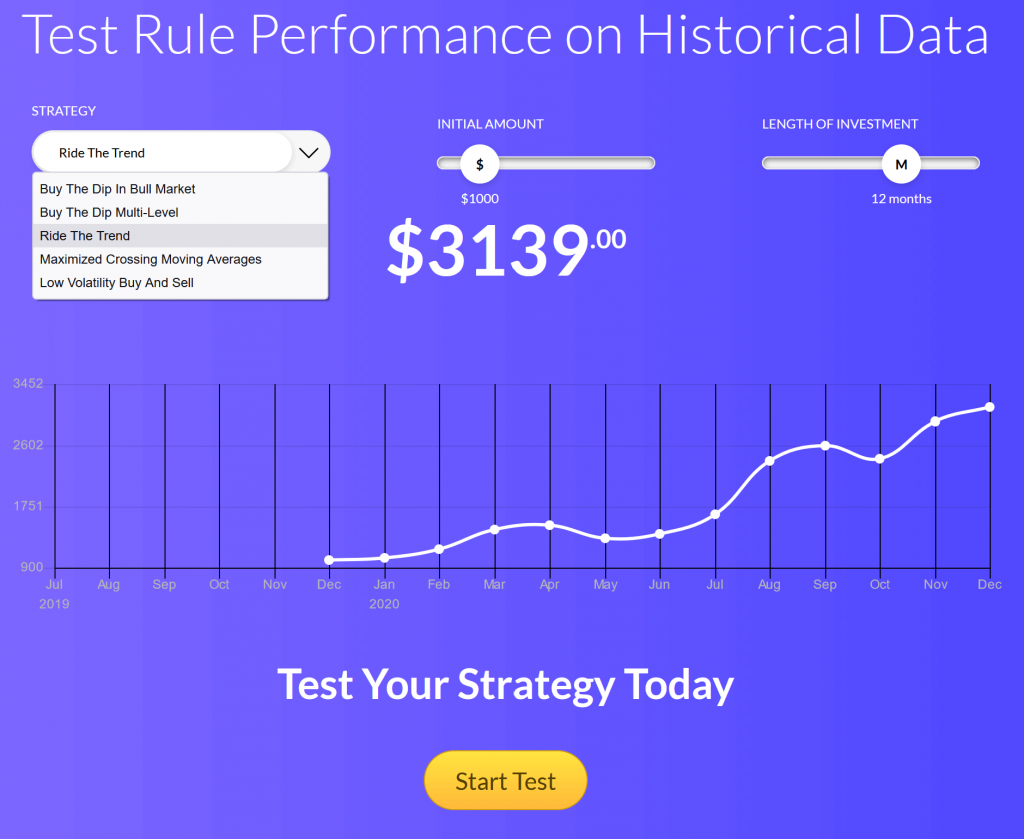

Cyptohopper

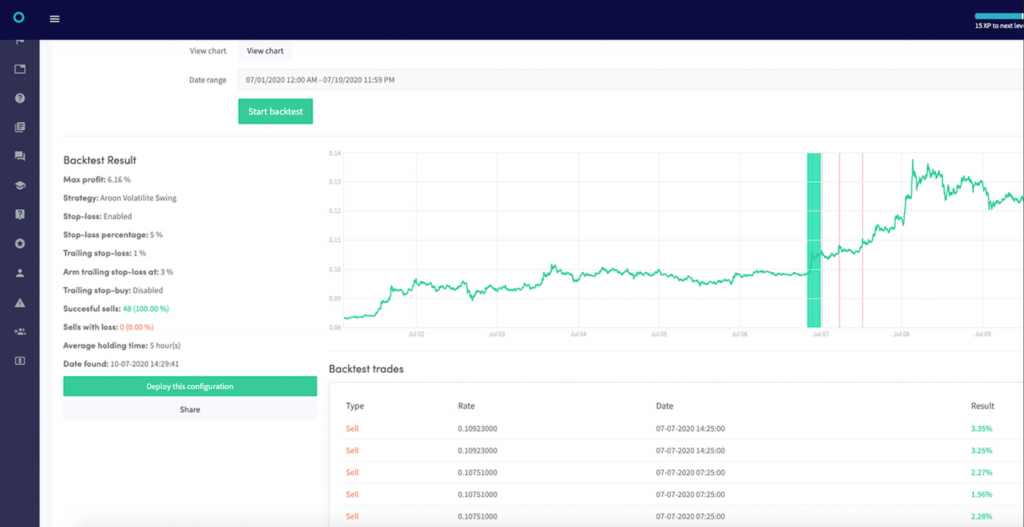

Creating, testing, and executing automated trading strategies is what Cryptohopper is all about. Set up rules and conditions, monitor live data feeds, and react to a vast array of interacting technical indicators. Again, everything is tweakable and you can test your evolving strategy at each stage of development.

Cryptohopper’s trading bot backtesting feature happens on-site, and this is a clear advantage for me. There’s a comprehensive tutorial and a rather enthusiastic video on their website. Experiment with the length of time over which you select your test data, as longer periods can take a frustrating amount of time to process.

Before releasing your new trading bot into the environment, you might want to let it ‘Paper Trade.’ This is a dry run with play-money but against real live data. You can see what you would have won or lost. This is the most effective way to confirm a strategy is profitable as it relies on data in the context of the prevailing market – This is important as I shall explain this later.

Reliability

Both platforms are well established, professionally run, and I had absolutely no issues with operating either. However, the reliability of their trading strategies is another thing. Indeed the whole concept of creating trading bots and backtesting them is not always a reliable predictor of future success.

Backtesting fails to take into account the chaotic nature of the market. What you cannot simulate is the exact market conditions and sentiment prevalent at the time of the historic test data. The context of a trading strategy is hugely important, and it depends on the macro-situation, the news, and the broader market trends.

These seemingly unimportant inputs are missing from the historic test data. The errors caused are quickly magnified by the non-linearity in the system and soon, any useful prediction signals are swamped by the chaos. Exactly as we struggle to forecast the weather many days in advance, markets are also essentially unfathomable. But that shouldn’t stop you from having fun with bots!

Security

The important security feature of both platforms is that they don’t hold withdrawal rights over your exchange accounts. If someone did access your Coinrule or Cryptohopper account, they could wreak all sorts of havoc by placing crazy trades. Thankfully, they couldn’t steal your money.

Both of these platforms are built and managed by long-time pros. Security is an important part of their brands, and with 2FA (2 Factor Authentication), I am more than confident to use their services.

Supported Exchanges

In both cases, if you can’t find your preferred cryptocurrencies on their partner exchanges, it probably isn’t worth trading. There are plenty of options for leveraged trading, spot, futures, shorts, or whatever you can imagine. Coinrule has better options for equities and indices than Cryptohopper, which is more crypto-focused.

Coinrule Compatible Exchanges

Cyptohopper Compatible Exchanges

Which Crypto Trading Bot Is Best for You?

The answer to this is simple – it’s a unique bot built by the finest minds using the latest technology, and running on the very fastest processors and networks. This is not practical, so which off-the-shelf strategy would I recommend to run on your domestic PC, over your residential WiFi network? I wouldn’t.

The hard fact remains that buying and hodling over longer periods is far more profitable than trading your assets. Further, I would only ever allow a trading bot access to a limited portion of my total balance (maximum 5%), and I would monitor it relentlessly in the early stages. I certainly wouldn’t pay directly for an off-the-shelf bot or strategy.

It’s great fun, though, so have a dabble by all means. I recommend trying it in a bull market to stand more chance of a win. It’s easy to look like a genius when the whole crypto market is going up. If you can recreate your profits in a falling market, then you’ve cracked it!

FAQs

Conclusion

They are both great platforms for automating your trading, and I would be happy to use either. Coinrule is more expensive than Cryptohopper yet Cryptohooper offers more trading features.

For me, the deciding factor has to be the backtesting functions. Coinrule sends you to TradingView to execute your testing, whereas it’s integrated into Cryptohoper’s platform.

Check out our other guides and trading platform comparison that can be good alternatives: